International Business Machines Corporation (IBM)

EARNINGS ALERT: IBM, NOW

George Tsilis provides instant analysis of IBM (IBM) and Servicenow (NOW) earnings, and what it might spell out for the tech sector moving into the middle of this earnings season. ======== Schwab Network ======== Empowering every investor and trader, every market day.

IBM's software surge can't offset consulting revenue decline in Q3

International Business Machines Corp (NYSE:IBM) reported a mixed bag for its third-quarter earnings on Tuesday, with a notable performance from its software segment but disappointing results from its consulting and infrastructure units. The technology giant posted adjusted earnings per share (EPS) of $2.30, surpassing analysts' expectations of $2.23.

IBM stock slips on disappointing consulting and infrastructure revenue

IBM's software business outperformed thanks to acceleration in the Red Hat business. But the consulting and infrastructure units came up short on revenue.

IBM beats third-quarter profit estimates on software strength

International Business Machines beat analysts' estimates for third-quarter profit on Wednesday, helped by robust growth in its high-margin software segment as businesses prioritized spending on its IT services and doubled down on AI adoption.

Earnings Preview: What To Expect From IBM

IBM Inc. scheduled to report earnings after Wednesday's close. The stock just hit a record high near $237/share and is currently trading near that level.

How To Earn $500 A Month From IBM Stock Ahead Of Q3 Earnings

International Business Machines Corporation IBM will release earnings results for its third quarter, after the closing bell on Wednesday.

IBM Stock Offers A Whole Lot Of Nothing Going Into Earnings

IBM's recent stock surge is likely driven by AI hype, but its fundamental growth and valuation don't justify the high price. The company's dividend yield and growth rate are unimpressive, and buybacks are insufficient to offset stock-based compensation. IBM's free cash flow has gone nowhere over the years, but the stock's valuation has become elevated.

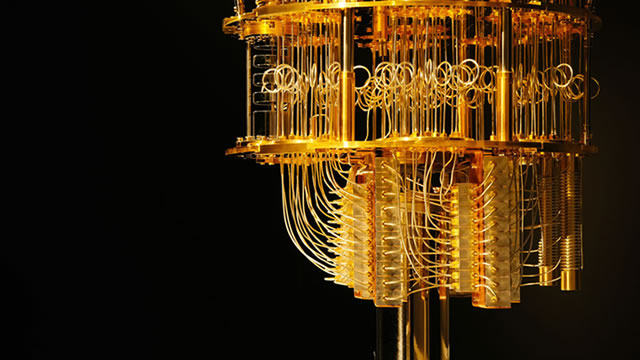

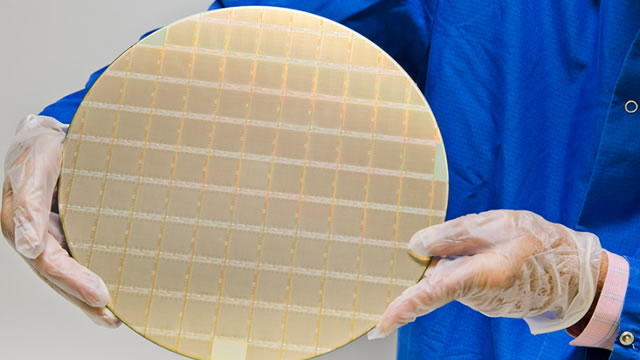

IBM Thinks Small to Win Enterprise AI

The tech giant's quick, cost-efficient AI models can be fine-tuned with enterprise data to produce impressive results.

IBM Q3 Earnings Preview: AI Push, Software Strength In Focus With Stock At Record Levels

With a 70% rally over the past 12 months, IBM stock is trading at record levels ahead of an important Q3 report Wednesday.

Will Higher Software Revenues Benefit IBM's Earnings in Q3?

IBM is likely to have recorded higher revenues from the Software segment on product innovation and the growing clout of watsonx.ai.

Will Solid Consulting Revenues Boost IBM's Q3 Earnings?

IBM is likely to have recorded higher revenues from the Consulting segment backed by rising demand for technology consulting and business transformation services.

IBM Earnings Preview: Big Technical Breakout; Company Hasn't Repo'ed Any Stock Since March '19

When IBM reports their Q3 2024 earnings Wednesday, consensus expectations will be looking for $2.23 in EPS on $2.6 billion in operating income, and $15 billion in revenue. Perhaps something the Street is warming up to is IBM's improved free cash flow. For Q4 '24 (typically IBM's strongest quarter of the year), the sell-side consensus is expecting $3.76 in EPS, $4.3 billion in operating income, and $17.9 billion in revenue.