Cisco Systems, Inc. (CSCO)

Q2 Metals unveils inaugural exploration target for Cisco lithium project in Quebec

Q2 Metals Corp (TSX-V:QTWO) is preparing its first exploration target for the Cisco lithium project in Quebec. The Vancouver, BC-based company is estimating there could be between 215 and 329 million tonnes of rock containing 1% to 1.38% lithium oxide (Li₂O) at the target.

Looking for Stocks with Positive Earnings Momentum? Check Out These 2 Computer and Technology Names

Investors looking for ways to find stocks that are set to beat quarterly earnings estimates should check out the Zacks Earnings ESP.

Cisco Systems (CSCO) Outperforms Broader Market: What You Need to Know

In the latest trading session, Cisco Systems (CSCO) closed at $68.3, marking a +1.38% move from the previous day.

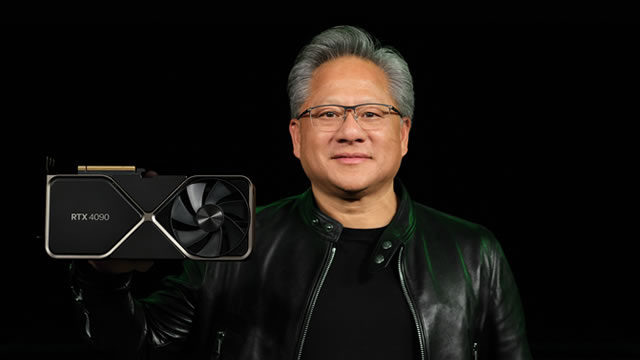

Could Nvidia still repeat Cisco's Dot-Com crash? What you need to know

Nvidia's (NASDAQ: NVDA) meteoric rise, driven by the artificial intelligence (AI) boom, has sparked concerns that the stock might crash, similar to what happened to Cisco (NASDAQ: CSCO) during the 2000 Dot-Com bubble.

Cisco Systems, Inc. (CSCO) Is a Trending Stock: Facts to Know Before Betting on It

Recently, Zacks.com users have been paying close attention to Cisco (CSCO). This makes it worthwhile to examine what the stock has in store.

Cisco Systems (CSCO) Sees a More Significant Dip Than Broader Market: Some Facts to Know

Cisco Systems (CSCO) closed at $67.95 in the latest trading session, marking a -1.18% move from the prior day.

CSCO vs. DELL: Which AI Enterprise Infrastructure Stock is a Buy?

Cisco Systems CSCO and Dell Technologies DELL are key providers of AI-powered enterprise infrastructure solutions. Cisco offers network infrastructure to power AI training and inference workloads for both webscalers and enterprises with high-density routers and switches, improved network management, and high-performance optics.

Cisco: No Longer A Forgotten Technology Company And Is Going Much Higher

Cisco is breaking out after years of stagnation, driven by data center buildouts, AI tailwinds, and a diversified software/subscription revenue mix. Shares remain undervalued despite strong profitability, robust capital returns, and accelerating recurring revenue; the market is mispricing Cisco's growth and shareholder focus. Recent results highlight surging security/software growth, major AI infrastructure orders, and strategic partnerships, positioning Cisco as a leader in AI networking and security.

Cisco Shares Trade Near 52-Week High: What's Next for CSCO Investors?

CSCO is benefiting from an expanding security and AI portfolio despite challenging macroeconomic conditions and stretched valuation.

BofA Securities Top Q3 Stocks Picks Feature 4 Incredible Dividend Ideas

Dividend stocks are a favorite among investors for good reason.

Cisco's Margins Riding on Supply Chain: Will the Expansion Continue?

Cisco Systems CSCO has been benefiting from a flexible and diversified supply chain that is driving gross margin expansion. This improvement, along with productivity improvements and disciplined cost management, bodes well for operating margin expansion.

Cisco Systems (CSCO) Rises Higher Than Market: Key Facts

Cisco Systems (CSCO) concluded the recent trading session at $69.38, signifying a +1.06% move from its prior day's close.