Warrior Met Coal, Inc. (HCC)

Warrior Met Coal: Low-Cost Producer With Upside

Warrior Met Coal, Inc. is well-positioned to weather current low coal prices due to its low-cost production and strong balance sheet, with Blue Creek set to enhance margins and production. Despite current oversupply and weak market conditions, long-term demand for metallurgical coal is expected to rise, driven by emerging markets like India and the green energy transition. The Blue Creek project, on time and on budget, will significantly boost HCC's production and margins, making it a valuable long-term investment below $50/share.

EC Approves Bristol Myers' Opdivo Plus Yervoy for First-Line HCC

The EC approves BMY's combination of Opdivo and Yervoy for the first-line treatment of adult patients with unresectable or advanced hepatocellular carcinoma.

Warrior Met Coal: A Rough Q4, But The Company Has A Healthy Cash Buffer

Warrior Met Coal has healthy margins due to export focus, high-quality coal, and low operating costs, with all production based in Alabama. Q4 2024 results showed adjusted EBITDA of $53M and net income of $1M, with a cash margin of $35/t, despite weak coking coal prices. Full-year 2024 saw 8.0 million short tons sold at $188/t, with a cash margin of $63/t; 2025 guidance indicates a marginal production increase.

Warrior Met Coal, Inc. (HCC) Q4 2024 Earnings Call Transcript

Warrior Met Coal, Inc. (NYSE:HCC ) Q4 2024 Earnings Conference Call February 13, 2025 4:30 PM ET Corporate Participants D'Andre Wright - Vice President of External Affairs and Communications Walter Scheller - Chief Executive Officer Dale Boyles - Chief Financial Officer Conference Call Participants Nick Giles - B. Riley Katja Jancic - BMO Capital Markets Nathan Martin - The Benchmark Company Operator Good afternoon.

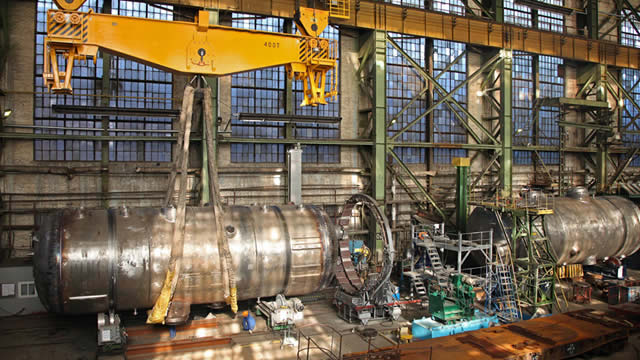

Warrior Met Coal: Will Blue Creek Mine, A Large CAPEX Investment, Be Profitable?

Warrior Met Coal's Blue Creek project could double production by 2030, but heavy CAPEX and market volatility pose significant risks. The coal market's dependence on China's steel industry and India's growing demand are critical factors for Warrior's future performance. Despite strong cash flow generation, Warrior's increased share issuance and investment needs for Blue Creek may strain finances if market conditions worsen.

Warrior Met Coal: Characterized By Low Operating Expenses And Solid Capital Deployment

Warrior Met Coal: Characterized By Low Operating Expenses And Solid Capital Deployment

Are Investors Undervaluing Warrior Met Coal (HCC) Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Warrior Met Coal: A Satisfactory Q3 In A Challenging Market

The adjusted EBITDA of $78M was the lowest figure since early 2021. Adjusted earnings were $42M, which was relatively impressive given the challenging market conditions. The development project Blue Creek is on time, which has the potential to re-rate the stock substantially over the next couple of years.

Warrior Met Coal, Inc. (HCC) Q3 2024 Earnings Call Transcript

Warrior Met Coal, Inc. (NYSE:HCC ) Q3 2024 Earnings Conference Call October 30, 2024 4:30 PM ET Company Participants D'Andre Wright - Vice President of External Affairs and Communications Walter Scheller, III - Chief Executive Officer Dale Boyles - Chief Financial Officer Conference Call Participants Lucas Pipes - B. Riley Securities Nathan Martin - The Benchmark Company Katja Jancic - BMO Capital Markets Operator Good afternoon.

Warrior Met Coal (HCC) Surpasses Q3 Earnings and Revenue Estimates

Warrior Met Coal (HCC) came out with quarterly earnings of $0.80 per share, beating the Zacks Consensus Estimate of $0.40 per share. This compares to earnings of $1.85 per share a year ago.

Earnings Preview: Warrior Met Coal (HCC) Q3 Earnings Expected to Decline

Warrior Met Coal (HCC) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Warrior Met Coal: A Low-Cost Producer But A Hold For Now

Warrior Met Coal is the low-cost producer of met coal in the United States. The development of the Blue Creek mine may be ill timed due to the current steel demand environment. With the current uncertain macro backdrop, I issue a hold rating on HCC.