Ford Motor Company (F)

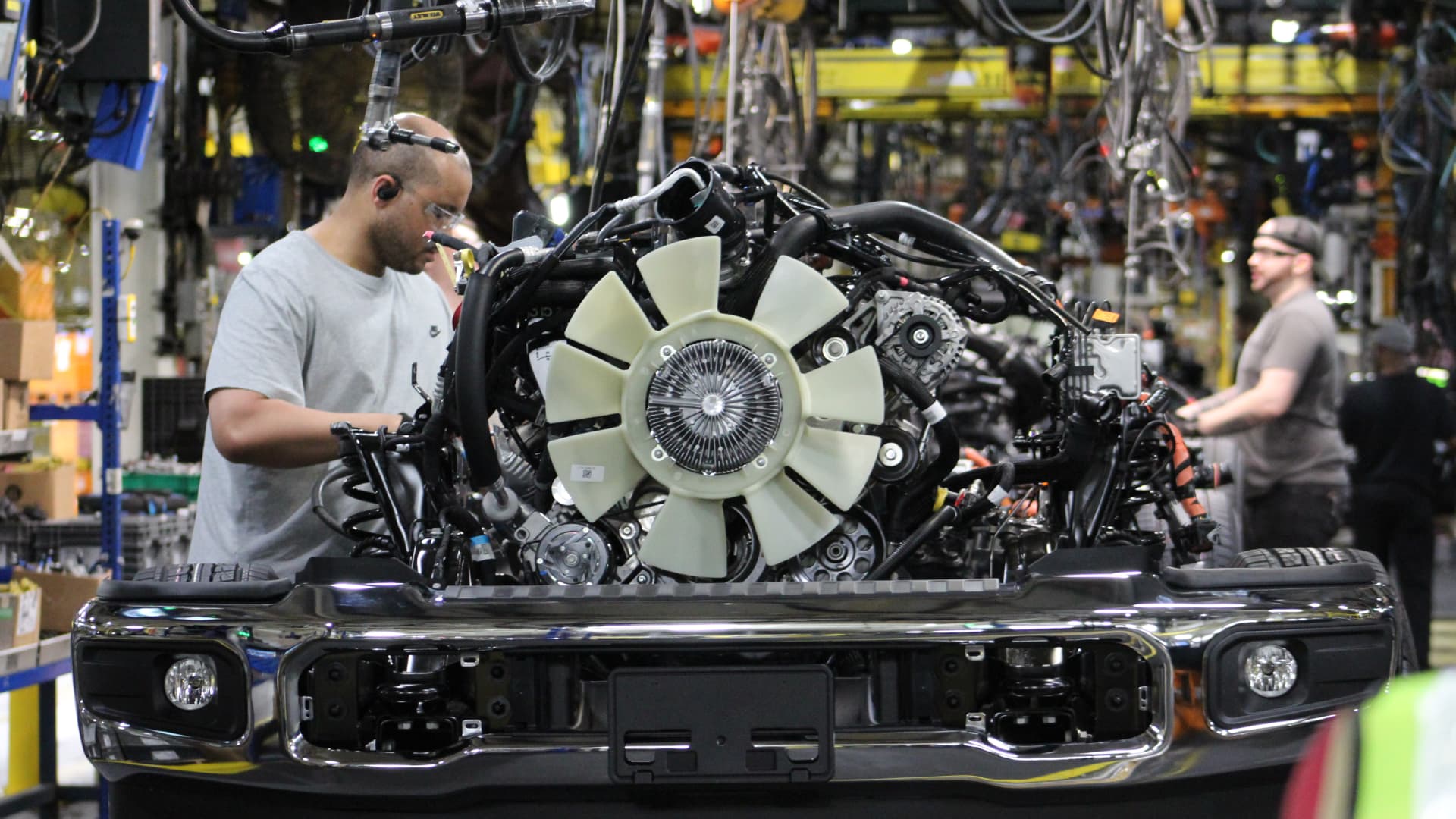

Cost and 'chaos' continue to test resiliency of U.S. auto industry

The auto industry faced a slew of challenges at the beginning of the year from tariffs to inflation and supply chain concerns. Auto executives, insiders and analysts told CNBC that the industry has been resilient and things aren't as bad as they once feared, but there are growing concerns about the state of the consumer and suppliers.

Ford and GM Take Yet Another Gut Punch Amid Bumpy 2025

2025 hasn't exactly been kind to the automotive industry as automakers grapple with sluggish electric vehicle (EV) sales (and hefty losses associated with them currently), a reduction in emissions standards, and the implementation of tariffs on imported vehicles and auto parts, among other unfavorable developments.

Ford issues record 103 safety recalls in 2025 with four months still remaining in the year

Kelly Blue Book reports Ford Motor Company issued the most safety recalls among automakers in 2025 with over 103 alerts, surpassing previous records.

3 Solid Dividend Stocks to Buy Under $25

For income investors with a smaller amount of new money to put to work, going for some of the lower-priced stocks could make a lot of sense, especially if one's brokerage doesn't allow for the purchase of partial shares.

Ford recalls nearly 625K US vehicles over faulty seat belts, camera displays

It's just the latest recall this year in a heavy batch for Ford, one of the “Big Three” automakers based near Detroit, Mich.

Investors Heavily Search Ford Motor Company (F): Here is What You Need to Know

Zacks.com users have recently been watching Ford Motor (F) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Ford Recall Record Worst in History

People have lost count of the number of recalls by Ford Motor Co. (NYSE: F) this year.

Ford Q3 Earnings Loom: How Should You Play F Stock Ahead of Results?

Ford heads into Q3 earnings with record EV sales and solid truck demand but rising recall and tariff costs could test its margins.

Ford temporarily cuts production at Kentucky truck plant after fire erupts at supplier

A fire at aluminum supplier Novelis forces Ford to pause production of three-row SUVs at Kentucky Truck Plant, affecting Expedition and Lincoln Navigator manufacturing.

Ford Cuts Production of Five Trucks, SUVs After Aluminum-Supply Disruption

A fire knocked a crucial aluminum supplier offline until next year. Moneymaking F-150 trucks are vulnerable.

Ford Motor Company (F) Rises But Trails Market: What Investors Should Know

Ford Motor Company (F) closed at $11.54 in the latest trading session, marking a +1.14% move from the prior day.

Ford Withdraws Tax Credit Program: Should You Hold or Fold the Stock?

F's Q3 sales surge, Ford Pro momentum and undervalued stock offset EV losses and tariff headwinds for a resilient long-term outlook.