NRG Energy, Inc. (NRG)

NRG Energy, Inc. (NRG) Is a Trending Stock: Facts to Know Before Betting on It

NRG (NRG) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Why NRG (NRG) is Poised to Beat Earnings Estimates Again

NRG (NRG) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Is the Options Market Predicting a Spike in NRG Energy Stock?

Investors need to pay close attention to NRG stock based on the movements in the options market lately.

NRG Energy (NRG) Suffers a Larger Drop Than the General Market: Key Insights

The latest trading day saw NRG Energy (NRG) settling at $151.27, representing a -4.68% change from its previous close.

Why NRG Energy (NRG) is a Top Momentum Stock for the Long-Term

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Is NRG (NRG) a Buy as Wall Street Analysts Look Optimistic?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Investors Heavily Search NRG Energy, Inc. (NRG): Here is What You Need to Know

Zacks.com users have recently been watching NRG (NRG) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

NRG Energy (NRG) Stock Sinks As Market Gains: Here's Why

NRG Energy (NRG) closed the most recent trading day at $160.58, moving 1.28% from the previous trading session.

Is NRG (NRG) a Solid Growth Stock? 3 Reasons to Think "Yes"

NRG (NRG) is well positioned to outperform the market, as it exhibits above-average growth in financials.

NRG or VST: Which Is the Better Value Stock Right Now?

Investors with an interest in Utility - Electric Power stocks have likely encountered both NRG Energy (NRG) and Vistra Corp. (VST). But which of these two stocks is more attractive to value investors?

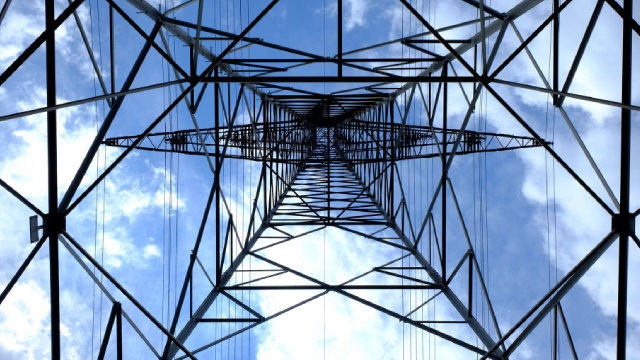

Can NRG Energy Meet the Surging Power Needs of the Data Center Boom?

NRG is gradually increasing its production volume to meet the growing demand for power from data centers.

NRG vs. NEE: Which U.S. Power Stock Has Better Investment Potential?

NRG and NEE continue to expand their clean energy generation portfolio and efficiently serve their customers in the United States.