Coinbase Global, Inc. (COIN)

Coinbase Global, Inc. (COIN) Presents at Morgan Stanley US Financials, Payments & CRE Conference Transcript

Coinbase Global, Inc. (NASDAQ:COIN ) Morgan Stanley US Financials, Payments & CRE Conference Call June 10, 2025 1:50 PM ET Company Participants Gregory Alexander Tusar - Former Vice President of Institutional Product Conference Call Participants Michael J. Cyprys - Morgan Stanley, Research Division Michael J.

COIN Outpaces Industry in 3 Months: Time to Buy the Stock?

COIN surges 33% in 3 months, outpacing peers as it expands globally, adds assets, and eyes crypto derivatives dominance.

Coinbase's Transaction Fees Improve: Will it Accelerate Growth?

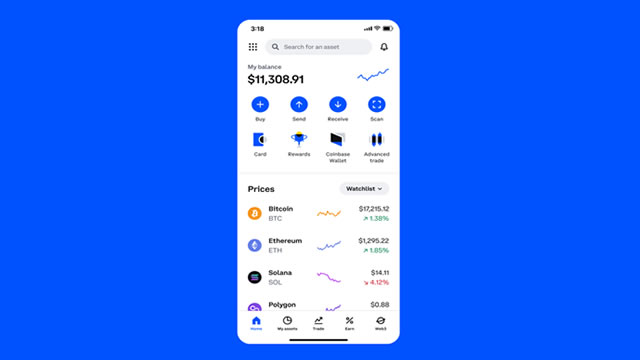

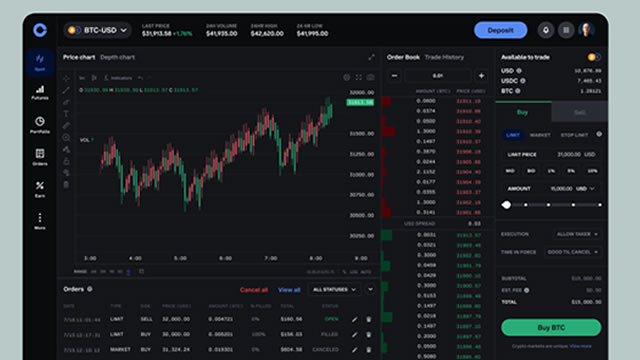

Coinbase Global generates the bulk of its revenues from transaction fees, the largest but most volatile income source.

Coinbase Global, Inc. (COIN) Is a Trending Stock: Facts to Know Before Betting on It

Coinbase Global (COIN) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Report: Coinbase Learned of Data Breach in January

Coinbase reportedly knew in January about a data breach at an outsourcing company that it publicly disclosed May 14 in a filing with the Securities and Exchange Commission (SEC).

Coinbase breach linked to customer data leak in India, sources say

Cryptocurrency exchange Coinbase knew as far back as January about a customer data leak at an outsourcing company connected to a larger breach estimated to cost up to $400 million, six people familiar with the matter told Reuters.

Coinbase: The Winner Of Bitcoin's Institutional Adoption (Initiate With Buy)

Coinbase became the first crypto-native company in the S&P 500, signaling broader institutional acceptance of digital assets. COIN dominates crypto custody, holding keys for 90% of Bitcoin ETF assets as well as keys for the US Marshals Service. The investment case hinges on retail trading growth and institutional bitcoin adoption. Subscription & services revenue is the signal in its Q1 results and transaction revenues are noise.

Robinhood vs. Coinbase: Why One Stock Is a Much Bigger Winner

The boom in Bitcoin is driving both stocks. But Robinhood is on a meteoric rise because of the very obvious rebound in riskier stocks.

COIN vs. XYZ: Which Crypto-Focused Fintech Stock is a Safe Investment?

COIN gains 6% YTD as crypto tailwinds boost revenues. Block drops 31% amid fintech rivalry and weak consumer spending.

S&P 500 Gains and Losses Today: Coinbase Stock Climbs as Cryptocurrency Prices Surge

Major U.S. equities indexes were mixed on Thursday after the House of Representatives passed a far-reaching budget bill that includes significant tax cuts and reduced spending on government health care and food assistance programs. The proposed budget will now head to the Senate, where it could see changes and amendments.

Coinbase says its data breach affects at least 69,000 customers

Coinbase said at least 69,461 customers had personal and financial information stolen during a months-long data breach that it disclosed last week.

Should You Buy COIN Stock At $260?

Coinbase Global (NASDAQ:COIN) has garnered significant attention recently, surging over 25% last week. This upward momentum followed its inclusion as the first crypto exchange stock in the broader S&P 500 index, taking the place of Discover Financial Services, which is in the process of being acquired by Capital One.