Marvell Technology, Inc. (MRVL)

Is Most-Watched Stock Marvell Technology, Inc. (MRVL) Worth Betting on Now?

Marvell (MRVL) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Marvell (MRVL) International Revenue Performance Explored

Explore Marvell's (MRVL) international revenue trends and how these numbers impact Wall Street's forecasts and what's ahead for the stock.

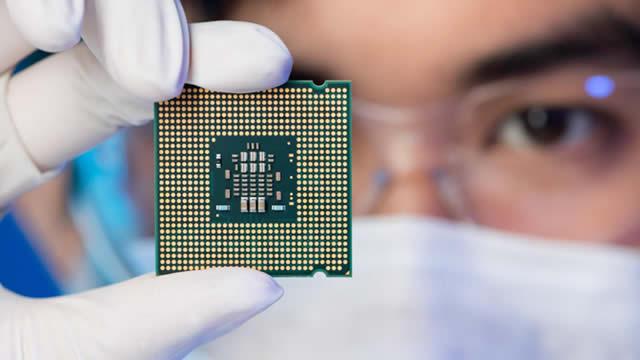

Marvell Technology AI Boom is Just Getting Started with ASIC

While semiconductor developer Marvell Technology, Inc. NASDAQ: MRVL is a benefactor in the artificial technology (AI) revolution, headline numbers for their second-quarter fiscal 2025 results don't paint the immediate upside potential. This is because the rest of the business shows weakness from the non-AI semiconductor cycle slowdown.

Marvell Technology Q2: Ramping Up Electro-Optics And Custom Silicon In H2

I reiterate a 'Buy' rating for Marvell Technology with a one-year price target of $90 per share, driven by strong growth in AI revenues from optics and custom ASIC. Marvell's data center business grew by 92% year-over-year, with significant contributions from electro-optic and custom silicon products, which are expected to continue driving growth. The company is guiding for high-teens sequential growth in Q3, with revenue projected at $1.45 billion, driven by increasing demand for high-bandwidth AI applications and interconnectivity solutions.

Marvell Technology Seeing Strong AI Chip Demand

Marvell Technology posted better-than-expected Q2 sales thanks to custom chips for AI applications. MRVL stock rose Friday.

Marvell stock: Could MRVL be the next big thing in AI?

Marvell Technology Inc (NASDAQ: MRVL) is emerging as a major player in the artificial intelligence sector, according to Ivana Delevska, founder and chief investment officer of Spear Invest. With shares of the semiconductor giant surging over 30% this month, Delevska remains highly optimistic about MRVL's potential as AI drives unprecedented growth in networking.

Marvell Technology Posts First Beat-And-Raise In 5 Quarters: Analysts Focus On 'Solid AI Story'

Marvell Technology Inc MRVL shares climbed in early trading on Friday, after the company reported upbeat second-quarter sales.

Marvell Technology Stock Surges on Better-Than-Expected Sales, Boosted by AI Demand

Marvell Technology (MRVL) shares surged nearly 5% in early trading Friday after the maker of networking circuits posted better-than-expected quarterly sales, driven by demand for equipment to support artificial intelligence (AI).

Marvell Q2 Earnings Beat: Will Strong Q3 Guidance Lift Shares?

MRVL's fiscal second-quarter results show the benefits of strong growth in the data center segment, partially offset by a decline in other segments.

2 Tech Stocks Making Moves After Earnings

Shares of Dell Technologies Inc (NYSE:DELL) and Marvell Technology Inc (NASDAQ:MRVL) are moving higher following their respective earnings reports.

Marvell Tops Its Q2 Guidance, Improves Margins

Q2 FY2025 net revenue was $1.27 billion, in line with management's guidance. Data center segment revenue surged 92% year over year to $880.9 million.

Marvell Technology, Inc. (MRVL) Q2 2025 Earnings Call Transcript

Marvell Technology, Inc. (NASDAQ:MRVL ) Q2 2025 Earnings Call Transcript August 29, 2024 4:45 PM ET Company Participants Ashish Saran - SVP of IR Matt Murphy - Chairman and CEO Willem Meintjes - CFO Conference Call Participants Tore Svanberg - Stifel Toshiya Hari - Goldman Sachs Timothy Arcuri - UBS Ross Seymore - Deutsche Bank Vivek Arya - Bank of America Matt Ramsay - TD Cowen Christopher Rolland - Susquehanna Harlan Sur - JPMorgan Aaron Rakers - Wells Fargo Srinivas Pajjuri - Raymond James Quinn Bolton - Needham Harsh Kumar - Piper Sandler Karl Ackerman - BNP Paribas Operator Good afternoon and welcome to Marvell Technology, Inc.'s Second Quarter of Fiscal Year 2025 Earnings Conference Call. All participants will be in listen-only mode.