NVIDIA Corporation (NVDA)

Nvidia CEO says he's confident Trump-Xi had good talks

Nvidia CEO Jensen Huang said on Thursday he was confident that U.S. President Donald Trump and Chinese leader Xi Jinping had a good conversation during a meeting in South Korea earlier in the day.

Nvidia boost as Xi and Trump meet for critical trade talks

Speculation that Washington could permit Nvidia Corp (NASDAQ:NVDA, ETR:NVD) to resume exporting its most advanced chips to China pushed the company's shares up 3% in after-hours trading, reinforcing its status as the world's most valuable company. The prospect of a breakthrough came as Chinese President Xi Jinping and US President Donald Trump began high-stakes talks in Busan, South Korea, on Thursday aimed at determining whether the two powers can extend their fragile trade truce or slip back into confrontation.

Top Large Cap Stocks To Keep An Eye On – October 28th

NVIDIA, Tesla, and Invesco QQQ are the three Large Cap stocks to watch today, according to MarketBeat's stock screener tool. Large-cap stocks are shares of companies with a large market capitalization-commonly defined as roughly $10 billion or more-calculated by multiplying a company's share price by its outstanding shares. Investors generally view large caps as established,

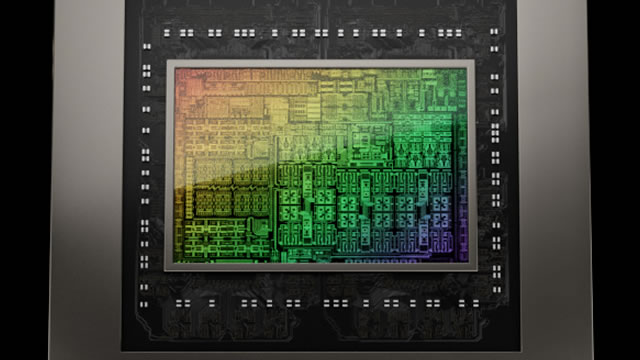

Despite high expectations, Trump didn't discuss Nvidia's Blackwell chip with Xi

U.S. President Donald Trump may have teased that he could discuss Nvidia's state-of-the-art artificial intelligence Blackwell chips with Chinese President Xi Jinping, but in the end, he said the topic didn't come up.

Trump says Nvidia's high-end Blackwell chip did not figure in talks with China's Xi

U.S. President Donald Trump said on Thursday he did not discuss chipmaker Nvidia's state-of-art Blackwell artificial intelligence chip during talks with Chinese President Xi Jinping.

NVIDIA (NVDA) Shares Surge 3% Today: Why One Picture Drove $400 Billion In Stock Gains

NVIDIA (Nasdaq: NVDA) shares closed the day up 2.99% on Wednesday.

Nvidia Is Now Worth $5 Trillion as It Consolidates Power in A.I. Boom

The A.I. chip maker has become a linchpin in the Trump administration's trade negotiations in Asia.

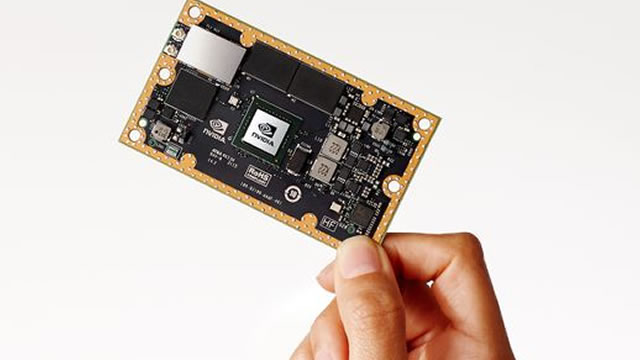

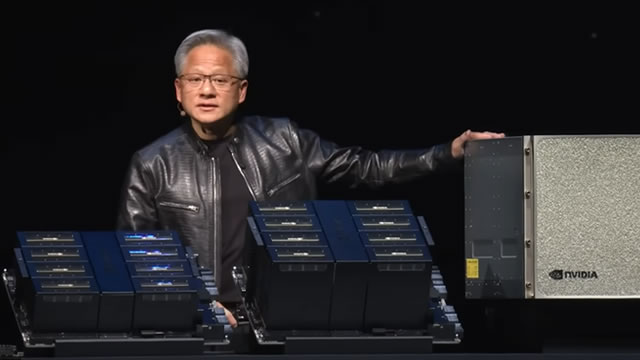

Nvidia AI vision reaches new inflection point with Huang's GTC keynote, analysts say

Nvidia Corp (NASDAQ:NVDA, ETR:NVD)'s latest announcements mark another major turning point in the artificial intelligence revolution, according to Wedbush analysts, who believe CEO Jensen Huang's keynote at the company's GTC event in Washington, DC, underscores Nvidia's role as the driving force behind the next era of AI infrastructure. “Huang's remarks reinforce our view that Nvidia remains at the center of one of the most disruptive technology shifts in modern history,” the analysts wrote.

As Nvidia's market cap hits $5 trillion, these other tech giants are nearing trillion-dollar milestones of their own

Today, Nvidia Corporation (Nasdaq: NVDA) became the first company to cross the $5 trillion valuation—in premarket trading, at least.

Nvidia becomes first public company worth $5 trillion

The biggest beneficiary of the ongoing AI boom, Nvidia has become the first public company to pass the $5 trillion market cap milestone.

Nvidia at $5 Trillion Raises Dot-Com Era Ghosts. Maybe It Shouldn't.

Nvidia captures two of new economy's most-important drivers.

Nvidia Becomes The First $5 Trillion Company: Why Shares Could Keep Climbing

Nvidia Corporation tops $5 trillion, leading the Dow (with Caterpillar Inc.) after a bullish GTC showcase in Washington, D.C. NVDA shares are up 55% YTD, with strong seasonals and momentum into year-end. Valuation still reasonable, backed by $500 billion in AI revenue visibility and firm margins.