PDD Holdings Inc. American Depositary Shares (PDD)

PDD Holdings: A Top E-Commerce Growth Play For 2025

PDD Holdings' impressive revenue and earnings growth, driven by its discount e-Commerce platform Temu, supports a bullish investment case. The company's valuation is attractive, trading at a lower price-to-earnings ratio compared to Alibaba and JD.com, despite strong top line growth. Risks include fierce competition in the Chinese e-Commerce market and a potential future slowdown in revenue growth.

PDD Holdings Falls 33.4% in 2024: Time for a Comeback in 2025?

PDD's growth slowdown, margin pressure and regulatory risks make its discounted valuation a trap. Sell before profitability further deteriorates in 2025.

Here is What to Know Beyond Why PDD Holdings Inc. Sponsored ADR (PDD) is a Trending Stock

Zacks.com users have recently been watching PDD Holdings Inc. Sponsored ADR (PDD) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Is Trending Stock PDD Holdings Inc. Sponsored ADR (PDD) a Buy Now?

PDD Holdings Inc. Sponsored ADR (PDD) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

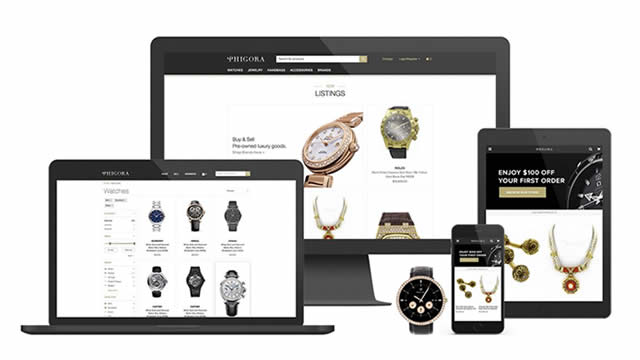

PDD's Temu app tops U.S. iOS downloads for second year running amid greater scrutiny of China companies

The latest ranking highlights the continued success Chinese apps are having in the U.S., with Bytdance's TikTok ranking third and Temu-competitor Shein coming in at number 12. Temu's success comes amid increased scrutiny by U.S. officials, which might worsen under the incoming Trump administration.

E-Commerce Giant PDD Looks Due For a Big Comeback in 2025

Despite explosive revenue growth in 2024, PDD's NASDAQ: PDD share price has not fared well. Shares are down 29% on the year as of the December 12 close.

PDD Holdings: Great Business, Big Potential, Low Valuation

PDD Holdings' unique social e-commerce model and cost advantages are disrupting giants like Alibaba and JD, with the potential to become China's first consistent one trillion-dollar company. Pinduoduo's low-cost structure and network effects create significant competitive advantages, driving rapid user growth and high profitability, making it a strong buy. Temu's global expansion, low acquisition costs, and asset-light model position it for significant profitability and market disruption in the US and Europe.

Is PDD Holdings Inc. Sponsored ADR (PDD) a Buy as Wall Street Analysts Look Optimistic?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Is Most-Watched Stock PDD Holdings Inc. Sponsored ADR (PDD) Worth Betting on Now?

PDD Holdings Inc. Sponsored ADR (PDD) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Temu told to suspend Vietnam operations, state media reports

Chinese online retailer Temu has been told to suspend its operations in Vietnam after it failed to meet an end-November deadline for business registration in the Southeast Asian country, Vietnamese state media reported on Thursday.

PDD Holdings: Cheap With A Christmas Catalyst (Rating Upgrade)

The last time I covered PDD Holdings I rated it a hold because of its decelerating growth. Now however the stock is a approaching deep value territory with the holiday season looming. Yesterday, Seeking Alpha News reported that PDD's TEMU was courting U.S. retailers for its upcoming Christmas sales drive.

PDD Holdings Plunges 5.1% Since Q3 Earnings: Time to Sell the Stock?

Despite a 44% revenue jump, PDD's rising costs, fierce competition and management's warning of lower profits signal it's time to exit before further decline.