Merck & Co., Inc. (MRK)

Merck Loses Around $32B in 3 Months: Time to Sell the Stock?

Declining estimates and the recent price drop make investors skeptical about holding MRK stock.

Merck (MRK) Stock Dips While Market Gains: Key Facts

In the closing of the recent trading day, Merck (MRK) stood at $117.23, denoting a -1.19% change from the preceding trading day.

Summit Therapeutics Bests Merck's Top Selling Drug In Phase III Trial

Summit Therapeutics' ivonescimab shows improved efficacy over Merck's Keytruda in Phase III trials, targeting both PD-1 and VEGF, potentially expanding the PD-1 inhibitor market. Despite risks, Summit's promising data and significant insider investment suggest a speculative buy, with potential for major upside if FDA approval is achieved. Ivonescimab's dual mechanism could disrupt the oncology market, similar to Regeneron's Eylea, positioning Summit for substantial growth if it captures market share.

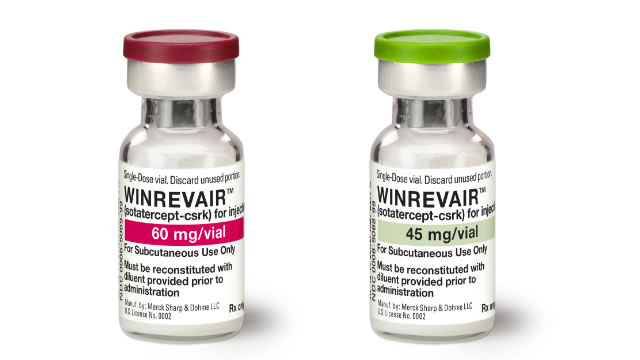

Merck's Keytruda Obtains its First FDA Approval for Mesothelioma

The FDA approves MRK's Keytruda for first-line treatment of malignant pleural mesothelioma. This marks Keytruda's first approval for the given indication.

Investors Heavily Search Merck & Co., Inc. (MRK): Here is What You Need to Know

Merck (MRK) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Study: Merck and Daiichi's Lung Cancer Treatment Shows Promise

MRK and Daiichi Sankyo's patritumab deruxtecan shows statistically significant progression-free survival improvement in previously treated EGFR-mutated NSCLC.

Is It Worth Investing in Merck (MRK) Based on Wall Street's Bullish Views?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Merck & Co., Inc. (MRK) Bank of America Global Healthcare Conference (Transcript)

Merck & Co., Inc. (NYSE:MRK ) Bank of America Global Healthcare Conference September 18, 2024 6:40 AM ET Company Participants Joseph Romanelli - President, Human Health International Peter Dannenbaum - Head of Investor Relations Conference Call Participants Chen Yang - Bank of America Chen Yang Thank you for attending our Global Healthcare Conference. Today, I have the pleasure to host Joe Romanelli, President of Human Health International; and Peter Dannenbaum, Head of Investor Relations.

Merck wins first FDA approval for Keytruda as a treatment for mesothelioma

Merck & Co. Inc. said Wednesday the U.S. Food and Drug Administration has approved its blockbuster cancer drug Keytruda as a treatment for malignant plural mesothelioma, a rare cancer associated with asbestos.

Where Will Merck Stock Be in 5 Years?

Its blockbuster Keytruda cancer drug is scheduled to lose patent protection by the end of this decade. The company is betting on an extensive candidate pipeline and new indications to drive long-term growth.

Merck Appears Ready To Return To June Highs (Technical Analysis)

Merck's 15% decline in July is presenting investors with an intermediate to long-term buying opportunity. Long-term trend lines and Bollinger Bands indicate strong support at $110. We expect Merck to return to the July high of $133. Sentiment indicators show "too many" investors expect lower prices for Merck, which is a positive signal for higher prices.

Merck (MRK) Increases Yet Falls Behind Market: What Investors Need to Know

In the most recent trading session, Merck (MRK) closed at $115.86, indicating a +0.53% shift from the previous trading day.