CVS Health Corporation (CVS)

CVS Health Corporation (CVS) Is a Trending Stock: Facts to Know Before Betting on It

Zacks.com users have recently been watching CVS Health (CVS) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

CVS vs. ELV: Which Healthcare Titan Is the Stronger Investment Today?

CVS Health advances with Aetna margin recovery, digital investments and cost savings, making it the stronger healthcare bet over Elevance.

CVS Health Services' Q2 AOI Falls Despite Sales Gain: More Risk Ahead?

CVS Health's Q2 Health Services revenues climb 10%. Yet, AOI slips as cost pressures and Oak Street's rising MBR ail.

Jim Cramer talks what is driving CVS higher this year

'Mad Money' host Jim Cramer takes a look at CVS and what is driving the stock up.

CVS Gains in Pharmacy & Consumer Wellness Despite Reimbursement Woes

CVS Health's Pharmacy & Consumer Wellness unit posts double-digit revenue gains despite ongoing reimbursement headwinds.

4 Value Stocks Every Investor Should Hold in Volatile Times

StoneCo, CVS, Integer Holdings and USANA emerge as attractive value stocks with low cash-flow ratios and solid growth outlooks.

Value Investing: 5 Undervalued Stocks Worth Adding to Your Portfolio

StoneCo, CVS Health, KT, KB Financial and USANA Health stand out as undervalued picks with low P/B ratios and solid growth prospects.

Should You Invest in CVS Health (CVS) Based on Bullish Wall Street Views?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

CVS unit must pay $290 million in drug whistleblower lawsuit, judge rules

A federal judge ordered CVS Health's pharmacy benefit manager unit to pay $289.9 million in damages and penalties after it overcharged Medicare for prescription drugs.

Investors Heavily Search CVS Health Corporation (CVS): Here is What You Need to Know

Recently, Zacks.com users have been paying close attention to CVS Health (CVS). This makes it worthwhile to examine what the stock has in store.

CVS Health: Health Insurers Get Buffett's Stamp Of Approval (Rating Upgrade)

Super investors like Buffett and Michael Bury piled heavily into UnitedHealthcare in Q2, signalling confidence that the sector's business model remains intact despite recent headwinds. CVS has emerged as a top performer in 2025, with strong revenue growth and raised guidance, outpacing struggling peers like UnitedHealth. The sector faces ongoing uncertainties—rising costs, regulatory scrutiny, and budget cuts—but long-term healthcare spending trends remain favorable.

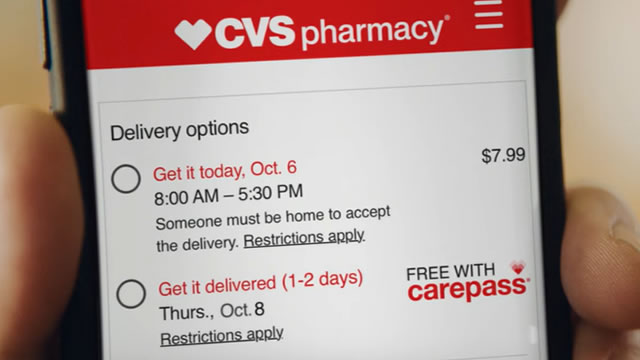

CVS Advances Digital Efforts to Simplify Healthcare Experience

CVS Health commits $20B to build an open health platform, joining tech giants in a push to streamline patient care access nationwide.