Graniteshares 2x Long Nvidia Daily ETF (NVDL)

Investors Betting on Tech Stock Rebound Burned by Selloff

Investors who bet big on tech stocks rebounding from a tough July are seeing their money evaporate in the current meltdown.

NVDL: Buy The Real AI Driver And Create DIY Option Income

NVDL and NVDY can be used to build an AI wealth grower in a portfolio. NVDL offers a more aggressive growth engine with highly profitable DIY option income. YieldMax NVDY has significant monthly distributions and flexibility in adjusting DIY reinvesting strategy.

USD: A Watered-Down Version Of NVDL

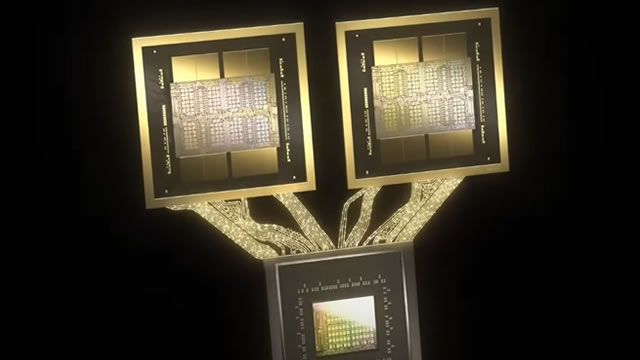

Semiconductor industry momentum driven by Nvidia Corporation stock, with market-cap weighted ETFs heavily influenced by the stock's performance. ProShares Ultra Semiconductors ETF offers leveraged exposure to the semiconductor industry, but heavily weighted towards Nvidia. Consider using GraniteShares 2x Long NVDA Daily ETF for a more pure play on Nvidia, with potentially higher returns but also higher risk.

Like Nvidia? These 3 ETFs Have What You Want.

Nvidia has performed well over the past year. That has helped boost performance for ETFs in the tech sector.

NVDL: The Best Leveraged ETF To Maximize Your Nvidia Gains Post Q1 Earnings

Nvidia's success is more than just a flash in the pan, making it a strong investment option. NVDA's Q1 earnings report exceeded expectations, leading to a surge in its stock price. The upcoming stock split will increase liquidity and attract more investors to leveraged ETFs like NVDL. The timing is right to boost your overall gains.