International Business Machines Corporation (IBM)

IBM Soars to New Highs on Q4 Earnings Beat: ETFs to Tap

IBM rallies 13% to a new all-time high following robust fourth-quarter 2024 results. Investors could tap the moment with these ETFs.

This AI stock just had its best day in a decade – Here's what's driving the surge

IBM (NYSE: IBM) stock surged nearly 13% on January 30, marking its best single-day gain in over a decade.

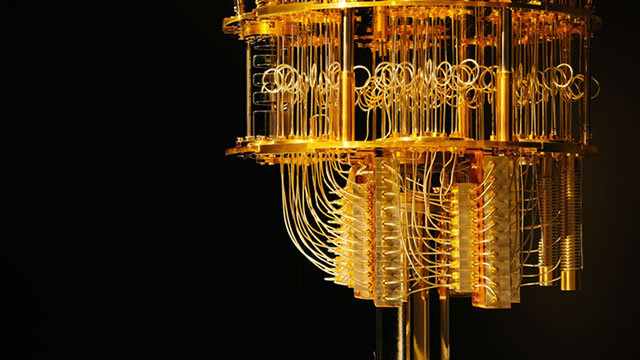

Telefonica, IBM Join Forces to Develop Quantum-Safe Security Solutions

TEF and IBM aim to develop and deliver security solutions that empower businesses to protect their critical data in a post-quantum world.

Watch These IBM Price Levels as Stock Soars After AI Drives Strong Earnings

International Business Machines (IBM) shares soared Thursday after the computing giant posted better-than-expected fourth-quarter earnings, boosted by the strength of its AI business.

IBM stock jumps 12% after strong Q4 results, fueled by AI growth

IBM saw a remarkable 12% surge in its stock price on Thursday, driven by a strong fourth-quarter performance that showcased the company's impressive growth in artificial intelligence (AI). This boost marked IBM's best day since July 2000, when shares soared 13%.

Why IBM's stock is having its best day since the dot-com era

IBM looks set for a much better growth trajectory as its consulting business starts cashing in more on AI.

Josh Brown's best stocks list: IBM, Gartner, Cognizant Tech, Accenture, Cloudflare and GoDaddy

Josh Brown, CEO of Ritholtz Wealth Management, joins CNBC's "Halftime Report" to reveal his favorite stocks in the market.

Why IBM Stock Was Up 14% Today

International Business Machines (IBM 12.89%) stock soared 13.6% through 11:10 a.m. Thursday morning after the tech giant beat on both sales and earnings last night.

IBM Stock Jumps, Leads S&P 500 Gainers, on Results, Open-Source AI Strategy

IBM (IBM) shares jumped 13% to lead S&P 500 gainers Thursday, a day after the company posted fourth-quarter results that topped analysts' estimates as its artificial intelligence (AI)-enabled business surged.

IBM rallies nearly 14%, heads for best day ever on strong earnings

IBM surged 14% on the back of a strong fourth-quarter print as artificial intelligence growth boosted its software business. The move put the stock on pace for its best day on record based on data going back as far as 1972.

IBM shares pop on strong revenue growth guidance

International Business Machines Corp (NYSE:IBM) shares surged after the software firm delivered an earnings beat and impressed investors with strong revenue guidance for the year. For 2025, the company said it expects revenue growth of at least 5%, above Street expectations of 3.5% growth to about $64.9 billion.

Tech Earnings Breakdown: IBM, Wolfspeed Report Results

Big Tech is hitting the earnings confessional hard, with reports from Meta Platforms (META) and Microsoft (MSFT) to unpack.