Clearway Energy Inc. (CWEN)

CWEN vs. ORA: Which Stock Is the Better Value Option?

Investors interested in Alternative Energy - Other stocks are likely familiar with Clearway Energy (CWEN) and Ormat Technologies (ORA). But which of these two stocks is more attractive to value investors?

Clearway Energy Q3 Earnings Lag Estimates, Revenues Surpass

CWEN's third-quarter earnings and revenues increase year over year. Total operating costs and expenses also rise during the same period.

Clearway Energy (CWEN) Misses Q3 Earnings Estimates

Clearway Energy (CWEN) came out with quarterly earnings of $0.31 per share, missing the Zacks Consensus Estimate of $0.48 per share. This compares to earnings of $0.03 per share a year ago.

Clearway Energy (CWEN) Increases Despite Market Slip: Here's What You Need to Know

In the most recent trading session, Clearway Energy (CWEN) closed at $26.98, indicating a +0.52% shift from the previous trading day.

Clearway Energy (CWEN) Beats Stock Market Upswing: What Investors Need to Know

In the latest trading session, Clearway Energy (CWEN) closed at $28.15, marking a +1.22% move from the previous day.

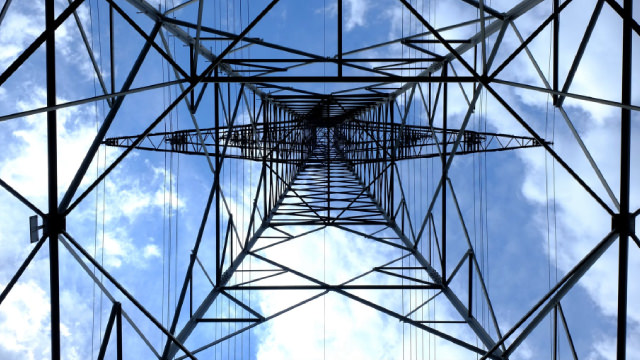

Clearway Initiates Work on Solar & Storage Projects in Texas

CWEN announces the close of financing and begins construction of the 300-MW Pine Forest solar and 200-MW Pine Forest.

CWEN or BE: Which Is the Better Value Stock Right Now?

Investors looking for stocks in the Alternative Energy - Other sector might want to consider either Clearway Energy (CWEN) or Bloom Energy (BE). But which of these two stocks presents investors with the better value opportunity right now?

3 High-Yield Dividend Stocks to Buy and Hold Forever

Clearway Energy is poised to benefit as renewable energy capacity booms. Verizon has one of few 5G nationwide networks and a new acquisition to drive growth.

Clearway Energy (CWEN) Stock Slides as Market Rises: Facts to Know Before You Trade

The latest trading day saw Clearway Energy (CWEN) settling at $30.02, representing a -1.48% change from its previous close.

Should You Invest in Clearway Energy (CWEN) Based on Bullish Wall Street Views?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Clearway Energy (CWEN) Beats Stock Market Upswing: What Investors Need to Know

Clearway Energy (CWEN) concluded the recent trading session at $29.36, signifying a +0.1% move from its prior day's close.

Clearway Energy: Ambitious Targets, But Compounding Ability Limited

Clearway Energy Inc. stock is up 5% since last publication in May on stronger fundamentals. The company posted Q2 earnings of $336mm in revenue and $353mm in adj. EBITDA. Management aims for a path to $2.15 of CAFD per share, funded internally and through excess corporate debt capacity.