Coinbase Global, Inc. (COIN)

Coinbase: Navigating Cyclicality With Emerging Growth Engines

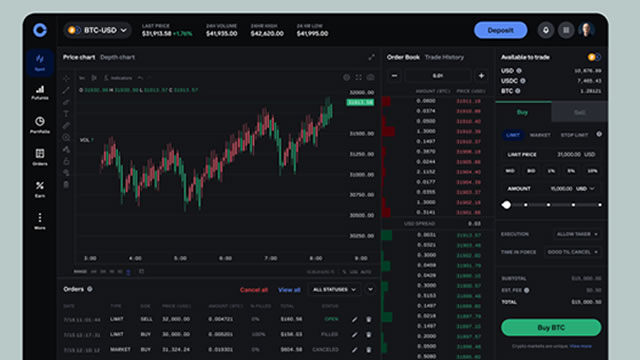

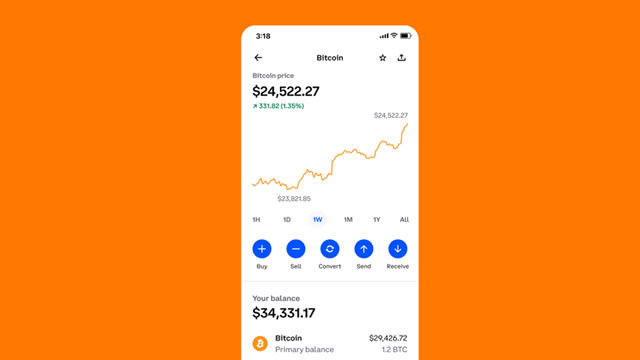

Coinbase Global (COIN) remains a Buy due to growth in stablecoins, L2, and derivatives, despite recent price corrections and cyclical trading revenues. COIN's subscription and services segment, including USDC and Base L2, is reducing revenue cyclicality and supporting high margins, enhancing long-term attractiveness. The YieldMax COIN Option Income Strategy ETF (CONY) underperformed expectations during corrections, prompting a Sell rating, while direct COIN accumulation is favored after deep pullbacks.

Here is What to Know Beyond Why Coinbase Global, Inc. (COIN) is a Trending Stock

Zacks.com users have recently been watching Coinbase Global (COIN) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

COIN to Buy Vector: Is the Crypto Leader on an Acquisition Spree?

Coinbase Global COIN is set to buy Vector.fun in its efforts to expand access to Solana. Vector is an on-chain trading platform built on Solana, and when integrated into COIN's platform, will aid users in broader access to on-chain markets.

Coinbase CLO explains what the Senate crypto bill could mean for the market

Coinbase chief legal officer Paul Grewal breaks down the Senate's growing push for a crypto market structure bill and what it could mean for digital asset regulation on ‘The Claman Countdown.' #fox #media #us #usa #new #news #foxbusiness #coinbase #crypto #cryptocurrency #bitcoin #blockchain #regulation #senate #congress #law #digitalassets #finance #economy #markets #investment #business #technology

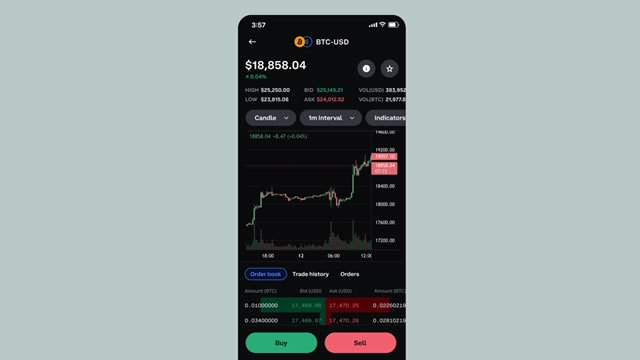

Is it Too Soon to Buy the Dip in Coinbase (COIN) Stock?

Considering its fortunes are closely tied to digital assets, Coinbase stock has plunged over 25% this month as the price of Bitcoin drops further below $100,000.

COIN Enters Prediction Market: Another Step to Go Beyond Crypto?

Coinbase partners with Kalshi to launch a regulated prediction market, expanding beyond crypto trading into event-based investments.

Crypto Has Bitcoin Alternatives to Sell You as the Coin's Price Slips Below $90,000

Investment appetites are being tested as products-including new exchange-traded funds, initial coin offerings and an index-linked token-launch into a bear market for the industry's best-known asset.

Is Trending Stock Coinbase Global, Inc. (COIN) a Buy Now?

Coinbase Global (COIN) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Despite Coinbase departure, only 28 companies have left Delaware this year

Coinbase this week became the latest high-profile company to announce plans to leave Delaware and incorporate elsewhere. While Elon Musk and a select few others have been vocal about exiting Delaware, they remain distinctly in the minority.

COIN Stock Rallies 22% YTD But Valuation Is Expensive: How to Play

COIN's premium valuation and projected earnings decline temper optimism despite strong growth and crypto market expansion.

Coinbase Broadens Reach With New Token Platform and UK Expansion

Coinbase expands with a new token sales platform, a UK savings account launch and a strategic shift after ending the BVNK deal.

Coinbase moves incorporation to Texas from Delaware, following Musk's lead

Coinbase Chief Legal Officer Paul Grewal wrote in a Wall Street Journal op-ed that the crypto platform is moving its state of incorporation to Texas from Delaware. Elon Musk has led the campaign to exit Delaware, reincorporating Tesla and SpaceX in Texas.