Mercury Systems Inc. (MRCY)

Mercury Systems Gears Up For Q2 Print; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Mercury Systems, Inc. MRCY is expected to release earnings results for its fourth quarter, after the closing bell on Tuesday, Aug. 13.

Ahead of Mercury Systems (MRCY) Q4 Earnings: Get Ready With Wall Street Estimates for Key Metrics

Looking beyond Wall Street's top -and-bottom-line estimate forecasts for Mercury Systems (MRCY), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended June 2024.

Earnings Preview: Mercury Systems (MRCY) Q4 Earnings Expected to Decline

Mercury Systems (MRCY) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Mercury (MRCY) Secures $13.2 Million Agreement From U.S. Navy

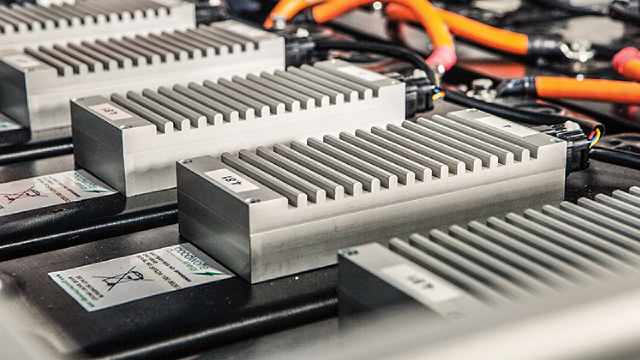

Mercury (MRCY) secures a $13.2 million agreement from the U.S. Navy to advance chip-sale technologies, which will reduce electronic warfare design timelines.

Mercury Systems (MRCY) Up 5.6% Since Last Earnings Report: Can It Continue?

Mercury Systems (MRCY) reported earnings 30 days ago. What's next for the stock?

Mercury Systems, Inc. (NASDAQ:MRCY) Shares Sold by Swiss National Bank

Swiss National Bank lessened its stake in shares of Mercury Systems, Inc. (NASDAQ:MRCY – Free Report) by 8.8% in the fourth quarter, according to its most recent filing with the SEC. The fund owned 105,000 shares of the technology company’s stock after selling 10,100 shares during the period. Swiss National Bank owned about 0.18% of Mercury Systems worth $3,840,000 at the end of the most recent reporting period. A number of other institutional investors and hedge funds also recently modified their holdings of MRCY. William Blair Investment Management LLC lifted its holdings in shares of Mercury Systems by 25.6% during the third quarter. William Blair Investment Management LLC now owns 6,749,562 shares of the technology company’s stock valued at $250,341,000 after purchasing an additional 1,376,905 shares during the last quarter. Vanguard Group Inc. lifted its stake in Mercury Systems by 8.3% during the third quarter. Vanguard Group Inc. now owns 5,615,965 shares of the technology company’s stock valued at $208,296,000 after buying an additional 429,532 shares in the last quarter. JANA Partners Management LP acquired a new position in shares of Mercury Systems in the third quarter worth about $174,518,000. Conestoga Capital Advisors LLC increased its position in shares of Mercury Systems by 13.4% in the fourth quarter. Conestoga Capital Advisors LLC now owns 2,450,459 shares of the technology company’s stock worth $89,613,000 after acquiring an additional 288,973 shares in the last quarter. Finally, Victory Capital Management Inc. raised its holdings in shares of Mercury Systems by 1.6% during the fourth quarter. Victory Capital Management Inc. now owns 1,800,182 shares of the technology company’s stock valued at $65,833,000 after acquiring an additional 27,488 shares during the period. Institutional investors and hedge funds own 95.99% of the company’s stock. Analyst Ratings Changes Several research firms have weighed in on MRCY. Truist Financial lowered their price objective on shares of Mercury Systems from $28.00 to $26.00 and set a “hold” rating on the stock in a research report on Wednesday, May 8th. Royal Bank of Canada dropped their price target on Mercury Systems from $35.00 to $30.00 and set a “sector perform” rating on the stock in a research report on Wednesday, February 7th. Finally, The Goldman Sachs Group decreased their price objective on Mercury Systems from $24.00 to $21.00 and set a “sell” rating for the company in a research report on Thursday, February 8th. Four research analysts have rated the stock with a sell rating and four have given a hold rating to the company. According to MarketBeat, the stock has a consensus rating of “Hold” and a consensus price target of $29.63. View Our Latest Stock Report on MRCY Mercury Systems Stock Up 1.3 % Shares of Mercury Systems stock opened at $31.65 on Monday. The firm has a market cap of $1.88 billion, a price-to-earnings ratio of -13.47 and a beta of 0.68. The stock has a 50-day simple moving average of $28.77 and a 200-day simple moving average of $31.43. Mercury Systems, Inc. has a 52-week low of $25.31 and a 52-week high of $43.84. The company has a debt-to-equity ratio of 0.42, a current ratio of 4.58 and a quick ratio of 2.93. Mercury Systems Profile (Free Report) Mercury Systems, Inc, a technology company, manufactures and sells components, products, modules, and subsystems for aerospace and defense industries in the United States, Europe, and the Asia Pacific. Its products and solutions are deployed in approximately 300 programs with 25 defense contractors and commercial aviation customers.