Newmont Corporation (NEM)

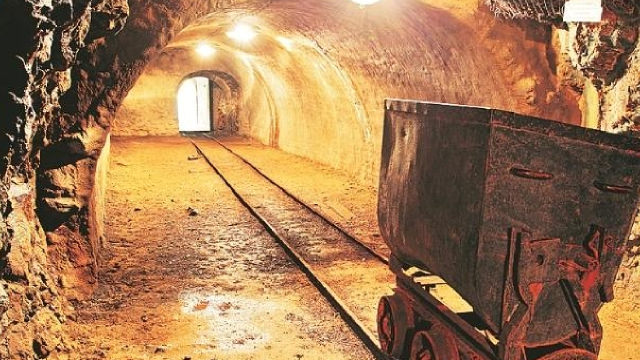

Gold Terra Announces a 2 Year Extension on Option Agreement with Newmont to November 21st, 2027 to purchase 100% of Past Producing 16 g/t Gold Con Mine, Yellowknife, NWT

VANCOUVER, BC / ACCESSWIRE / September 9, 2024 / Gold Terra Resource Corp. (TSX-V:YGT)(Frankfurt:TX0)(OTCQX:YGTFF) ("Gold Terra" or the "Company") is pleased to announce it has extended its four (4) year definitive option agreement (the "Option Agreement") with Newmont Canada FN Holdings ULC ("Newmont FN") and Miramar Northern Mining Ltd. ("MNML"), both wholly owned subsidiaries of Newmont Corporation ("Newmont"), to a six (6) year agreement which grants Gold Terra the option, upon meeting certain minimum requirements, to purchase MNML from Newmont FN (the "Transaction"), which includes 100% of all the assets, mineral leases, Crown mineral claims, and surface rights comprising the Con Mine, as well as the areas immediately adjacent to the Con Mine, as shown in Exhibit A (the "Con Mine Property").

Newmont Corporation (NEM) Increases Despite Market Slip: Here's What You Need to Know

The latest trading day saw Newmont Corporation (NEM) settling at $51.93, representing a +0.62% change from its previous close.

Newmont Corporation (NEM) is Attracting Investor Attention: Here is What You Should Know

Newmont (NEM) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Here's Why Newmont Corporation (NEM) Gained But Lagged the Market Today

Newmont Corporation (NEM) reachead $53.39 at the closing of the latest trading day, reflecting a +0.39% change compared to its last close.

Newmont: Raising My Price Target As Gold Hits Record Highs

I reiterate a buy rating on Newmont Mining due to higher gold prices and improved EPS growth trends over the next two years. Newmont reported strong Q2 results with a significant EPS beat and robust revenue growth, aided by high gold prices and effective management. Key risks include potential declines in gold prices, higher interest rates, and geopolitical issues, but the growth trajectory and balance sheet improvements remain promising.

Newmont: The 'Time Has Come' As Powell Signals Cut

Newmont Corporation investors have outperformed the S&P 500 since its February 2024 lows. Is there more to come? Fed Chair Jerome Powell announced the "time has come" to lower interest rates. The rally might not be over yet. Newmont's second-half production ramp coincides with near-term bullishness in gold prices, lifting investor sentiments.

Why Is Newmont (NEM) Up 12.5% Since Last Earnings Report?

Newmont (NEM) reported earnings 30 days ago. What's next for the stock?

Is Newmont (NEM) a Buy as Wall Street Analysts Look Optimistic?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Newmont Corporation (NEM) is Attracting Investor Attention: Here is What You Should Know

Newmont (NEM) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

VIX Vixens: 7 Attractive Stock Bets as the Fear Gauge Spikes

Early this month, the CBOE Volatility Index, or VIX soared to multi-year highs. As a contrarian indicator, a northward trek of the fear gauge implies a negative outlook for equities.

Why Newmont Corporation (NEM) is a Top Momentum Stock for the Long-Term

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Newmont's (NEM) 5G Trial at Cadia Mine Shows Strong Results

Newmont (NEM) demonstrates the potential to reach upload rates of about 90 Mbps along access drives and declines throughout the underground complex.