Merck & Co., Inc. (MRK)

Can Keytruda Sustain Merck's Growth Through the Rest of 2025?

MRK banks on Keytruda's soaring sales and new oncology strategies to fuel 2025 growth, even as competition and patent loss loom.

Merck: Buy The Weakness

Merck trades at a single-digit P/E, reflecting underperformance but strong financials and a robust dividend yield near 3.9%. Keytruda's ongoing success and expanded indications drive near-term results, but loss of exclusivity looms in three years. Merck's pipeline and Verona acquisition position it to offset Keytruda revenue loss, with $50B+ mid-2030s opportunity projected.

Merck's Narrowed 2025 Sales View: What it Means After Q2 Results?

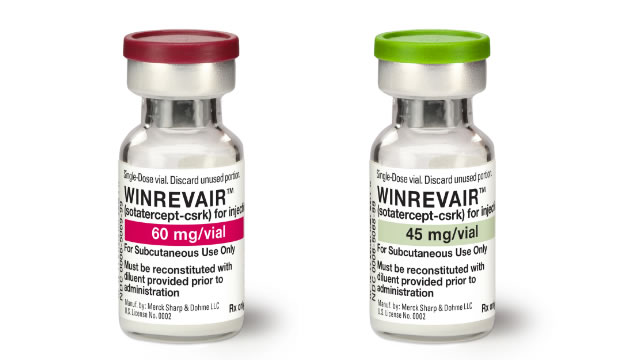

MRK trims its 2025 sales range but lifts the lower end of its EPS outlook. Keytruda, Animal Health and new drugs are expected to drive a second-half rebound.

Merck Stock Down 4% Since Q2 Results: How to Play the Stock

Merck slips following its Q2 results as Gardasil sales slump. However, Keytruda, new launches and a rich pipeline bolster its long-term case.

Why Merck (MRK) is a Top Value Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Investors Heavily Search Merck & Co., Inc. (MRK): Here is What You Need to Know

Merck (MRK) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Income Strategy: I'm Buying 2 Elite Mispriced Dividends

In the current tech-heavy market, I explore two compelling value stocks with strong yields and trade at deep discounts to historical valuations. Both have competitive advantages and strong histories of capital returns to shareholders. Both appear to be severely mispriced, offering enterprising investors the opportunity to capture value before the market pendulum swings back.

Merck Unveils Cost-Cutting Plan: Can it Create Long-Term Value?

MRK targets $3B in annual savings by 2027 as it cuts jobs and refocuses investment ahead of Keytruda's 2028 patent cliff.

Merck & Co., Inc. (MRK) Q2 2025 Earnings Call Transcript

Merck & Co., Inc. (NYSE:MRK ) Q2 2025 Earnings Conference Call July 29, 2025 9:00 AM ET Company Participants Caroline A. Litchfield - Executive VP & CFO Dean Y.

Here's What Key Metrics Tell Us About Merck (MRK) Q2 Earnings

Although the revenue and EPS for Merck (MRK) give a sense of how its business performed in the quarter ended June 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Merck will lay off employees and shed some real estate to cut $3 billion in costs

Merck's stock is falling after a rare revenue miss, and the announcement of a $3 billion cost-cutting plan that will include layoffs.

Merck (MRK) Tops Q2 Earnings Estimates

Merck (MRK) came out with quarterly earnings of $2.13 per share, beating the Zacks Consensus Estimate of $2.01 per share. This compares to earnings of $2.28 per share a year ago.