Mastercard Inc. (MA)

Trump Tariff Sell-Off: 3 Superb Stocks That Make for No-Brainer Buys Right Now

When examined over long stretches, stocks stand atop the pedestal in terms of annualized return, relative to all other asset classes. But this doesn't mean the Dow Jones Industrial Average (^DJI -1.33%), S&P 500 (^GSPC 0.13%), and Nasdaq Composite (^IXIC -0.13%) move from Point A to B in a straight line.

Mastercard: Another Wonderful Business With A Price Tag To Match

Mastercard is definitely a wonderful business, both when assessed qualitatively and quantitatively. The future risks for the company are tolerable, and definitely preferrable in relation to most other businesses. The company's future prospects are excellent.

MasterCard (MA) Ascends But Remains Behind Market: Some Facts to Note

The latest trading day saw MasterCard (MA) settling at $512.46, representing a +0.53% change from its previous close.

Mastercard Premium Valuation: Opportunity or Risk in a Shaky Economy?

Beyond macroeconomic and financial concerns, MA also faces rising regulatory scrutiny and legal challenges.

Is Most-Watched Stock Mastercard Incorporated (MA) Worth Betting on Now?

MasterCard (MA) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Mastercard & PayTabs Launch Payment Platform to Aid Egyptian SMEs

MA partners with PayTabs to unveil a white-labeled digital payments platform to improve payment experiences for SMEs in Egypt, thereby bolstering MA's nationwide presence.

Will MasterCard (MA) Beat Estimates Again in Its Next Earnings Report?

MasterCard (MA) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

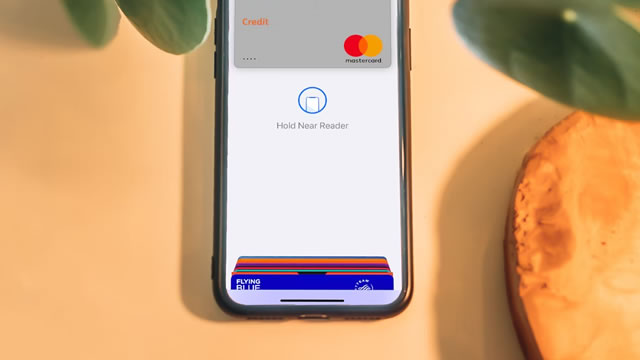

Mastercard Transforms Payments With 2030 Vision for Australia

MA unveils a bold 2030 vision featuring biometrics, contactless cards, and real-time payments to enhance security, convenience, and growth.

Mastercard: With A Large Market Share And High Growth, Great Returns Are Probable

Mastercard is a 'Strong Buy' due to the decline in cash use and the rise in payment card transactions, driven in part by the growth of e-commerce. Despite recent market drops, MA's stable financial growth and predictable future make it a great buy at a discounted price. The 9 Pillar Analysis shows the Company's solid fundamentals, with high revenue, net income, and free cash flow growth, despite a slight premium, which, I believe, is deserved.

Mastercard: This High-Quality Compounder Just Became Reasonably Valued

Mastercard is a high-growth stock with a strong moat, now reasonably valued after a recent sell-off, making it a Buy for long-term investors. Beyond credit cards, Mastercard's services like fraud detection and cybersecurity are growing rapidly, contributing to 38% of total revenue and offering substantial growth potential. Financials show steady revenue, high profitability, and strong free cash flow, indicating a robust competitive advantage and long-term growth prospects.

Mastercard Is Taking On the World and Winning

The Mastercard (MA -7.67%) logo is pretty ubiquitous in the United States. It adorns credit cards, debit cards, store windows, websites, and credit card processing machines.

Mastercard vs. AmEx: Which Payments Giant Has More Room to Run?

Compared to MA's more globally diversified business, AXP remains more exposed to domestic economic shifts.