Micron Technology Inc. (MTE)

Summary

Micron Earnings And Quant Deep Dive: Why MU Remains A Top AI Stock

Micron's stellar earnings highlight why it's a leader in the AI revolution and a Quant Strong Buy. In this article, I explain the reasoning behind both. As investors navigate a more volatile market, Micron stands out not because it's immune to cycles, but because its fundamentals are increasingly shaped by long-term AI demand. From high-bandwidth memory that feeds AI accelerators to advanced DRAM and NAND that power data centers to the edge, Micron sits at the forefront of the AI infrastructure buildout.

Showing Storage's Essential A.I. Play: MU's A.I.

Daniel Kern calls Micron's (MU) earnings "really fantastic" and its forecast just as great. Sold out orders in high-bandwidth memory chips for 2026 points to what Daniel believes will serve as a significant year for the chipmaker.

AI Stocks Got Some Good News—And Surged. Will This Micron-Powered Momentum Last?

AI stocks soared Thursday after memory chip maker Micron (MU) reported quarterly results far stronger-than-expected. That offered tech investors a glimmer of hope after weeks of disappointing performance for AI stocks.

Micron Technology Inc. (MTE) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

When is the next earnings date?

Has Micron Technology Inc. ever had a stock split?

Micron Technology Inc. Profile

| XFRA Exchange | US Country |

Overview

Micron Technology, Inc. is a global leader in the design, development, manufacture, and sale of memory and storage products. Founded in 1978 and based in Boise, Idaho, Micron operates through four main business units: Compute and Networking Business Unit, Mobile Business Unit, Embedded Business Unit, and Storage Business Unit. The company's products play integral roles across various markets, including cloud server, enterprise and client computing, graphics, networking, industrial, automotive, smartphone, and other mobile devices. Micron markets its products globally through a combination of direct sales forces, independent sales representatives, distributors, and retailers. It also utilizes a web-based direct sales channel, alongside channel and distribution partners, under the Micron and Crucial brands, as well as private labels.

Products and Services

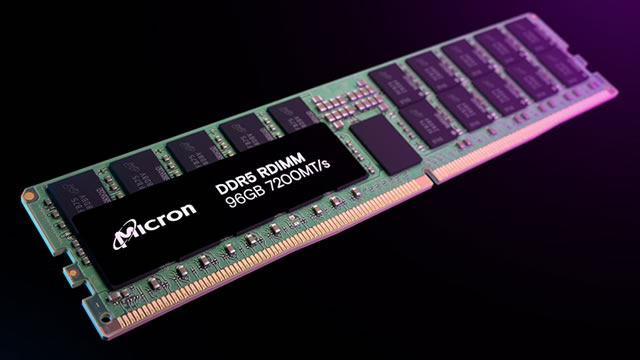

- Dynamic Random Access Memory (DRAM):

These semiconductor devices are known for their low latency, offering high-speed data retrieval. They are used across various applications, including cloud server, enterprise, client computing, graphics, networking, and automotive markets.

- Non-Volatile Memory:

This category includes both re-writable semiconductor storage devices and re-writable semiconductor memory devices that offer fast read speeds. These products are critical for smartphone and other mobile-device markets, providing persistent data storage.

- Solid State Drives (SSDs) and Component-Level Solutions:

Micron offers SSDs and component-level storage solutions for the enterprise and cloud, client, and consumer storage markets. These products are essential for enhancing data storage capabilities and performance in various computing environments.

- Discrete Storage Products:

The company provides discrete storage products in components and wafers. These products cater to the specific needs of the automotive, industrial, and consumer markets, where tailored storage solutions are often required.

- Memory and Storage Products for Specialized Markets:

Micron's memory and storage solutions also extend to automotive, industrial, and consumer markets, demonstrating the company's versatile application of its technologies to meet the diverse needs of these sectors.