Copart Inc. (CPRT)

These 2 Auto Stocks Are Profiting as Used Cars and Parts Thrive

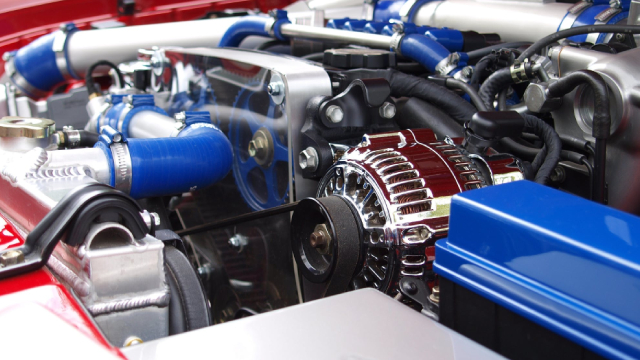

The auto/tires/trucks sector has been in a slump, as evidenced by weaker results and forecasts from manufacturers like Ford Motor Co. NYSE: F and Stellantis NYSE: STLA. High financing costs and an uncertain macroeconomic climate have caused consumers to tighten their spending, especially on big-ticket items like cars.

Final Trades: John Deere, Copart, Amgen and the IYH

The Investment Committee give you their top stocks to watch for the second half.

Why Is Copart (CPRT) Up 5.4% Since Last Earnings Report?

Copart (CPRT) reported earnings 30 days ago. What's next for the stock?

Copart: Trading Short-Term Results For Long-Term Market Share Will Fuel Future Compounding

Copart's strong market position and first-mover advantage in online vehicle auctions have driven impressive annual returns of 28.6% over the past decade. The company's robust balance sheet, with substantial liquidity and minimal debt, supports ongoing expansion and long-term growth without needing external capital. Despite recent margin compression due to increased operating expenses, Copart's strategy of prioritizing customer service and long-term relationships with insurers remains sound.

Copart's Shares Plunge 10% in 6 Months: More Downside Ahead?

CPRT's rising operating expenses, coupled with higher capital spending and downward EPS estimate revisions for fiscal 2025, cast doubt on its prospects.

Brokers Suggest Investing in Copart (CPRT): Read This Before Placing a Bet

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Copart: Fantastic Business, Tricky Valuation

Copart has grown from a junkyard to a $47 billion leader in vehicle auctions and remarketing, benefiting from strong demand drivers like aging fleets, accidents, and sustainability trends. Despite impressive sales and cash flow growth in fiscal 2024, Copart faced margin pressure due to rising costs and investments in growth. The company remains debt-free with strong liquidity. While Copart's long-term outlook is strong, its current valuation appears high given economic risks and lower margins. I maintain a Neutral rating, looking for better buying opportunities.

Copart's Q4 Saw Top-Line Growth, But Bottom-Line Contractions

Q4 revenue reached $1.07 billion, up 7.2% year over year. Fiscal 2024 revenue totalled $4.24 billion, up 9.5%.

Copart, Inc. (CPRT) Q4 2024 Earnings Call Transcript

Copart, Inc. (NASDAQ:CPRT ) Q4 2024 Earnings Conference Call September 4, 2024 5:30 PM ET Company Participants Jeff Liaw - Chief Executive Officer Leah Stearns - Chief Financial Officer Conference Call Participants Bob Labick - CJS Securities John Healy - Northcoast Research Craig Kennison - Robert W. Baird & Co. Chris Bottiglieri - Exane BNP Paribas Bret Jordan - Jefferies Jash Patwa - JPMorgan Operator Good day, everyone, and welcome to the Copart Incorporated Fourth Quarter Fiscal 2024 Earnings Call.

Copart, Inc. (CPRT) Misses Q4 Earnings Estimates

Copart, Inc. (CPRT) came out with quarterly earnings of $0.33 per share, missing the Zacks Consensus Estimate of $0.37 per share. This compares to earnings of $0.34 per share a year ago.

Why Copart, Inc. (CPRT) Dipped More Than Broader Market Today

In the latest trading session, Copart, Inc. (CPRT) closed at $52.56, marking a -0.38% move from the previous day.

Copart, Inc. (CPRT) Rises Yet Lags Behind Market: Some Facts Worth Knowing

Copart, Inc. (CPRT) closed at $51.59 in the latest trading session, marking a +0.55% move from the prior day.