Honeywell International Inc. (HON)

Honeywell (HON) and Qualcomm Expand AI Partnership for Energy Solutions

Honeywell (HON, Financial) shares have risen over 1.5%, trading at $210.145. Qualcomm also saw an increase of over 1%, with its stock priced at $168.14.

Honeywell: Spinning Off Advanced Materials Is A Positive Catalyst, Initiate With 'Buy'

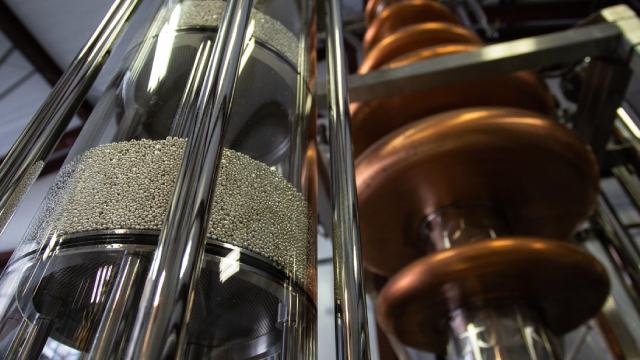

Honeywell's spin-off of the Advanced Materials business is seen as value accretive, enabling focus on core growth areas: automation, aviation, and energy transitions. The spin-off, projected for late 2025 or early 2026, will be tax-free and allows Honeywell to align better with its software-industrial strategy. Honeywell's strong pricing power and balanced growth between price and volume, especially in commercial aviation aftermarket and Building Technologies, bolster its financial outlook.

Honeywell (HON) Stock Moves on Business Rationalization News

Honeywell International (HON, Financial) shares rose by 1.8% following the company's strategic announcement to spin off its advanced materials unit into a new independent, publicly traded company. This move is part of Honeywell's broader strategy to streamline operations and concentrate on core business areas, enhancing growth prospects.

Why Honeywell Stock Topped the Market on Tuesday

The company is forging ahead with its long-term goal of becoming leaner and more focused.

Tradepulse Power Inflow Alert: Honeywell International Inc. Receives Alert And Rises 1.6% During Trading Day

THE STOCK RECEIVES ALERT AND REVERSES EARLY DOWNTREND TO CLIMB HIGHER

Honeywell Stock Is Rising on Spinoff Announcement.

Industrial firm Honeywell plans to spin off its advanced-materials business to shareholders. The separation should be complete by the end of 2025 or early 2026.

Will Honeywell International (HON) Beat Estimates Again in Its Next Earnings Report?

Honeywell International (HON) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Honeywell Rewards Shareholders With 5% Dividend Increase

HON's measures to consistently reward shareholders through dividends and share buybacks hold promise.

Here's Why Hold Strategy is Apt for Honeywell Stock Right Now

HON gains from strength in its Aerospace unit, acquired assets and shareholder-friendly policies. Softness in the warehouse and workflow solutions unit remains concerning.

Honeywell & Qualcomm Partner to Develop AI-Enabled Agent Solution

The collaboration between HON and Qualcomm aims to boost workers' efficiency in distribution centers and retail industries.

Honeywell International Inc. (HON) Advances While Market Declines: Some Information for Investors

Honeywell International Inc. (HON) concluded the recent trading session at $206.78, signifying a +0.74% move from its prior day's close.

Honeywell In A Holding Pattern: Why Now Isn't The Time To Buy

Honeywell International Inc. has strong long-term potential, particularly in aerospace and defense, but current growth metrics lag sector peers, justifying a 'Hold' rating. Despite a robust dividend history and solid cash flow, Honeywell's high valuation and margin pressures suggest waiting for a better entry point. Recent acquisitions have bolstered revenue but raised concerns about long-term sustainability and integration costs, impacting short-term profits and margins.