NVIDIA Corporation (NVDA)

Nvidia: Irrational AI Bubble Anxiety

Nvidia Corporation remains a top AI chip play, with strong demand and robust growth projections ahead of its FQ3 '26 earnings report this week. The AI GPU company is expected to post significant revenue and EPS growth, with consensus estimates pointing to a massive sequential jump and continued outperformance. Despite market fears of an AI bubble, NVDA stock trades at reasonable multiples relative to its growth, lacking the premium valuation typical of bubbles.

Is Nvidia Stock a Buy, Sell or Hold Ahead of Earnings?

It's been a very strong quarter for big tech earnings, but that meant much for the share prices of the season's earnings beaters.

Do These Markets Feel 'Healthy' to You? Some Experts Say to Back Off Stocks

Many investors have taken a glass-half-full view of markets lately. But others see the glass as cracked.

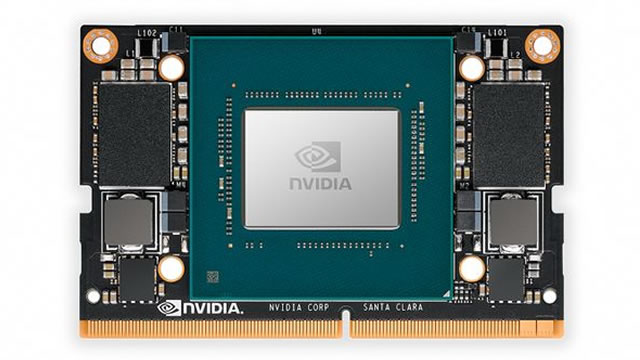

Arm custom chips get a boost with Nvidia partnership

Arm on Monday said that central processing units based on its technology will be able to integrate with AI chips using Nvidia's NVLink Fusion technology. The move will make it easier for customers of both companies to pair Arm-based Neoverse CPUs with Nvidia's dominant graphics processing units.

AI Bubble Talk is Cheap -- How to Navigate the Worry

In August I wrote an investment piece titled "AI Bubble Talk is Cheap" for Zacks Confidential to highlight the facts and figures of the 5th industrial revolution being driven by companies like NVIDIA ( NVDA ), Taiwan Semiconductor ( TSM ), and OpenAI. So I've spent no small amount of time since August continuing to collect the "AI Bubble" arguments and pit them against sound research from AI investment wizards like Coatue Management.

Stocks Slide Ahead of Nvidia Earnings, Jobs Data | Closing Bell

Comprehensive cross-platform coverage of the U.S. market close on Bloomberg Television, Bloomberg Radio, and YouTube with Romaine Bostick, Katie Greifeld, Carol Massar and Tim Stenovec. -------- More on Bloomberg Television and Markets Like this video?

NVIDIA and 2 Stocks to Buy for Earnings Growth

NVIDIA leads a trio of stocks showing strong earnings growth and rising estimates, signaling potential momentum ahead.

Nvidia's earnings to be key validation moment for AI sector, Wedbush believes

Nvidia Corp (NASDAQ:NVDA, XETRA:NVD) will report its latest quarterly results after the market close on Wednesday, and analysts at Wedbush believe investors across the technology sector will be closely watching the update as a barometer for broader AI demand. The analysts believe that with tech stocks experiencing volatility and renewed concerns about an “AI bubble,” the focus this week “comes down to gauging the AI Revolution demand story which starts and ends with Nvidia.

Nvidia Stock Options Stay Hot Ahead of Earnings Event

With tech valuation concerns running rampant, it's no surprise that Nvidia Corp's (NASDAQ:NVDA) third-quarter earnings report is one of the most highly-anticipated events of the week.

How Nvidia can reassure investors at the biggest earnings event of the quarter

Nvidia has already hinted at its financial road map for next year. Investors will be looking for commentary about 2027 when the chip maker reports earnings on Wednesday.

Peter Thiel sells off Nvidia stake amid AI valuation concerns

Nvidia Corp (NASDAQ:NVDA, ETR:NVD) shares traded more than 2% lower after it was revealed that billionaire investor Peter Thiel sold his entire holding in the AI chipmaker through his hedge fund. According to filings for the third quarter of 2025, the divestment included approximately 538,000 shares, valued at nearly $100 million, and reduced the fund's equity portfolio by roughly two-thirds.

Econ Data Comes Out This Week, Along with NVDA, WMT Earnings

New jobs data joins Trump's food tariff exemptions on the last big earnings week of Q3.