General Electric Company (GE)

GE Vernova Analysts Boost Their Forecasts After Strong Q4 Results

GE Vernova Inc. GEV reported worse-than-expected fourth-quarter EPS and revenue on Wednesday.

GE Aerospace's stock flies toward an 18-year high after strong earnings, outlook

GE Aerospace said that it plans to buy back $7 billion in stock and raise dividends by 30% this year.

GE Aerospace Stock Soars as Q4 Revenue, Profit Blow Past Estimates

Shares of GE Aerospace (GE) surged in premarket trading Thursday after the company reported fourth-quarter results far above analysts' estimates.

GE Aerospace forecasts 2025 profit above estimates on robust aftermarket demand

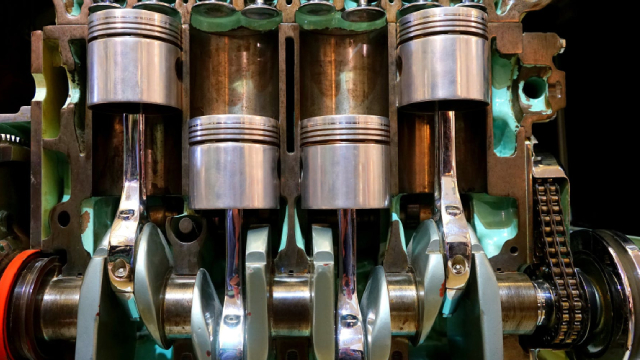

GE Aerospace on Thursday forecast profit for the current year above estimates, as persistent shortage of new aircraft forces airlines to fly older jets, creating strong demand for its high-margin parts and services.

GE Aerospace Earnings Are Coming. It's All About Production.

The stock's spectacular gains over the past year means the results and outlook need to be especially good.

GE Vernova misses Q4 revenue estimates

GE Vernova (GEV) reaffirmed its 2025 outlook despite missing fourth quarter revenue expectations. Chris Dendrinos, RBC Capital Markets Analyst, joins Catalysts to discuss GE Vernova's results.

GE Vernova working with all three companies tied to Stargate investment

CNBC's Seema Mody reports on the latest news regarding GE Vernova.

These 2 Transportation Stocks Could Beat Earnings: Why They Should Be on Your Radar

Investors looking for ways to find stocks that are set to beat quarterly earnings estimates should check out the Zacks Earnings ESP.

GE Vernova posts rise in quarterly profit but misses revenue estimates

GE Vernova on Wednesday reported a rise in fourth-quarter profit, helped by strong performance in its grid equipment and services segment, but missed its revenue estimates.

How To Earn $500 A Month From GE Aerospace Stock Ahead Of Q4 Earnings

GE Aerospace GE will release its fourth-quarter financial results before the opening bell on Thursday, Jan. 23.

GE Vernova's stock heads for a record as revenue missed, but outlook kept intact

GE Vernova stock bounces back as wind orders tumble, but electrification orders more than double.

GE Aerospace Set to Post Q4 Earnings: What Lies Ahead for the Stock? (Revised)

GE's fourth-quarter results are likely to benefit from strength across its commercial and defense end markets. High costs and expenses are likely to have been spoilsports.