General Electric Company (GE)

GE: Strength In The Aviation Industry Is A Good Sign For The Company (Rating Upgrade)

GE Aerospace's strong performance and restructuring under CEO Larry Culp have positioned the company for long-term growth in the aviation industry. GE's impressive Q1 earnings, with EPS and revenue beating expectations, and a robust order book highlight its financial strength. The aviation industry's growth, driven by rising demand in emerging markets, supports GE's undervaluation, despite its high forward P/E ratio.

Why Shares of GE Aerospace Are Down Today Despite a Lift From Wall Street

Shares of GE Aerospace (GE -2.99%) traded nearly 3% lower in the final hour of trading despite a Wall Street analyst lifting his price target on the stock.

GE Aerospace Wins Deal From Korean Air to Supply Engines

GE clinches a deal to supply Korean Air with GEnx and GE9X engines for the fleet of 787-10s and 777- 9s aircraft.

StandardAero: An Aero Engine Buy To Capitalize On GE Engines

StandardAero, Inc., a pure-play aero engine company, shows strong growth prospects in commercial aerospace, military, and business aviation, with a diverse geographic sales distribution. Despite negative free cash flow in 2024 due to investments, StandardAero expects double-digit sales growth and stable margins in 2025, with positive free cash flow. SARO stock is rated a buy, supported by 14% annual EBITDA growth, significant future free cash flow, and potential accretive M&A opportunities.

Buy 3 U.S. Giants Flying High Year to Date Defying Severe Volatility

Three U.S. bigwigs flying high year to date with more upside are GILD, GE and PGR.

GE Aerospace Wins Deal From U.S. Air Force to Supply F110 Engines

GE clinches a deal to supply F110 engines for the U.S. Air Force's F-15 and F-16 aircraft.

Why GE Aerospace Stock Topped the Market Today

On news of a new contract with a rock-steady arm of the U.S. government, investors loaded up on storied industrial company GE Aerospace (GE 2.60%) stock during Monday's trading session. The company's shares closed the day 2.5% higher, notching a convincing beat over the bellwether S&P 500's (^GSPC 0.64%) 0.6% increase.

GE Aerospace secures $1.8 billion U.S. Air Force contract

GE Aerospace said on Friday it had secured a contract from the U.S. Air Force valued up to $1.8 billion.

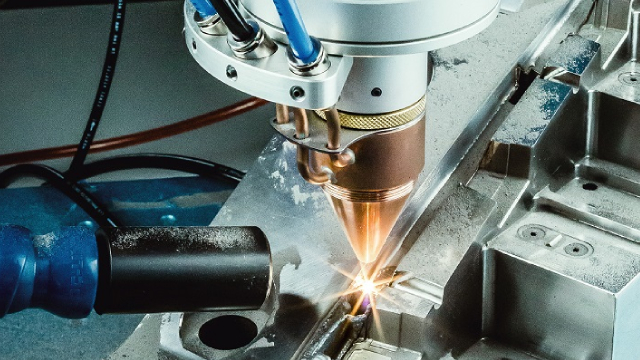

GE Aerospace to invest nearly $1B in US manufacturing

GE Aerospace is the latest company to announce an investment in the U.S. economy under the Trump administration. GE said the funds are nearly double last year's commitment.

GE Aerospace to invest about $1 billion in US manufacturing this year

GE Aerospace said on Wednesday it would invest nearly $1 billion in its U.S. factories and supply chain in 2025, as it looks to increase the use of new parts and materials in its operations.

Billionaire Nelson Peltz Has 67% of His Hedge Fund's $3.9 Billion Portfolio Invested in Just 3 Stocks

2024 was quite a year for Nelson Peltz's hedge fund, Trian Fund Management.

3 Of My Highest-Conviction Dividend Ideas With A Special Tailwind

Air travel is a modern miracle, yet I have a love/hate relationship with it. While flying can be uncomfortable, the ability to cross continents in hours is astounding. The aerospace industry is booming, with strong demand and innovation driving growth. I've invested heavily in this sector, betting on its long-term potential. My portfolio focuses on companies with durable moats, strong growth, and dividend potential. Despite risks, I believe aerospace will remain a cornerstone of global connectivity and my investments.