Dow Inc. (DOW)

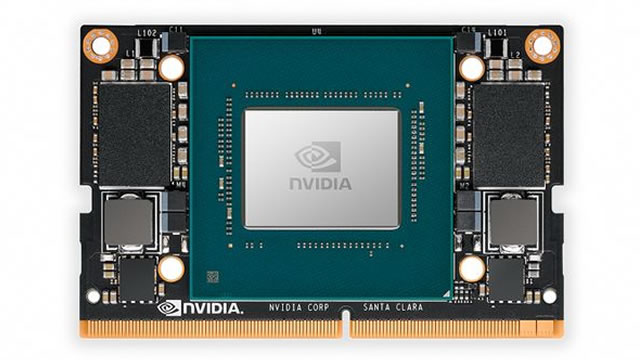

Stock Market Today: Dow Futures Gain; Nvidia Stock Falls After Earnings

Results are due from retailers Dollar General and Best Buy this morning

Dow: Much Lower Risk For Investors After A Kitchen Sink Quarter

After Dow shares fell by more than 50% over the past year, the likelihood of a market overreaction is quite high. The headlines look quite scary after what was likely a kitchen sink quarter. From a cash flow point of view, however, things are not as dire, and the dividend yield is still attractive.

Dow Jones and Nasdaq futures reflect caution ahead 'main event' Nvidia earnings

Wall Street futures were circumspect ahead of Wednesday's opening bell, as investors braced for Nvidia earnings after the close that many feel are all-important. Futures for the Dow Jones, S&P 500 and Nasdaq 100 were all less than 0.1% above where they finished yesterday.

Stock Market Today: Dow Futures Waver and Dollar Weakens; Nvidia Earnings in Focus

Trump weighs quickly announcing a nominee to replace Lisa Cook on Federal Reserve board

NASDAQ Index, S&P 500 and Dow Jones Forecasts – US Indices Continue to Be Noisy

The US indices are giving back a bit of the gains from the Jackson Hole speech on Friday, as we are looking at this as a potential change in the attitude of the markets in general. At this point, we are still bullish, but pullbacks are inevitable.

5 Blue-Chip Stocks to Buy as the Dow Achieves New Milestones

JPM, GS, JNJ, DIS, and MSFT are five blue-chip stocks that stand out with strong growth drivers and upgraded estimates as the Dow hits record highs.

Dow Jones set to retreat from record highs, Nvidia earnings eyed

8:32am: Stocks pull back US stocks are set to open lower on Monday, following a surge on Friday driven by rate cut optimism. Investors last week welcomed signals from Federal Reserve chair Jerome Powell that rate cuts could start as soon as September, with the Dow Jones adding more than 800 points or 1.8%.

Wall Street Breakfast Podcast: After Dow's Record Close, Stock Futures Lower

Stock futures edged lower after the Dow's record close; markets buoyed by Powell's dovish Jackson Hole remarks and hopes for Fed rate cuts. Investors closely watching upcoming inflation data and Nvidia's earnings, which follow a notable tech sector pullback and Friday's rally.

NASDAQ Index, S&P 500 and Dow Jones Forecasts – US Indices Somewhat Quiet Overnight

The US indices that I follow all look somewhat quiet in premarket trading, as we are likely waiting for the next inflation numbers, and of course that speech by Jerome Powell this Friday.

Dow Jones ETF Outperforming: Will the Rally Continue?

DIA is outperforming as sector rotation, rate cut optimism and gains in heavyweights fuel Dow's record highs.

Tech Experiences Slight Selloff, Dow Ekes +10 Points

The Dow closed the session up +10 points, +0.02%, while the Nasdaq shed -314 points on the day, -1.46%.

Dow, Nasdaq futures flat as Intel, Palo Alto shine premarket

8:15am: Eye on geopolitics Wall Street looks set for a quiet open on Tuesday, with futures barely budging as investors digest the first big retail earnings of the week and keep one eye on geopolitics. Dow futures inched up about 0.1%, while contracts tied to the S&P 500 hovered just below flat.