Robinhood Markets, Inc. (HOOD)

Robinhood Set to Report Q1 Earnings: Here's How to Play HOOD Stock

Robinhood Markets HOOD is set to release its first-quarter 2025 results tomorrow after the market closes. Robinhood's fourth-quarter performance was impressive.

Markets Think Robinhood Earnings Could Send the Stock Up

Whenever markets start to behave a certain way around a stock, especially during earnings season, investors usually benefit greatly from reverse-engineering the views taken ahead of the biggest catalyst of the quarter. Typically, there are both technical and fundamental reasons behind the way markets like to treat and value a certain stock (or sector, for that matter), and today, investors have an opportunity to ride this bullish wave.

Unlocking Q1 Potential of Robinhood Markets (HOOD): Exploring Wall Street Estimates for Key Metrics

Evaluate the expected performance of Robinhood Markets (HOOD) for the quarter ended March 2025, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

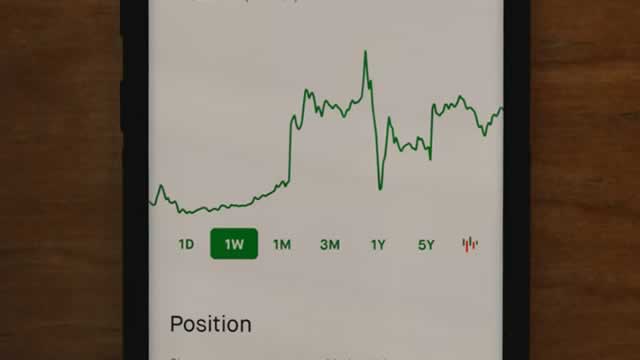

Robinhood Stock Falls 6.1% in a Month: Should You Buy, Sell or Hold?

Robinhood stock falls 6.1% in a month. Can product diversification efforts offer support or will regulatory fines weigh on its growth?

Robinhood Markets, Inc. (HOOD) Earnings Expected to Grow: Should You Buy?

Robinhood Markets (HOOD) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Wall Street Bulls Look Optimistic About Robinhood Markets (HOOD): Should You Buy?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Here is What to Know Beyond Why Robinhood Markets, Inc. (HOOD) is a Trending Stock

Robinhood Markets (HOOD) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Robinhood: The Next Generation Of Financial Services

Robinhood has experienced rapid growth but faces concerns over macroeconomic conditions. Robinhood is expanding beyond investing into broader financial services, leveraging its strong brand and fostering a culture of innovation. The company's strategy targets younger, internet-first customers, aiming to capture value over time as their financial needs evolve.

Robinhood: Cash-Rich And Ready To Run

I'm investing in Robinhood Markets, Inc. because it's one of the few fintechs generating serious free cash flow. I like that it's completely debt-free, with a rock-solid balance sheet and over $5 billion in cash and securities. With HOOD stock at 26x forward free cash flow, I believe I'm paying a very reasonable multiple for a business still growing at 15%+.

Robinhood Strategies Could Be a Game-Changer for Young Investors

Since President Trump's Liberation Day announcement, HOOD stock is down just 5% as of the April 10 close. This compares to returns of down 7% and down 8.5% for the S&P 500 Index and the Financial Select Sector SPDR Fund NYSEARCA: XLF, respectively.

Robinhood Markets, Inc. (HOOD) is Attracting Investor Attention: Here is What You Should Know

Robinhood Markets (HOOD) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Robinhood Markets (HOOD) Moves 23.5% Higher: Will This Strength Last?

Robinhood Markets (HOOD) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term.