Enovix Corporation (ENVX)

Are Computer and Technology Stocks Lagging Enovix Corporation (ENVX) This Year?

Here is how Enovix Corporation (ENVX) and Genius Sports Limited (GENI) have performed compared to their sector so far this year.

Enovix Corporation (ENVX) May Find a Bottom Soon, Here's Why You Should Buy the Stock Now

Enovix Corporation (ENVX) appears to have found support after losing some value lately, as indicated by the formation of a hammer chart. In addition to this technical chart pattern, strong agreement among Wall Street analysts in revising earnings estimates higher enhances the stock's potential for a turnaround in the near term.

Enovix Corporation (ENVX) Expected to Beat Earnings Estimates: Should You Buy?

Enovix Corporation (ENVX) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Enovix Corporation (ENVX) Just Flashed Golden Cross Signal: Do You Buy?

Enovix Corporation (ENVX) is looking like an interesting pick from a technical perspective, as the company reached a key level of support. Recently, ENVX's 50-day simple moving average crossed above its 200-day simple moving average, known as a "golden cross.

Wall Street Analysts See a 62.71% Upside in Enovix Corporation (ENVX): Can the Stock Really Move This High?

The average of price targets set by Wall Street analysts indicates a potential upside of 62.7% in Enovix Corporation (ENVX). While the effectiveness of this highly sought-after metric is questionable, the positive trend in earnings estimate revisions might translate into an upside in the stock.

Enovix Shares Hit 6-Month High; Long-Term Highs to Follow

Enovix's NASDAQ: ENVX share price surged in July, reaching a 6-month high early in the month, and longer-term highs are expected to follow. The move is driven by a steadily improving news cycle, which includes ramping up production, robust demand, a surprise buyback authorization, and improved guidance affirming it all.

Strength Seen in Enovix Corporation (ENVX): Can Its 20.8% Jump Turn into More Strength?

Enovix Corporation (ENVX) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions may not translate into further price increase in the near term.

Enovix: Sell On Persistent Commercialization Challenges

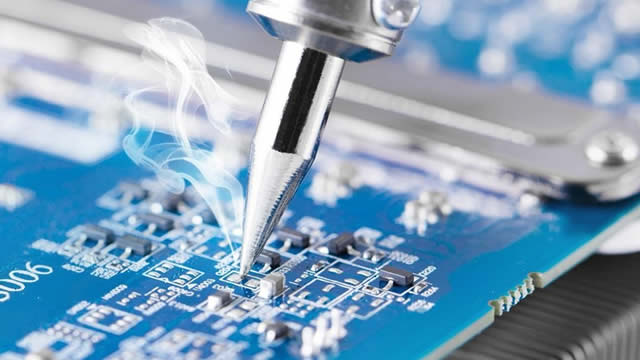

Advanced lithium-ion battery manufacturer Enovix reported Q1/2025 results slightly ahead of muted expectations. While the company continues to invest in its Malaysian manufacturing operations, cash burn has decreased substantially in recent quarters. According to management, the ramp-up of the company's manufacturing facility in Malaysia and commercialization efforts for its first generation EX-1M batteries are going to plan.

Enovix Corporation (ENVX) Q1 2025 Earnings Call Transcript

Enovix Corporation (NASDAQ:ENVX ) Q1 2025 Earnings Conference Call April 30, 2025 5:00 PM ET Company Participants Robert Lahey - Head of Investor Relations Raj Talluri - President and Chief Executive Officer Ajay Marathe - Chief Operating Officer Ryan Benton - Chief Financial Officer Conference Call Participants Colin Rusch - Oppenheimer George Gianarikas - Canaccord Genuity Ananda Baruah - Loop Capital Markets Derek Soderberg - Cantor Fitzgerald William Peterson - JPMorgan Gus Richard - Northland Capital Markets Ryan Pfingst - B. Riley Operator Thank you for standing by and welcome to the Enovix Corporation First Quarter 2025 Earnings Conference Call.

Enovix Corporation (ENVX) Reports Q1 Loss, Tops Revenue Estimates

Enovix Corporation (ENVX) came out with a quarterly loss of $0.15 per share versus the Zacks Consensus Estimate of a loss of $0.18. This compares to loss of $0.31 per share a year ago.

Enovix Corporation (ENVX) Expected to Beat Earnings Estimates: What to Know Ahead of Q1 Release

Enovix Corporation (ENVX) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Enovix: The Tariff Dip Could Be A Generational Buying Opportunity

The latest tariffs imposed by the US are likely to have a minimal impact on Enovix, in my opinion. Enovix's pioneer status could help its pricing power, even with the tariffs. Enovix's acquisition of SolarEdge's facility in South Korea will help boost its position in the drone industry, considering the capabilities of Routejade's batteries.