Marvell Technology, Inc. (MRVL)

Marvell Technology (MRVL) Upgrades Its Alaska Portfolio

Marvell Technology (MRVL) launches the Alaska A 1.6T PAM4 DSP for active electrical cables focusing on high-speed networking for AI/ML workloads.

Why You Shouldn't Bet Against Marvell (MRVL) Stock

Marvell (MRVL) has seen solid earnings estimate revision activity over the past month, and belongs to a strong industry as well.

Here is What to Know Beyond Why Marvell Technology, Inc. (MRVL) is a Trending Stock

Recently, Zacks.com users have been paying close attention to Marvell (MRVL). This makes it worthwhile to examine what the stock has in store.

Marvell Technology Data Center Revenues Surge, But the Rest Fall

Marvell Technology Inc. NASDAQ: MRVL is a leading semiconductor company in the computer and technology sector sector that designs and manufactures high-performance chips. They are a powerhouse when it comes to their largest market addressing data infrastructure solutions and data centers.

Marvell Technology: Path To An Upcycle Has Become More Visible

Marvell Technology's 1Q25 results show a clear path to growth recovery, with visible catalysts for acceleration in 2H25. The Data Center segment has shown four consecutive quarters of positive sequential growth, indicating an upcycle. MRVL's valuation is attractive, and the stock should easily trade back to previous levels as the recovery potential becomes more visible.

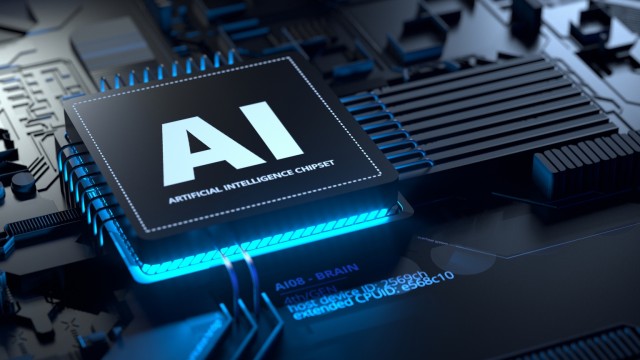

Marvell: Even A Tiny Piece Of The AI Pie Means A Lot

Marvell Technology's stock price has experienced significant fluctuations in recent years, driven by factors such as Fed policy and AI hype. The company is positioning itself in the data center AI chip market, with both compute and networking solutions. Despite facing competition, Marvell has the potential to capture a significant portion of the AI chip market, which could greatly impact its income.

Marvell Technology, Inc. (MRVL) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to Marvell (MRVL). This makes it worthwhile to examine what the stock has in store.

Is Marvell Stock a Buy Now?

Demand for Marvell's AI-related products helped its data center business grow 87% year over year in Q1. Other areas of Marvell's business are struggling, with Q1 revenue down compared to the prior fiscal year.

Is Marvell Technology Stock a Buy?

Weak demand for Marvell's chips from four end markets weighed on the company's performance last quarter. However, Marvell's data center business is growing at an incredible pace thanks to AI.

Is Semiconductor Stock Marvell an Excellent Investment?

Marvell Technologies is still recovering from a cyclical slowdown that is causing revenue to decrease.

Interpreting Marvell (MRVL) International Revenue Trends

Explore how Marvell's (MRVL) revenue from international markets is changing and the resulting impact on Wall Street's predictions and the stock's prospects.

Wall Street Analysts Predict a 27.8% Upside in Marvell (MRVL): Here's What You Should Know

The mean of analysts' price targets for Marvell (MRVL) points to a 27.8% upside in the stock. While this highly sought-after metric has not proven reasonably effective, strong agreement among analysts in raising earnings estimates does indicate an upside in the stock.