Robinhood Markets, Inc. (HOOD)

Which Brokerage Tech Stock is Poised for Bigger Gains: HOOD or TW?

Does Robinhood's fintech evolution, AI and crypto expansion and 254% stock surge make it a standout over Tradeweb's steadier institutional path? Let's find out.

Robinhood's Remarkable Growth: It's Not Too Late For Investors

Robinhood Markets Inc. recently released their Q3 results, which revealed exceptional revenue growth, significant milestones, and potential new business segments. HOOD's founder-led management, led by CEO Vlad Tenev, is committed to democratizing investing and actively engages with the retail investor community. The company is diversifying with new products like Robinhood Social, Ventures, banking, and credit cards, aiming to reduce reliance on volatile trading revenues.

Is Most-Watched Stock Robinhood Markets, Inc. (HOOD) Worth Betting on Now?

Recently, Zacks.com users have been paying close attention to Robinhood Markets (HOOD). This makes it worthwhile to examine what the stock has in store.

New Strong Buy Stocks for Nov. 11: HOOD, TCMD, and More

Here are five stocks added to the Zacks Rank #1 (Strong Buy) List today:

IBKR vs. HOOD: Which Stock Is the Better Value Option?

Investors looking for stocks in the Financial - Investment Bank sector might want to consider either Interactive Brokers Group, Inc. (IBKR) or Robinhood Markets, Inc. (HOOD). But which of these two stocks is more attractive to value investors?

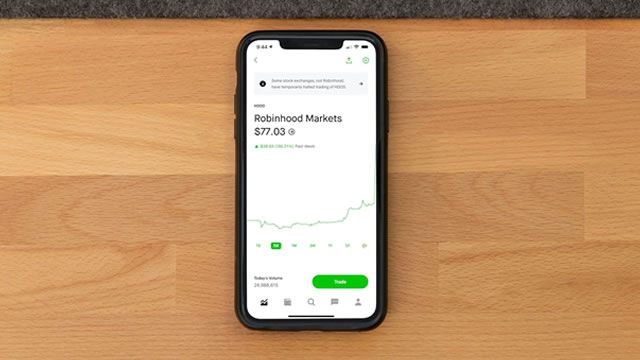

Is Robinhood's 11% Post-Earnings Fall a Buy-the-Dip Opportunity?

Shares of Robinhood Markets NASDAQ: HOOD just took their biggest hit in quite a while. On Nov. 6, shares closed down by nearly 11% as investors reacted to the firm's Q3 2025 earnings.

HOOW: The High-Yield Illusion Behind Roundhill's Weekly Leverage Machine

Roundhill HOOD WeeklyPay ETF offers a high yield, but most distributions are return of capital, not genuine income. HOOW's leveraged, weekly-reset structure amplifies both gains and losses, making it a tactical, not buy-and-hold, investment. The high yield is misleading, as weekly payouts erode the fund's NAV, and total return often lags HOOD, even in strong years.

Robinhood Markets (HOOD) Reports Q3 Earnings: What Key Metrics Have to Say

While the top- and bottom-line numbers for Robinhood Markets (HOOD) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Robinhood Markets, Inc. (HOOD) Q3 2025 Earnings Call Transcript

Robinhood Markets, Inc. ( HOOD ) Q3 2025 Earnings Call November 5, 2025 5:00 PM EST Company Participants Vladimir Tenev - Co-Founder, President, CEO & Chairman of the Board Jason Warnick - Chief Financial Officer Shiv Verma - Senior VP of Finance & Strategy and Treasurer Chris Koegel - Vice President of Corporate Finance & Investor Relations Conference Call Participants Patrick Moley - Piper Sandler & Co., Research Division Alexander Markgraff - KeyBanc Capital Markets Inc., Research Division Devin Ryan - Citizens JMP Securities, LLC, Research Division Jeff John Roberts Brian Bedell - Deutsche Bank AG, Research Division Dan Dolev - Mizuho Securities USA LLC, Research Division Brett Knoblauch - Cantor Fitzgerald & Co., Research Division Edward Engel - Compass Point Research & Trading, LLC, Research Division Steven Chubak - Wolfe Research, LLC Madeline Daleiden - JPMorgan Chase & Co, Research Division Presentation Operator Thank you to everyone for joining Robinhood's Q3 2025 Earnings Call, whether you're tuning into the live stream at home or here with us in person. With us today are Chairman and CEO, Vlad Tenev; CFO, Jason Warnick; SVP of Finance and Strategy and Treasurer, Shiv Verma; and VP of Corporate Finance and Investor Relations, Chris Koegel.

Robinhood Markets, Inc. (HOOD) Surpasses Q3 Earnings and Revenue Estimates

Robinhood Markets, Inc. (HOOD) came out with quarterly earnings of $0.61 per share, beating the Zacks Consensus Estimate of $0.51 per share. This compares to earnings of $0.17 per share a year ago.

Robinhood doubles its revenue as customers flock to Prediction Markets, other new businesses

Robinhood reported third-quarter earnings late Wednesday, posting revenue that doubled year on year to $1.27 billion, and profit of 61 cents a share, up 259% compared with last year.

Robinhood doubles revenue as it beats third-quarter earnings expectations

Robinhood beat Wall Street expectations for the third quarter on Wednesday. Transaction-based revenue, which is a proxy for trading activity, came in at $730 million but missed the StreetAccount estimate.