Nordson Corporation (NDSN)

Nordson (NDSN) Gears Up to Report Q3 Earnings: What to Expect

Nordson's (NDSN) third-quarter fiscal 2024 results are likely to benefit from solid momentum in the Industrial Precision Solutions segment, partly offset by high costs and expenses.

Countdown to Nordson (NDSN) Q3 Earnings: A Look at Estimates Beyond Revenue and EPS

Looking beyond Wall Street's top -and-bottom-line estimate forecasts for Nordson (NDSN), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended July 2024.

Reasons Why You Should Avoid Betting on Nordson (NDSN) Stock

Softness in the Advanced Technology Solutions segment, rising operating expenses and forex woes weigh on Nordson's (NDSN) operations.

Nordson (NDSN) to Acquire Atrion & Boost Medical Offerings

Nordson (NDSN) announces to acquire Atrion. This will enable it to strengthen its medical offerings and boost its position in the infusion and cardiovascular therapies market.

Nordson Corporation (NDSN) Q2 2024 Earnings Call Transcript

Nordson Corporation (NASDAQ:NDSN ) Q2 2024 Earnings Conference Call May 21, 2024 8:30 AM ET Company Participants Lara Mahoney - Vice President of Investor Relations and Corporate Communications Sundaram Nagarajan - President and Chief Executive Officer Stephen Shamrock - Chief Accounting Officer Conference Call Participants Michael Halloran - Baird James Heaney - Jefferies Matt Summerville - D.A. Davidson Christopher Glynn - Oppenheimer Christopher Dankert - Loop Capital Markets Walter Liptak - Seaport Research Andrew Buscaglia - BNP Paribas Jeffrey Hammond - KeyBanc Capital Markets Operator Thank you for standing by.

What's Next For Nordson Stock After Its Recent 10% Fall?

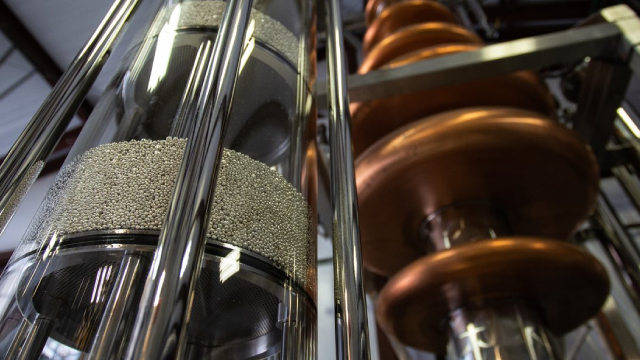

Nordson Corp stock (NASDAQ NASDAQ : NDSN), an industrial company that makes dispensing equipment for consumer and industrial adhesives, sealants, polymers, and coatings, saw its stock plunge nearly 10% on Tuesday, May 21, after the company reported its Q2 fiscal 2024 results (fiscal ends in October). The company reported mixed results, with revenues missing and earnings beating the street estimates.

Top 5 Industrials Stocks That May Explode This Quarter - Nordson (NASDAQ:NDSN)

The most oversold stocks in the industrials sector presents an opportunity to buy into undervalued companies.

Top 5 Industrials Stocks That May Explode This Quarter - Nordson (NASDAQ:NDSN)

The most oversold stocks in the industrials sector presents an opportunity to buy into undervalued companies.

Nordson's (NDSN) Q2 Earnings Top Estimates, Revenues Rise Y/Y

Nordson's (NDSN) second-quarter fiscal 2024 revenues increase 0.1% due to strong momentum in the Industrial Precision Solutions and Medical and Fluid Solutions segments.

Nordson Stock Tumbles After Company Trims Sales and Earnings Guidance

Nordson (NDSN) shares fell sharply in premarket trading Tuesday morning after the industrial equipment maker trimmed its annual sales and earnings outlook amid weakness in electronics orders and agricultural challenges in Europe.

Nordson (NDSN) Q2 Earnings: Taking a Look at Key Metrics Versus Estimates

Although the revenue and EPS for Nordson (NDSN) give a sense of how its business performed in the quarter ended April 2024, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Nordson (NDSN) Q2 Earnings Surpass Estimates

Nordson (NDSN) came out with quarterly earnings of $2.34 per share, beating the Zacks Consensus Estimate of $2.30 per share. This compares to earnings of $2.26 per share a year ago.