DoorDash, Inc. (DASH)

DoorDash Adds Max Streaming Service to DashPass Membership Program

DoorDash's DashPass membership program now includes offers from Warner Bros. Discovery's Max streaming service.

DoorDash to offer Max streaming to members in the US as competition intensifies

DoorDash on Tuesday said it had partnered with Warner Bros Discovery's Max to provide the streaming service at no extra cost to its membership program subscribers in the United States.

DoorDash Delivers: Earnings Review - Reiterating A Buy

I'm reiterating my buy rating on Dash after its 2Q24 report and confirm my belief that the company is now in its next leg of growth. In my opinion, Dash will continue seeing strong momentum in its grocery offering and I expect it to further improve the top-line in the near term. Management's focus is on 1. Introducing new merchants to the U.S. marketplace in the grocery, beauty, home, etc and 2. Expanding International markets, which should pay off big time in FY24.

Market Crash? No Problem for DoorDash Stock's Impressive Earnings

Investors are now worried about the market crashing, with the U.S. 10-year treasury bond finally breaking below a 4% yield for the first time since the Federal Reserve (the Fed) started hiking interest rates to combat inflation and a red-hot economy. The S&P 500 is trading lower by up to 1.5% as weak economic data starts coming in for August.

DoorDash (DASH) Reports Q2 Loss, Beats Revenue Estimates

DoorDash's (DASH) second-quarter 2024 results reflect strength in total orders and Marketplace GOV.

DoorDash Stock Pops After Earnings. It's More Than a Food Delivery Company.

Analysts predict more gains for the shares.

DoorDash Analysts Boost Their Forecasts After Strong Sales

DoorDash, Inc. DASH reported better-than-expected second-quarter revenue results on Thursday.

DoorDash: This Is The Beginning Of A Long Rally

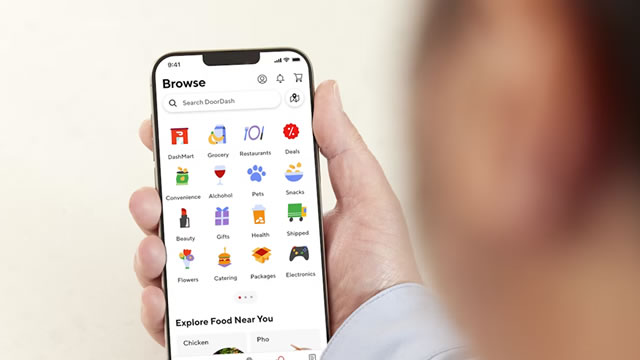

DoorDash rallied sharply after posting Q2 results, owing to tremendous order strength as well as margin leverage. The company has vastly expanded its order categories, ranging from groceries to alcohol and sporting goods. Non-food orders are representing a greater percentage of new users. The company is also seeing record additions of DashPass memberships, and is also generating more revenue from advertising, boosting its margin profile.

DoorDash sees record orders and revenue in second quarter even as US restaurant traffic slows

DoorDash said Thursday that it set records for orders and revenue in the second quarter, growth that came despite slowing U.S. restaurant traffic.

DoorDash, Inc. (DASH) Q2 2024 Earnings Call Transcript

DoorDash, Inc. (NASDAQ:DASH ) Q2 2024 Earnings Conference Call August 1, 2024 5:00 PM ET Company Participants Andy Hargreaves - Vice President, Investor Relations Tony Xu - Co-Founder, Chair and CEO Ravi Inukonda - Chief Financial Officer Conference Call Participants Nikhil Devnani - Bernstein Ross Sandler - Barclays Michael Morton - MoffettNathanson Andrew Boone - JMP Securities Brad Erickson - RBC Capital Markets Bernie McTernan - Needham Michael McGovern - Bank of America Ron Josey - Citi Lee Horowitz - Deutsche Bank Shweta Khajuria - Wolfe Research John Colantuoni - Jefferies Mark Zgutowicz - The Benchmark Company Operator Thank you for standing by. My name is John, and I'll be your conference operator for today.

DoorDash, Inc. (DASH) Reports Q2 Loss, Tops Revenue Estimates

DoorDash, Inc. (DASH) came out with a quarterly loss of $0.38 per share versus the Zacks Consensus Estimate of a loss of $0.10. This compares to loss of $0.44 per share a year ago.

DoorDash shares pop 13% on second-quarter revenue beat

DoorDash shares popped in extended trading Thursday after the company released second-quarter results that beat Wall Street's revenue expectations. The company's revenue increased 23% to $2.63 billion.