IDEX Corporation (IEX)

IDEX Q2 Earnings Surpass Estimates, Sales Increase Year Over Year

IEX tops Q2 estimates with 7% revenue growth, driven by acquisitions and strong HST performance, but margins slipped.

Idex (IEX) Reports Q2 Earnings: What Key Metrics Have to Say

The headline numbers for Idex (IEX) give insight into how the company performed in the quarter ended June 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Idex (IEX) Q2 Earnings and Revenues Beat Estimates

Idex (IEX) came out with quarterly earnings of $2.07 per share, beating the Zacks Consensus Estimate of $2 per share. This compares to earnings of $2.06 per share a year ago.

IDEX Gears Up to Post Q2 Earnings: Is a Beat in the Offing?

IEX is likely to extend its earnings beat streak as strong HST and FSDP demand offsets FMT softness and rising costs.

Idex (IEX) Expected to Beat Earnings Estimates: What to Know Ahead of Q2 Release

Idex (IEX) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Will Idex (IEX) Beat Estimates Again in Its Next Earnings Report?

Idex (IEX) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

IDEX: Navigating Uncertainty With Steady Growth And Strong Cash Flow

IDEX delivers steady cash flow and high margins from niche industrial markets, supported by a diversified portfolio and mission-critical products. Financial health is robust, with strong free cash flow, moderate leverage, and consistent shareholder returns via dividends and buybacks. The growth outlook is modest (1–3% organic sales, $8.10–8.45 EPS), but the valuation is fair given stability, efficiency, and resilience to market shocks.

IDEX Stock Exhibits Strong Prospects Despite Persisting Headwinds

IEX is set to benefit from the solid momentum across its FSDP & FMT segments. However, increasing expenses remain a concern.

IDEX Corporation (IEX) Q1 2025 Earnings Call Transcript

IDEX Corporation (NYSE:IEX ) Q1 2025 Earnings Call May 1, 2025 9:00 AM ET Company Participants Jim Giannakouros - Investor Relations Eric Ashleman - President and Chief Executive Officer Abhi Khandelwal - Senior Vice President and Chief Financial Officer Conference Call Participants Mike Halloran - Baird Nathan Jones - Stifel Vlad Bystricky - Citigroup Joe Giordano - Cowen Bryan Blair - Oppenheimer Deane Dray - RBC Capital Markets Brett Linzey - Mizuho Matt Summerville - D.A. Davidson Operator Greetings.

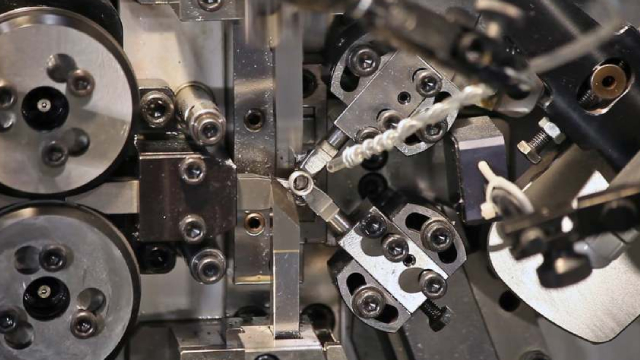

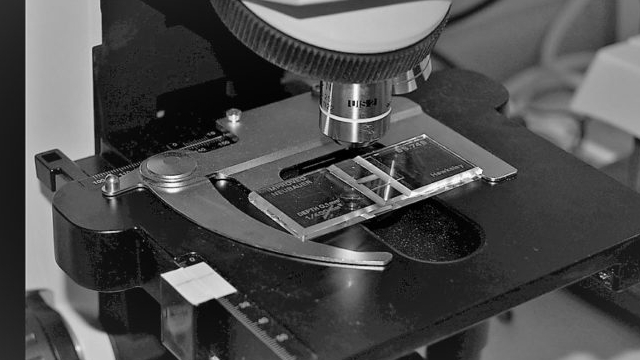

IDEX Corporation: There Is Upside Potential

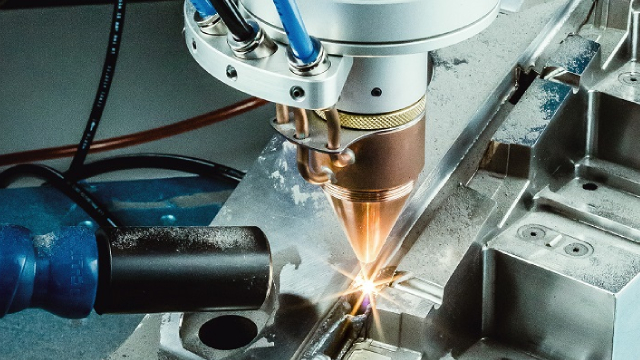

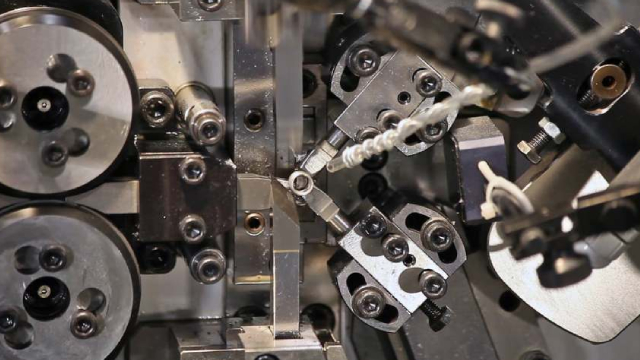

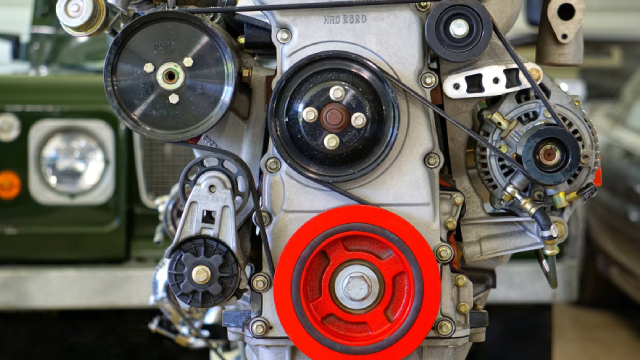

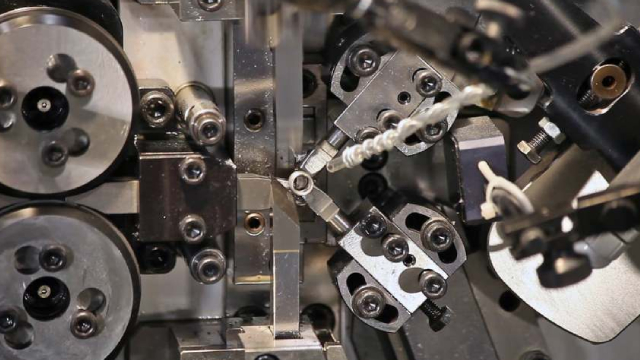

IDEX Corporation designs, manufactures, and sells precise fluid and material handling solutions, operating in three segments. Growth by acquisitions is somewhat risky, but IDEX has done an excellent job of not overpaying for the companies it acquires. The company has a solid history of dividend growth, raising its dividend at a clip of 9% over the past decade.

IDEX Q1 Earnings Surpass Estimates, Sales Increase Year Over Year

Strength in the Health & Science Technologies segment aids IEX's first-quarter results.

Idex (IEX) Q1 Earnings: How Key Metrics Compare to Wall Street Estimates

The headline numbers for Idex (IEX) give insight into how the company performed in the quarter ended March 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.