Nasdaq, Inc. (NDAQ)

Nasdaq leads early rebound, S&P 500 attempts recovery after entering correction territory

10:05am: Markets bounce back Stocks are rallying in early trading on Friday as markets attempt to rebound from a tumultuous week that saw the S&P 500 enter correction territory. Just after the open, the Dow Jones is up 260 points or 0.6%, trading at 41,073.

Live Nasdaq Composite: TSLA, NVDA and PLTR Rise

After a bright start to the last trading day of the week, inflation threatened to spoil the party.

How to Extract Income From the Nasdaq-100 Index

The Nasdaq-100 Index (NDX) is known for a lot of things — lengthy outperformance of the S&P 500 among them — but income isn't part of that list. Just look at the Invesco QQQ Trust (QQQ) and the Invesco NASDAQ 100 ETF (QQQM), both of which follow the NDX.

Nasdaq Surges 1.5%; Ulta Beauty Posts Upbeat Results

U.S. stocks traded higher this morning, with the Nasdaq Composite gaining around 1.5% on Friday.

The Nasdaq Just Hit Correction Territory. Here Are 5 Stocks You'll Regret Not Buying Right Now.

With the Nasdaq Composite in correction territory, investors should consider investing some cash in the stock market. Corrections are defined as a decline of 10% from an all-time high, but they occur fairly often (just over every year since 1980).

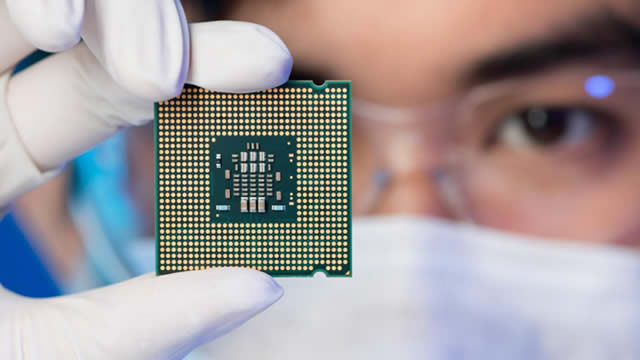

My Best Artificial Intelligence (AI) Chip Stock to Buy Amid the Nasdaq Correction (Hint: It's Not Nvidia)

The Nasdaq Composite index has entered correction territory as the tech-laden market index is now down more than 13% from the highs it achieved on Dec. 16 last year, and this souring market sentiment can be attributed to recent economic developments that have led investors to become risk averse.

Nasdaq Sell-Off: Why AMD Stock Is the AI Chip to Buy on the Dip

In today's video, I discuss Advanced Micro Devices (AMD -2.66%), its business strategy, growth opportunities, potential risks, and why investors should not ignore this space stock.

Nasdaq Sell-Off: 2 Stocks Down 53% and 31% to Buy on the Dip and Hold Forever

The Nasdaq Composite has dropped roughly 13% in less than a month (as of this writing). As distressing as it feels, long-term investors must remember that 10% "corrections" in the market are surprisingly common -- typically occurring once every two years.

Nasdaq Sell-Off: Is Wingstop Stock Still a Buy?

Restaurant chain Wingstop (WING -3.25%) is cheaper than it has been, but it is not a cheap stock. With the Nasdaq Composite (where Wingstop's shares trade) in correction territory, is it now time to buy this still fast-growing restaurant chain?

Better AI Buy in the Nasdaq Correction: Nvidia vs. AMD

Artificial intelligence (AI) stocks scored massive wins for investors last year and led the Nasdaq to a double-digit gain. This momentum continued into the early days of 2025, but in recent weeks, these once top-performing stocks have struggled.

Why I Capitalized on the Nasdaq Slump to Buy More of This Top ETF

I used to loathe it when the stock market sold off. It meant the value of my portfolio took a hit.

Nasdaq Correction: 3 No-Brainer Artificial Intelligence Stocks to Buy Right Now

The Nasdaq Composite (^IXIC -1.96%) is in correction territory as investors have been dumping growth stocks amid concerns related to tariffs, trade wars, and a potential slowdown in the economy in the months ahead. Buying shares of companies at a time like this can be unnerving, but if you're committed to holding on for the long term, the moves you make today could pay significantly in the future.