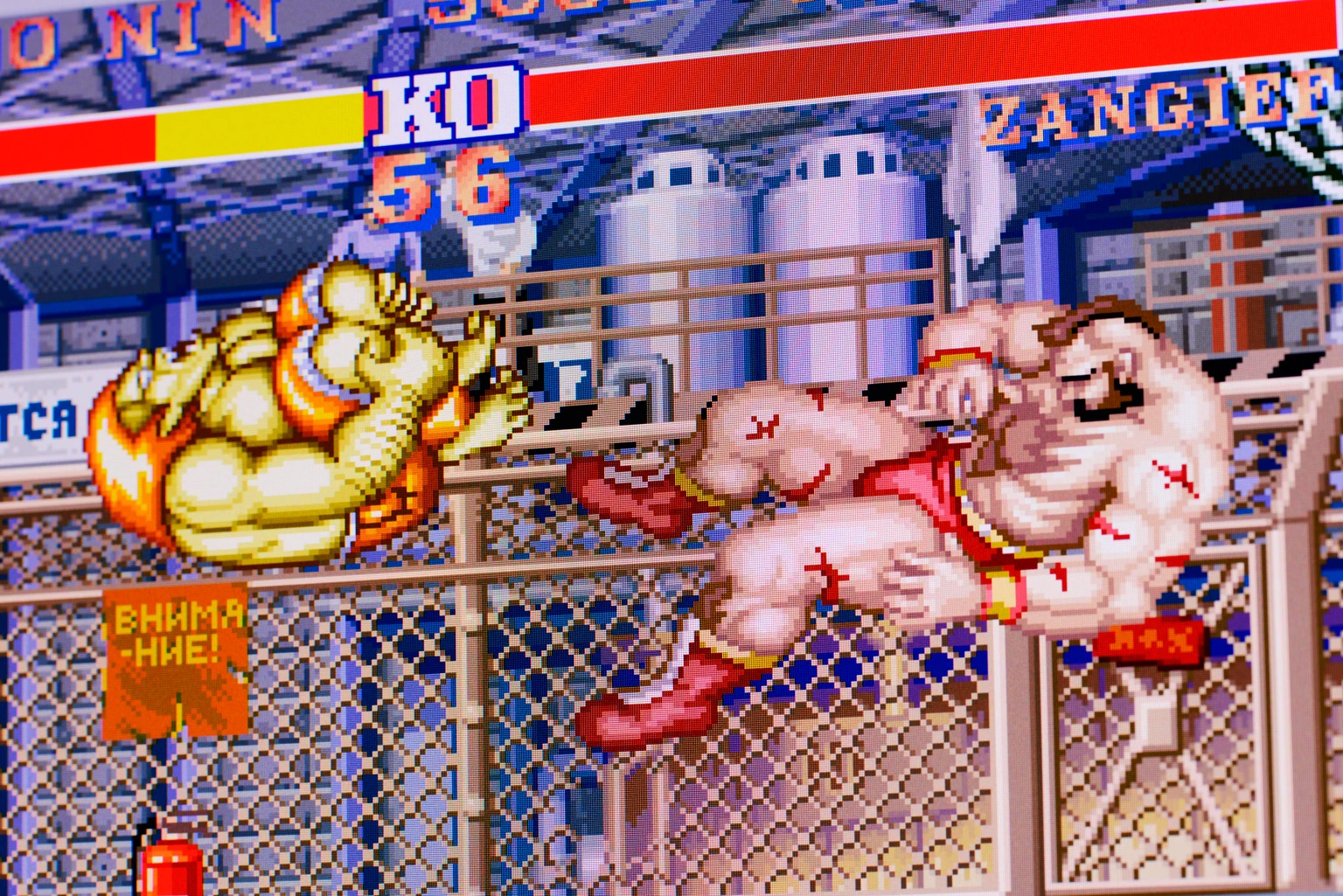

Capcom Co., Ltd. ADR (CCOEY)

Capcom: Record First-Half Profitability, Sector-Low Valuation, And 40% Upside (Rating Upgrade)

Capcom reported record first-half profitability, driven by digital content and strong amusement equipment results. Catalog unit sales rose 20.6% year over year, supporting a 62.9% segment operating margin. Operating cash flow declined due to front-loaded development and capital expenditures ahead of major 2026 releases.

Capcom Vs. Bandai Namco: Both Buys, But Bandai Namco Wins On Value And Upside

Capcom compounds through digital scale, high margins, strong free cash flow, and low reinvestment needs. Bandai Namco trades near 12.4x EV/EBITDA versus a 20.3x peer median despite global IP like Elden Ring, Gundam, and Dragon Ball. Twelve-month upside estimates: 13.5% for Capcom and 36.7% for Bandai Namco based on forward EBITDA growth and reasonable multiples.

Capcom (CCOEY) is on the Move, Here's Why the Trend Could be Sustainable

If you are looking for stocks that are well positioned to maintain their recent uptrend, Capcom (CCOEY) could be a great choice. It is one of the several stocks that passed through our "Recent Price Strength" screen.

Are Consumer Discretionary Stocks Lagging Capcom (CCOEY) This Year?

Here is how Capcom Co., Ltd. (CCOEY) and Roku (ROKU) have performed compared to their sector so far this year.

Capcom: Growth Decelerates While Valuation Climbs To New Highs

Capcom's stock soared 255% in five years, driven by blockbuster releases and stellar financials, but growth is now decelerating. Despite record results and strong franchises, the current EV/EBIT of 28.15x bakes in very high expectations for future growth. Management is investing in talent, new facilities, and strategic M&A to sustain growth, but gaming's cyclical nature poses risks.

Recent Price Trend in Capcom (CCOEY) is Your Friend, Here's Why

Capcom (CCOEY) could be a solid choice for shorter-term investors looking to capitalize on the recent price trend in fundamentally sound stocks. It is one of the many stocks that passed through our shorter-term trading strategy-based screen.

Is Capcom (CCOEY) Stock Outpacing Its Consumer Discretionary Peers This Year?

Here is how Capcom Co., Ltd. (CCOEY) and Liberty Media Corporation - Liberty Formula One Series A (FWONA) have performed compared to their sector so far this year.

Capcom (CCOEY) Is a Great Choice for 'Trend' Investors, Here's Why

If you are looking for stocks that are well positioned to maintain their recent uptrend, Capcom (CCOEY) could be a great choice. It is one of the several stocks that passed through our "Recent Price Strength" screen.

Here's Why Momentum in Capcom (CCOEY) Should Keep going

Capcom (CCOEY) made it through our "Recent Price Strength" screen and could be a great choice for investors looking to make a profit from stocks that are currently on the move.

Capcom: AI Tailwind Accelerates Content Creation

Capcom leverages generative AI to accelerate game development and content creation, benefiting mid-tier franchises and reducing costs. Blockbuster franchises like Monster Hunter and Resident Evil continue to perform exceptionally well, driving strong financial results. Capcom's robust financials and strategic release schedule position it for record-high profits, enabling further investment in AI technologies.

What Makes Capcom (CCOEY) a Good Fit for 'Trend Investing'

Capcom (CCOEY) could be a solid choice for shorter-term investors looking to capitalize on the recent price trend in fundamentally sound stocks. It is one of the many stocks that passed through our shorter-term trading strategy-based screen.

Are Consumer Discretionary Stocks Lagging Capcom (CCOEY) This Year?

Here is how Capcom Co., Ltd. (CCOEY) and Sony (SONY) have performed compared to their sector so far this year.