Jabil Inc. (JBL)

Jabil (JBL) Exceeds Market Returns: Some Facts to Consider

Jabil (JBL) closed at $218.72 in the latest trading session, marking a +2.18% move from the prior day.

Why Jabil (JBL) Outpaced the Stock Market Today

Jabil (JBL) concluded the recent trading session at $207.23, signifying a +1.59% move from its prior day's close.

Here's Why Jabil (JBL) is a Strong Value Stock

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Jabil (JBL) Suffers a Larger Drop Than the General Market: Key Insights

Jabil (JBL) closed at $192.49 in the latest trading session, marking a -3.8% move from the prior day.

Jabil (JBL) Rises Higher Than Market: Key Facts

Jabil (JBL) closed the most recent trading day at $219.26, moving +2.6% from the previous trading session.

Why Jabil (JBL) is a Top Value Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Why Jabil (JBL) Dipped More Than Broader Market Today

In the most recent trading session, Jabil (JBL) closed at $209.22, indicating a -5.03% shift from the previous trading day.

Jabil (JBL) Laps the Stock Market: Here's Why

Jabil (JBL) concluded the recent trading session at $212.44, signifying a +2.84% move from its prior day's close.

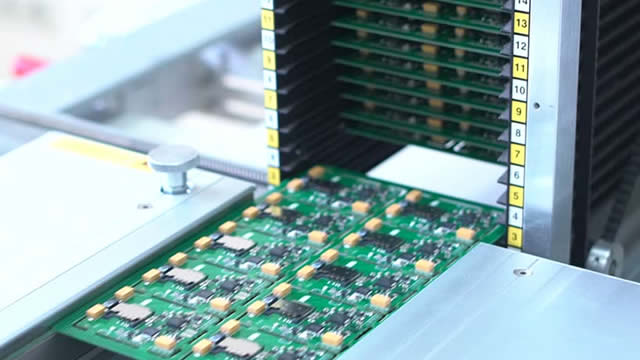

Jabil's Diverse Portfolio Fuels Revenue Growth: A Sign of More Upside?

JBL's broad portfolio spanning AI data center, renewables, semiconductor and retail automation is powering steady revenue gains and reinforcing its market resilience.

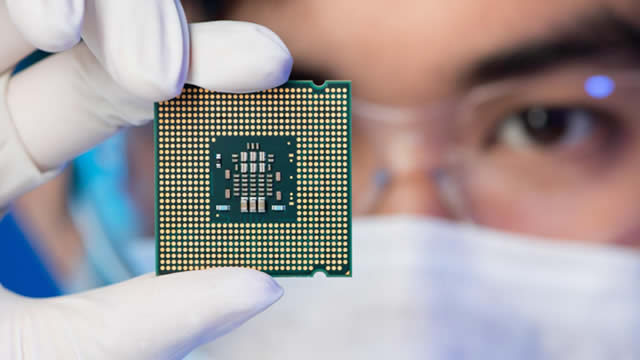

JBL vs. ANET: Which Tech Stock Offers More Upside in AI Networking?

ANET's strong data-center focus and AI-driven growth outlook give it a slight edge over JBL despite the latter's valuation appeal.

Jabil Stock Soars 40%, What's Next?

Jabil (NYSE: JBL) has emerged as one of the unexpected achievers of 2025, rising by approximately 40% year-to-date, whereas the S&P 500 has only increased by 18%. A surge in demand from AI infrastructure and data center clients has significantly benefited the company, and management further enhanced the situation with a newly announced $1 billion share buyback.

This High-Flying Artificial Intelligence (AI) Stock Plummeted Last Week. It Can Skyrocket Once Again.

Contract electronics manufacturer Jabil (JBL -6.31%) reported its fiscal 2025 fourth-quarter results (for the three months ended Aug. 31) on Sept. 25, and the stock dropped despite delivering stronger-than-expected results and guidance.