Nasdaq, Inc. (NDAQ)

Nasdaq Correction: The 2 Smartest Stocks to Buy and Hold Forever

When you're on an airplane, the pilot or a flight attendant will typically announce over the loudspeaker to "buckle your seatbelt" when the air is turbulent. That could be good advice for investors right now, too.

1 No-Brainer Artificial Intelligence (AI) ETF to Buy With $40 During the Nasdaq Sell-Off

The Nasdaq Composite (^IXIC -4.00%) index is home to almost every company listed on the Nasdaq stock exchange, many of which operate in the technology space. The highest-profile businesses in that group have largely been leaders in artificial intelligence (AI), and their stocks have produced some of the best returns over the past couple of years.

Nasdaq 100: Apple and Nvidia Selloff Sparks AI Concerns – What's Next for US Stocks?

Nasdaq plunges 4% as Apple and Nvidia sell off. AI concerns and new competition weigh on tech stocks.

The Top Nasdaq-100 Stock in 2025 Has Nothing to Do With Artificial Intelligence (AI)

In 2024, technology stocks involved in artificial intelligence (AI) led the Nasdaq-100 index higher, while healthcare stocks struggled due in part to concerns about how Robert F. Kennedy's nomination for Health and Human Services Secretary might impact the industry.

Nasdaq Sell-Off: Time to Buy the Dip on Nvidia?

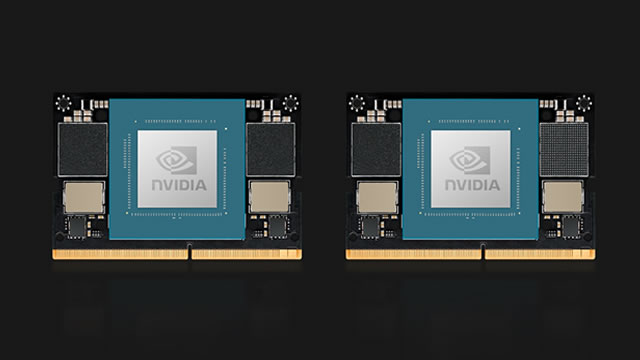

Investors haven't had many chances to consider buying shares of the artificial intelligence (AI) leader Nvidia (NVDA -5.07%) on a big dip over the last several years. But now is one of those times.

Nasdaq Sell-Off: This Magnificent Stock Is a Bargain Buy

The Nasdaq stock market has officially entered correction territory, with the Nasdaq Composite (^IXIC -4.00%) down by about 14% from its recent high as I write this. While the recent volatility can certainly be scary, it can also create buying opportunities for patient long-term investors.

Nasdaq Correction: Is This High-Yield Dividend Stock the Right Place to Run for Cover?

Stock markets rise and fall over time. It's just how the markets work.

The Nasdaq Just Hit Correction Territory: The 2 Smartest Stocks to Buy and Hold Forever

With the Nasdaq Composite (^IXIC -4.00%) moving into correction territory (down at least 10% from an all-time high), several of its constituent stocks are suddenly a lot more attractively priced than they were to start the year. While investors never like to see markets pull back into correction territory, it does present a great buying opportunity for some great companies caught up in the sell-off.

Nasdaq Correction: 1 Unstoppable Stock to Buy Before It Soars 600%, According to 1 Wall Street Analyst

The Nasdaq Composite (^IXIC -3.63%) has been riding high for more than two years now, as waning inflation, the prospect of lower interest rates, and the emergence of artificial intelligence (AI) helped fuel its impressive gains. In fact, since the bull market began in late 2022, the tech-centric index climbed as much as 95% before the recent market swoon.

Nasdaq Stock Market Correction: 2 Ultra-Cheap Stocks to Buy Right Now

The Nasdaq Composite (^IXIC -4.93%) is now 13% below its recent high, placing the tech-heavy index officially into correction territory. And while there are certainly good reasons why the market has been under pressure recently, such as recession fears and the potential effects of tariffs, situations like this also create buying opportunities for patient long-term investors to buy shares of great businesses.

Nasdaq Sell-Off: It's Finally Time to Buy This Market Darling Again

Some short-term market pain can set you up for long-term gain. That's what's going on with SoundHound AI (SOUN -14.05%) right now.

Nasdaq Correction: Time to Buy the Dip on Nvidia?

The Nasdaq Composite (^IXIC -4.17%) has moved into correction territory (down at least 10% from all-time highs). A significant contributor to that drop has been Nvidia (NVDA -5.11%) stock, which is down about 20% year to date, as of this writing.