Merck & Co., Inc. (MRK)

Merck & Co., Inc. (MRK) Is a Trending Stock: Facts to Know Before Betting on It

Merck (MRK) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Merck Proves Why It's Still A Top Pharma Pick

Despite a catastrophic drop in sales of the Gardasil franchise, mainly due to weak demand from China, Merck once again beat consensus EPS and revenue estimates. So, the key contributors whose performance pleasantly surprised me in Q1 2025, and thanks to which Merck's operating income margin remains above 40%, are Vaxneuvance, Winrevair, and Welireg. From its oncology franchise, I highlight Welireg as a 'gem,' whose sales amounted to $137 million in the first three months of 2025, an increase of 61.2% year-on-year.

MRK Down 21% YTD: Should You Buy, Hold or Sell the Stock?

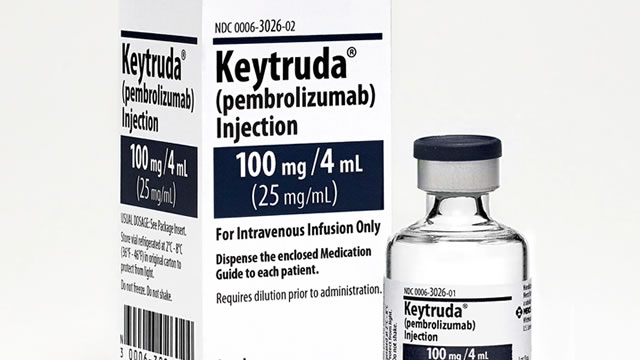

Merck stock lags industry as Keytruda dependency, Gardasil woes in China, and tariff risks cloud outlook despite pipeline strength and new launches.

Should You Buy MRK Stock At $80?

Merck (NYSE:MRK) stock has experienced a significant 22% decline this year, sharply underperforming the broader S&P 500 index, which is down only 1%. This downturn can be attributed to several factors: a lowered guidance for 2025 and growing concerns about the long-term growth prospects of its blockbuster drugs, Keytruda and Gardasil.

Merck: Defensive Yield Meets Long-Term Optionality

The market has largely priced in the 2028 Keytruda patent cliff, with Merck trading at a discount reflecting aggressive revenue erosion assumptions. Merck is actively expanding in oncology, immunology, and vaccines through acquisitions and R&D, offering long-term optionality beyond Keytruda. Gardasil's China-driven slump has limited downside left, with stable ex-China growth and male-use approval offering medium-term recovery potential.

Merck: Undervalued In Light Of Key Risks

Merck & Co. is undervalued, trading at lower multiples than peers, due to concerns over patent expirations and recent financial volatility. Despite modest overall revenue growth, oncology—especially Keytruda—drives strong segment performance, offsetting declines in virology and diabetes products. Management is aggressively investing in R&D and manufacturing expansion, with a robust drug pipeline and significant capital commitments to future growth.

MRK, Daiichi Begin Pivotal Esophageal Cancer Study With ADC Drug

The IDeate-Esophageal01 study is set to evaluate Merck & Daiichi's ADC drug ifinatamab deruxtecan in pre-treated patients with esophageal squamous cell carcinoma.

Merck & Co., Inc. (MRK) BofA Securities 2025 Healthcare Conference (Transcript)

Merck & Co., Inc. (NYSE:MRK ) BofA Securities 2025 Healthcare Conference May 14, 2025 1:40 PM ET Company Participants Jannie Oosthuizen - President Peter Dannenbaum - Senior Vice President, Investor Relations Marjorie Green - SVP, Head of Oncology Clinical Development Conference Call Participants Tim Anderson - Bank of America Tim Anderson Thanks for joining us for this, meeting. I'm Tim Anderson, the U.S. large-cap pharma and biotech analyst at Bank of America.

US FDA expands use of Merck's cancer drug for adrenal gland tumors

The U.S. Food and Drug Administration said on Wednesday it has approved the expanded use of Merck's cancer drug to treat two types adrenal gland tumors.

Merck Animal Health announces $895 million investment in Kansas

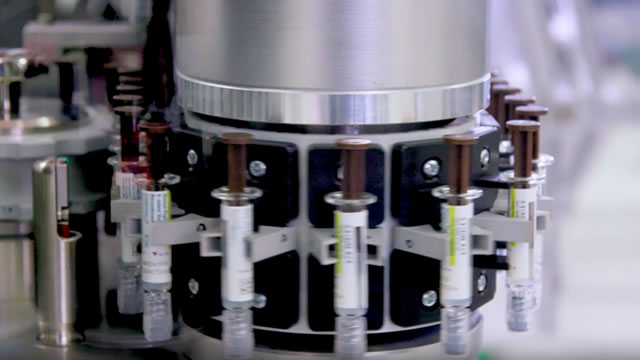

Merck Animal Health, a unit of Merck , said on Thursday it would invest $895 million to expand its manufacturing facility in De Soto, Kansas.

Investors Heavily Search Merck & Co., Inc. (MRK): Here is What You Need to Know

Zacks.com users have recently been watching Merck (MRK) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Merck to invest $1B in new US plant to make blockbuster cancer treatment Keytruda

The new facility will produce biologic drugs and Keytruda, becoming Merck's first in-house US site to make the blockbuster cancer treatment, the company said.