General Electric Company (GE)

GE Vernova Will Talk Growth Tuesday. Could a Dividend Be Next?

GE Vernova hosts an analyst event Tuesday evening. One holiday gift to investors could be a dividend.

Where Will GE Aerospace Be in 4 Years?

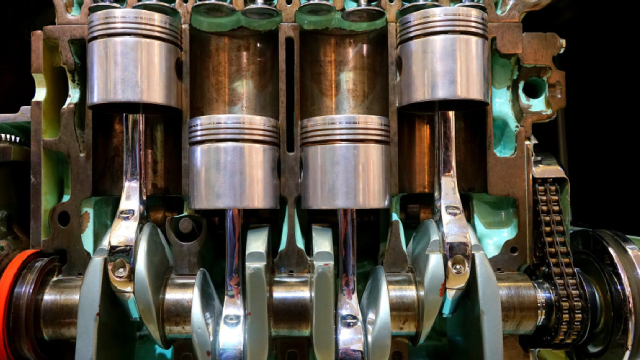

The company that we all once knew as "General Electric" has undergone massive changes over the past couple years. Spinning off first GE HealthCare and then GE Vernova (its energy business), what emerged earlier this year from the chrysalis is a new and reinvented "GE" known as GE Aerospace (GE 1.54%), a specialist in the manufacture of airplane engines for commercial aerospace giants like Boeing and Airbus, and also for the U.S. military.

How GE Vernova plans to deploy small nuclear reactors across the developed world

GE Vernova's small modular reactor, BWRX-300, could play a role in developing more nuclear power over the next decade. The General Electric spinoff is targeting more than $2 billion in annual revenue from its small reactor business by the mid-2030s.

GE reaches $362.5 million shareholder settlement over power unit

General Electric , doing business as GE Aerospace, will pay $362.5 million in cash to resolve a long-running shareholder lawsuit accusing it of hiding risks at its power business, court papers show.

GE Vernova: Leading Energy Transition, Initiate With A Buy

GE Vernova, spun off from General Electric in April 2024, specializes in electric power industry products and services, achieving double-digit organic revenue and order growth. Electrification and decarbonization trends, along with rising data center power needs, present significant growth opportunities for GEV's comprehensive energy solutions. Strong service components, representing 45% of total revenue, drive recurring revenue and significant margin expansion, particularly in the Power and Electrification segments.

GE Aerospace: The Top Aerospace Engine Stock To Buy

GE Aerospace's Q3 earnings showed positive metrics, with order inflow up 28% and adjusted EPS at $1.15, despite revenue falling short of expectations. The company faces supply chain challenges and pressures from key programs like the GE9X and CFM LEAP engines but is addressing these proactively. GE Aerospace has a strong commercial backlog and long-term service contracts, indicating significant long-term value and potential for profitability improvement.

IQ-AI subsidiary Imaging Biometrics expands GE partnership, adds board member - ICYMI

IQ-AI Ltd (LSE:IQAI, OTCQB:IQAIF) earlier this week announced an expanded partnership between its subsidiary, Imaging Biometrics, and GE Healthcare. The agreement will streamline the distribution of IB Neuro and IB Delta T1 platforms, which assist in assessing and treating brain tumours.

GE Aerospace Conducts Testing of Hybrid-Electric Turboshaft Engine

GE conducts a successful testing of a hybrid-electric turboshaft engine for the U.S. Army.

GE Vernova Stock Is an AI Winner. The Case to Buy.

Wells Fargo analyst Michael Blum launched coverage with a Buy rating and a $385 price target—the second highest on FactSet.

Rolls-Royce and GE Aviation stocks reversed: is the rally over?

GE Aviation (GE) and Rolls-Royce (RR) stocks have done well in the past few years, helped by a favorable business environment and turnaround strategies by their management. GE shares have jumped by 48% in the last twelve months, while Rolls-Royce has jumped by over 124% in the same period.

IQ-AI's Imaging Biometrics extends GE partnership

Imaging Biometrics (IB), a subsidiary of IQ-AI Ltd (LSE:IQAI, OTCQB:IQAIF), has extended its partnership with GE HealthCare to broaden access to its advanced imaging technology. Under the renewed agreement, GE HealthCare will distribute IB's IB Neuro and IB Delta T1 platforms to existing and new customers.

Think GE Aerospace Is Expensive? This Chart Might Change Your Mind.

Think GE Aerospace Is Expensive? This Chart Might Change Your Mind.