Cirrus Logic, Inc. (CRUS)

Cirrus Logic (CRUS) Up 11.7% Since Last Earnings Report: Can It Continue?

Cirrus Logic (CRUS) reported earnings 30 days ago. What's next for the stock?

Up 69% in 2024, This Red-Hot Artificial Intelligence (AI) Growth Stock Could Keep Soaring

Cirrus Logic recently delivered stronger-than-expected results, a trend that's likely to continue. The company is expected to win more business from its largest customer, which is all set to dive into the AI smartphone market next month.

Cirrus Logic (CRUS) Surges 58.7% YTD: Will the Upside Last?

Cirrus Logic's (CRUS) performance benefits from the increasing adoption of its existing portfolio and new product launches.

Cirrus Logic (CRUS) Reliance on International Sales: What Investors Need to Know

Review Cirrus Logic's (CRUS) international revenue performance and how it affects the predictions of financial analysts on Wall Street and the future prospects for the stock.

Cirrus Logic Stock Up After June-Quarter Beat-And-Raise Report

Semiconductor stocks finished the last big week of Q2 earnings season with a mixed bag of winners and losers. Cirrus Logic was among the winners.

Cirrus Logic's (CRUS) Q1 Earnings & Revenues Beat, Rise Y/Y

Cirrus Logic's (CRUS) fiscal first-quarter performance benefits from robust sales of Audio and High-performance mixed-signal products.

Cirrus Logic (CRUS) Beats Q1 Earnings and Revenue Estimates

Cirrus Logic (CRUS) came out with quarterly earnings of $1.12 per share, beating the Zacks Consensus Estimate of $0.62 per share. This compares to earnings of $0.67 per share a year ago.

Semiconductor Sales Gain Momentum: 4 Growth Stocks to Buy Now

Semiconductor providers like TSM, PI, CRUS and MU are riding on strong year-over-year sales growth, driven by strong demand for semiconductor components.

Why Cirrus Logic Rallied Today

A Keybanc analyst lifted his price target on Cirrus. The analyst is bullish on other AI and server stocks, as well, based on recent channel checks.

Cirrus Logic (CRUS) Soars 54.6% YTD: Will the Upside Last?

Cirrus Logic's (CRUS) performance benefits from the increasing adoption of its existing portfolio and new product launches amid challenging market conditions.

This Semiconductor Stock Has Jumped 48% in 2024, and Artificial Intelligence (AI) Could Help It Soar Further

Cirrus Logic delivered better-than-expected results last quarter that crushed Wall Street's expectations. Apple is the company's largest customer, and that could be a good thing for Cirrus as the tech giant's iPhone sales are expected to improve thanks to AI.

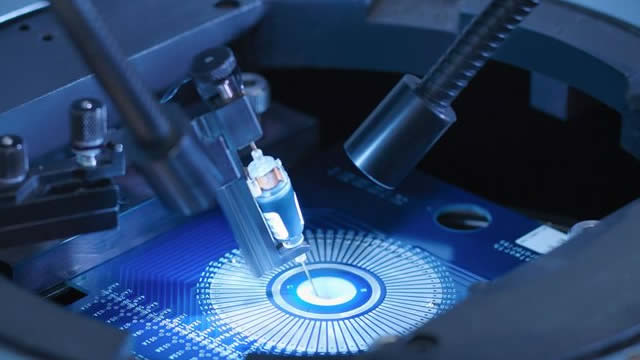

Cirrus Logic (CRUS) Unveils Next-Generation Pro Audio Devices

Cirrus Logic (CRUS) introduces a range of modern digital-to-analog converters and an ultra-high-performance audio CODEC, suitable for recording artists, live performers and audiophiles.