Lyft Inc. (LYFT)

Hitching A Bargain Ride With Lyft

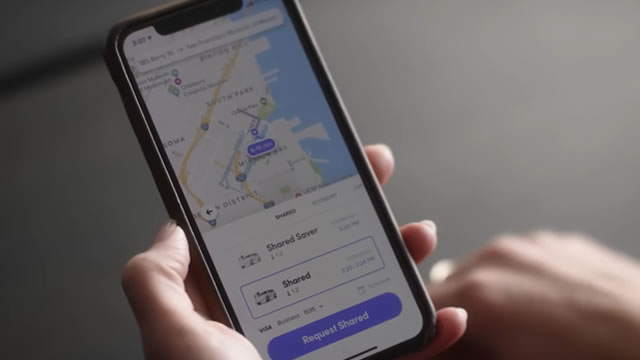

Lyft stock is undervalued, trading at less than 1X P/S and around 8X P/E, despite over 20% YoY revenue growth and recent profitability. Ride-sharing isn't a winner-takes-all business; Lyft's focused, customer-centric strategy and market dynamics ensure its survival against Uber. Robotaxis will complement, not disrupt, ride-sharing; partnerships like Lyft with Mobileye highlight synergies and operational necessities.

Is Lyft Set for Huge Growth With Europe Expansion?

Lyft (LYFT 2.81%) is acquiring a taxi app in Europe. This may seem like an odd addition to the business, but Travis Hoium explains why it's a perfect strategic fit in this video.

Lyft goes global, tariff impact on autos

Catalysts host Madison Mills takes a look at some of the top stories of April 16, 2025. Lyft CEO David Risher joins the show to discuss the company going international.

Lyft Pays $197 Million to Pick Up German Taxi App FreeNow

Lyft is expanding into Europe with its $197 million purchase of taxi app FreeNow. The deal, announced Wednesday (April 16), will see Lyft acquire the Germany-based company from BMW and Mercedes-Benz Mobility.

Lyft enters Europe with FREENOW acquisition

Lyft Inc (NASDAQ:LYFT) on Wednesday announced it is acquiring the European multi-mobility app FREENOW from BMW Group and Mercedes-Benz Mobility for €175 million (US$197) million in cash. The acquisition marks Lyft's largest move beyond North America, expanding its presence to nine European countries and more than 150 cities.

Lyft to buy taxi app FREENOW for $197M to enter Europe

Ride-hailing giant Lyft said it has agreed to acquire FREENOW, a German multi-mobility app with ride-hail at its core, from BMW and Mercedes-Benz Mobility for about $197 million in cash.

Lyft Stock Rises on Acquisition News

LYFT Inc (NYSE:LYFT) stock was last seen 1.7% higher premarket, after announcing its first European acquisition -- a $199 million deal to purchase Hamburg-based ride-hailing platform FreeNow from BMW and Mercedes-Benz.

Lyft to buy taxi app Free Now for $200 million to expand into Europe

Ride-hailing firm Lyft is buying European taxi app Free Now for $199 million. The acquisition — Lyft's first in Europe — is expected to close in the second half of 2025.

Lyft (LYFT) Suffers a Larger Drop Than the General Market: Key Insights

Lyft (LYFT) closed the most recent trading day at $12.27, moving -1.76% from the previous trading session.

Here's Why Lyft (LYFT) is a Strong Value Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Final Trade: GOOGL, BA, LYFT, GOLD

The final trades of the day with CNBC's Melissa Lee and the Fast Money traders.

Lyft: Holding Firm Ground Against Uber

Shares of Lyft have continued to crash in 2025, pushing the stock to a very cheap ~8x adjusted EBITDA and ~4x FCF multiples. I'm upgrading Lyft to a strong buy, especially on the back of strong Q4 results that showed record-breaking bookings at a 15% y/y growth pace. Lyft's pure rideshare focus is more recession-proof than Uber (as delivery orders are more discretionary), offering stable demand amid potential economic downturns.