Cadence Design Systems, Inc. (CDNS)

Cadence Design Systems: Accelerated Verification And Performance Should Support AI

Cadence Design Systems received a 'Hold' rating due to concerns about stock price valuation despite beating market consensus in Q2 earnings. CDNS's expanding AI portfolio and partnerships with key players position the company well to capture the growing demand in the EDA market. The company's FY24 outlook shows promising growth potential, with acquisitions and market leadership in key growth areas driving revenue growth.

Cadence Design Systems, Inc. (CDNS) Q2 2024 Earnings Call Transcript

Cadence Design Systems, Inc. (NASDAQ:CDNS ) Q2 2024 Earnings Conference Call July 22, 2024 4:30 PM ET Company Participants Richard Gu - VP, IR Anirudh Devgan - President & CEO John Wall - SVP & CFO Conference Call Participants Charles Shi - Needham & Company Gianmarco Conti - Deutsche Bank Vivek Arya - Bank of America Securities Joshua Tilton - Wolfe Research Ruben Roy - Stifel Jay Vleeschhouwer - Griffin Securities Harlan Sur - JPMorgan Jason Celino - KeyBanc Capital Markets Lee Simpson - Morgan Stanley Clarke Jeffries - Piper Sandler Joe Vruwink - Baird Operator Good afternoon. My name is Brianna, and I will be your conference operator today.

Cadence Design Systems (CDNS) Tops Q2 Earnings and Revenue Estimates

Cadence Design Systems (CDNS) came out with quarterly earnings of $1.28 per share, beating the Zacks Consensus Estimate of $1.23 per share. This compares to earnings of $1.22 per share a year ago.

Cadence Design Systems Beats Q2 Targets, But Guides Below Views

Cadence Design Systems beat Wall Street's targets for the second quarter, but guided below views for the current quarter.

Should You Buy Cadence (CDNS) Stock Ahead of Q2 Earnings?

Cadence's (CDNS) Q2 performance is likely to have benefited from higher customer demand. Weak global macroeconomic conditions and stiff competition are concerning.

Cadence Design Systems, Inc. (CDNS) is Attracting Investor Attention: Here is What You Should Know

Cadence (CDNS) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Here's Why Cadence Design Systems (CDNS) Fell More Than Broader Market

In the closing of the recent trading day, Cadence Design Systems (CDNS) stood at $314.07, denoting a -1.79% change from the preceding trading day.

2 Artificial Intelligence (AI) Stocks That Could Go Parabolic

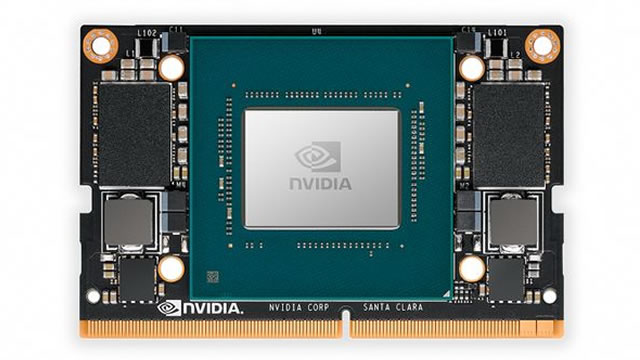

Nvidia and other megacap tech stocks have been the biggest winners of the artificial intelligence (AI) boom so far, and it's easy to see why. The implications of AI technology go far beyond these obvious plays.

Cadence (CDNS) Boosts System IP Portfolio With Janus NoC

Cadence (CDNS) has unveiled the Janus Network-on-Chip solution that will be available from July 2024.

Why Cadence Design Systems (CDNS) Outpaced the Stock Market Today

Cadence Design Systems (CDNS) closed at $311.53 in the latest trading session, marking a +0.77% move from the prior day.

Cadence Design Systems, Inc. (CDNS) is Attracting Investor Attention: Here is What You Should Know

Zacks.com users have recently been watching Cadence (CDNS) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Beyond Nvidia: 5 AI Stocks to Buy this June

Last month, my AI-powered stock-picking system, MarketMaster AI, awarded Nvidia (NASDAQ: NVDA ) a C-rated “hold” grade. Analysts were still raising their earnings estimates for the chipmaker, which was enough to offset the bearish pressure of high valuations.