Merck & Co., Inc. (MRK)

Merck Among 10 Companies To Announce Annual Dividend Increases In Second Half Of November

This is my latest article where I provide predictions of upcoming dividend increases from companies with long-term dividend growth histories. I expect 10 companies to announce their annual increases in the second half of November, including modest increases from Merck and a 10%+ increase from Raymond James Financial. Hormel Foods is expected to announce its 59th consecutive year of dividend growth, highlighting its long-term commitment to dividend increases.

Merck Inks $3.3B Licensing Deal With Chinese Biotech for Cancer Therapy

MRK in-licenses a bispecific antibody, based on the same mechanism as SMMT's lead drug, which outperformed its blockbuster drug, Keytruda, in a lung cancer study.

Merck: Keytruda's Sales Projections Outweigh Competitive And Patent Risks

Merck's stock is undervalued, trading at less than 4x expected 2024 revenues, despite strong revenue growth from Keytruda and other drugs. Keytruda's revenue is projected to increase by 70% from 2024 to 2032. Declining Gardasil sales in China and competition from Summit Therapeutics and Roche's Tecentriq may have contributed to recent stock volatility.

Merck signs $3.3 bln deal for experimental cancer drug

Merck has signed a licensing agreement worth up to $3.3 billion with Shanghai-based LaNova Medicines to develop, make and sell an experimental cancer drug, the two companies said on Thursday.

Merck & Co., Inc. (MRK) UBS Global Healthcare Conference (Transcript)

Merck & Co., Inc. (NYSE:MRK ) UBS Global Healthcare Conference November 13, 2024 12:30 PM ET Company Participants Jannie Oosthuizen - President of Human Health of the U.S. Joerg Koglin - SVP of Clinical Research Conference Call Participants Trung Huynh - UBS Trung Huynh Okay, great. I think we're at time here.

Here is What to Know Beyond Why Merck & Co., Inc. (MRK) is a Trending Stock

Recently, Zacks.com users have been paying close attention to Merck (MRK). This makes it worthwhile to examine what the stock has in store.

2 Hot Biopharma Stocks to Buy and Hold for 5 Years

If you're patient, these businesses have a lot of promising projects in the works.

Merck: An Undervalued Dividend Machine

Keytruda, Merck's flagship oncology drug, drives significant revenue growth, with a solid market position and patent protection ensuring continued growth. Merck is the second largest player in the oncology drugs industry, which is expected to observe a 6.7% CAGR over the next five years. Merck's consistent dividend payments over 34 years, healthy balance sheet, and attractive valuation highlight its investment appeal.

Is MRK Stock Undervalued At $100?

Merck (NYSE: MRK) recently reported its Q3 results, with revenues and earnings exceeding the street estimates. It garnered $16.7 billion in revenue and adjusted earnings of $1.57 per share, compared to the consensus estimates of $16.5 billion and $1.50, respectively.

2 Magnificent Stocks to Buy That Are Near 52-Week Lows

These stocks near 52-week lows could be ready to rebound.

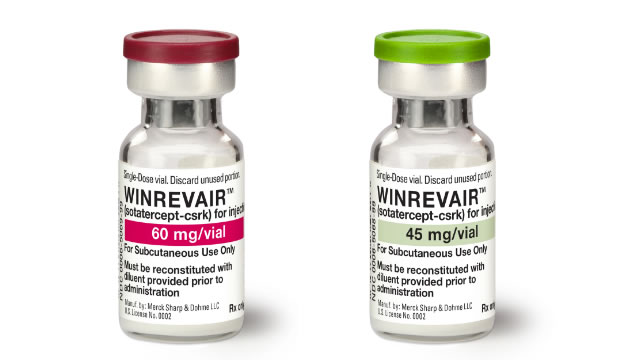

Merck's Gardasil Shot Challenges To Continue, Analysts Optimistic For Newly Approved Sotatercept For Rare Lung Disease

On Thursday, Merck & Co Inc MRK reported third-quarter sales of $16.66 billion, up 4% year over year, beating the consensus of $16.47 billion.

Is Merck Stock a Buy?

The next few years might get bumpy for the pharmaceutical giant, but the longer term looks better.