CMS Energy Corporation (CMS)

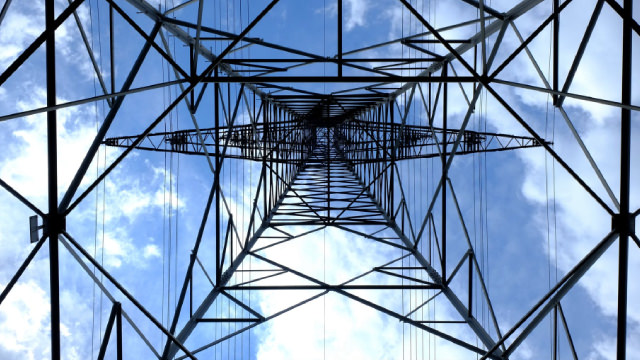

CMS Energy Eliminates More Than 72K Outages With Smart Technology

CMS significantly enhances Michigan's power grid by employing ATRs.

CMS Decision And O&P Network Build Out Make Myomo A Buy

Myomo's business model is now sustainable due to CMS reclassifying MyoPro, leading to lump sum payments and consistent insurance coverage. Medicare Part B coverage has significantly improved Myomo's operating margin and accelerated its product sales growth. The development of an Orthopedic and Prosthetic clinic network will lower customer acquisition costs and create recurring sales, enhancing long-term growth & margins.

CMS Energy (CMS) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

Although the revenue and EPS for CMS Energy (CMS) give a sense of how its business performed in the quarter ended September 2024, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

CMS Energy Corporation (CMS) Q3 2024 Earnings Call Transcript

CMS Energy Corporation (NYSE:CMS ) Q3 2024 Earnings Conference Call October 31, 2024 9:30 AM ET Company Participants Jason Shore - Treasurer & VP, IR Garrick Rochow - President & CEO Rejji Hayes - EVP & CFO Conference Call Participants Shar Pourreza - Guggenheim Partners Jeremy Tonet - JPMorgan Ross Fowler - Bank of America Julien Dumoulin-Smith - Jefferies Travis Miller - Morningstar Michael Sullivan - Wolfe Research Andrew Weisel - Scotiabank Angie Storozynski - Seaport Anthony Crowdell - Mizuho Operator Good morning, everyone, and welcome to the CMS Energy 2024 Third Quarter Results. The earnings news release issued earlier today and the presentation used in this webcast are available on CMS Energy's website in the Investor Relations section.

CMS Energy Q3 Earnings Beat Estimates, Revenues Improve Y/Y

CMS' third-quarter 2024 operating revenues totaled $1.74 billion, which lagged the Zacks Consensus Estimate by 4.9%. The top line, however, increased 4.2% on a year-over-year basis.

CMS Energy (CMS) Q3 Earnings Beat Estimates

CMS Energy (CMS) came out with quarterly earnings of $0.84 per share, beating the Zacks Consensus Estimate of $0.78 per share. This compares to earnings of $0.61 per share a year ago.

Stay Ahead of the Game With CMS Energy (CMS) Q3 Earnings: Wall Street's Insights on Key Metrics

Beyond analysts' top -and-bottom-line estimates for CMS Energy (CMS), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended September 2024.

CMS Energy (CMS) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

CMS Energy (CMS) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

CMS Energy Rides on Investments and Renewable Expansion

CMS is expected to benefit from its systematic investment plan and expansion of its renewable generation portfolio.

CMS Energy: Buy, But Favor The Subsidiary Preferred

CMS Energy is a high-quality utility stock with strong earnings and dividend growth, supported by a favorable regulatory environment in Michigan. Despite many "Hold" recommendations, CMS Energy's consistent performance and regulatory support make it a core utility holding for long-term investors. CMS.PR.B preferred stock offers a 5.6% yield and higher credit rating than the parent company, making it an appealing fixed-income investment.

CMS Energy (CMS) Q2 Earnings Beat, Revenues Improve Y/Y

CMS Energy's (CMS) Q2 earnings beat estimates but revenues miss the same.

CMS Energy (CMS) Surpasses Q2 Earnings Estimates

CMS Energy (CMS) came out with quarterly earnings of $0.66 per share, beating the Zacks Consensus Estimate of $0.63 per share. This compares to earnings of $0.75 per share a year ago.