Lam Research Corporation (LRCX)

Should You Buy, Sell or Hold Lam Research Stock Before Q1 Earnings?

LRCX's fiscal first-quarter results are expected to reflect the benefits of a rebound in the semiconductor industry and improving memory spending.

Could Lam Research Stock Help You Retire a Millionaire?

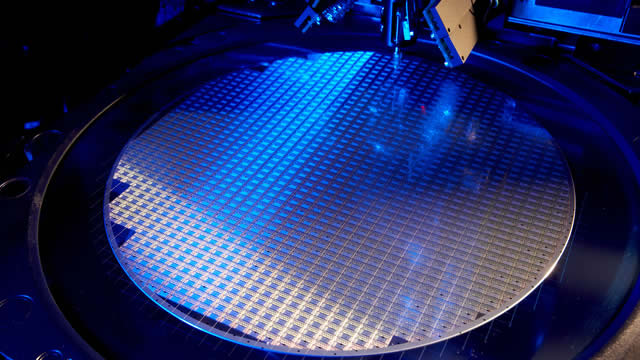

Semiconductor innovation is a multidecade investing trend that is poised to continue with the arrival of AI and other technologies.

Lam Research (LRCX) Stock Dips While Market Gains: Key Facts

Lam Research (LRCX) closed the most recent trading day at $72.84, moving -0.41% from the previous trading session.

Lam Research (LRCX) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Lam Research (LRCX) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Earnings Growth & Price Strength Make Lam Research (LRCX) a Stock to Watch

Finding strong, market-beating stocks with a positive earnings outlook becomes easier with the Focus List, a top feature of the Zacks Premium portfolio service.

Will Lam Research (LRCX) Beat Estimates Again in Its Next Earnings Report?

Lam Research (LRCX) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Here's Why Lam Research (LRCX) is a Strong Momentum Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Wall Street Analysts See Lam Research (LRCX) as a Buy: Should You Invest?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Wall Street Analysts Predict a 27.37% Upside in Lam Research (LRCX): Here's What You Should Know

The average of price targets set by Wall Street analysts indicates a potential upside of 27.4% in Lam Research (LRCX). While the effectiveness of this highly sought-after metric is questionable, the positive trend in earnings estimate revisions might translate into an upside in the stock.

Here's Why Lam Research (LRCX) Fell More Than Broader Market

Lam Research (LRCX) closed the most recent trading day at $80.61, moving -1.14% from the previous trading session.

Here's 1 Incredibly Cheap Semiconductor Stock to Buy Following Micron Technology's Latest Results

Micron's latest results suggest the memory chip market is in great shape. That's solid news for another semiconductor company.

A Few Years From Now, You'll Wish You'd Bought This Undervalued Stock

Lam Research combines strong competitive advantages, a key role in a growth industry, and reasonable valuation that should grab investor attention.