Merck & Co., Inc. (MRK)

Merck says its HPV vaccine for men was approved by China's drug regulator

U.S. drugmaker Merck & Co said on Wednesday its human papillomavirus (HPV) vaccine for men has been approved by China's medical products administration.

Merck (MRK) Rises Higher Than Market: Key Facts

Merck (MRK) closed at $99.72 in the latest trading session, marking a +0.59% move from the prior day.

China's WuXi Biologics to sell Ireland vaccine facility to Merck for $500 million

China's WuXi Biologics said on Monday it will sell its vaccine facility in Ireland to Merck for about $500 million.

Merck & Co., Inc. (MRK) Is a Trending Stock: Facts to Know Before Betting on It

Recently, Zacks.com users have been paying close attention to Merck (MRK). This makes it worthwhile to examine what the stock has in store.

UK approves Merck's therapy for rare lung condition

UK's Medicines and Healthcare products Regulatory Agency (MHRA) said on Tuesday it had approved Merck's therapy to treat a rare lung condition called pulmonary arterial hypertension.

Merck (MRK) Sees a More Significant Dip Than Broader Market: Some Facts to Know

The latest trading day saw Merck (MRK) settling at $98.37, representing a -1.33% change from its previous close.

2 Reasons to Sell Merck Stock and 1 Reason to Buy

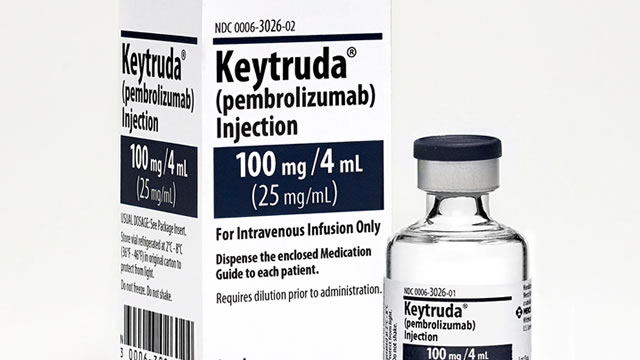

There is plenty to like about Merck (MRK -0.25%). It is one of the largest pharmaceutical companies and the owner of the world's current best-selling drug, cancer medicine Keytruda.

Merck (MRK) Rises Yet Lags Behind Market: Some Facts Worth Knowing

Merck (MRK) closed the most recent trading day at $99.45, moving +0.08% from the previous trading session.

Merck to discontinue drug for bacterial infection

Merck will discontinue its drug for a bacterial infection that can lead to fatal diarrhea, the U.S. Food and Drug Administration's website showed on Monday.

Merck: A Low-Hanging Fruit To Pick

Merck, a leading global pharmaceutical company that produces a range of medicines, vaccines, and animal healthcare products, is now a $258 billion (by market cap) healthcare behemoth. The US is the company's largest market, accounting for approximately 47% of worldwide sales. Merck has started showing signs of sustained growth starting from right about FY 2020, as Keytruda is growing way faster than 5% annually.

Is Merck the Next Big Weight-Loss Stock?

Watch out, Eli Lilly and Novo Nordisk. Merck (MRK -1.48%) is hungrily looking to take a bite out of the weight-loss drugs market.

MRK's Pivotal Study on Two-Drug, Once-Daily HIV Pill Meets Goals

Merck posts positive data from two phase III studies evaluating a two-drug, single-tablet regimen of doravirine/islatravir in adults with HIV-1 infection.