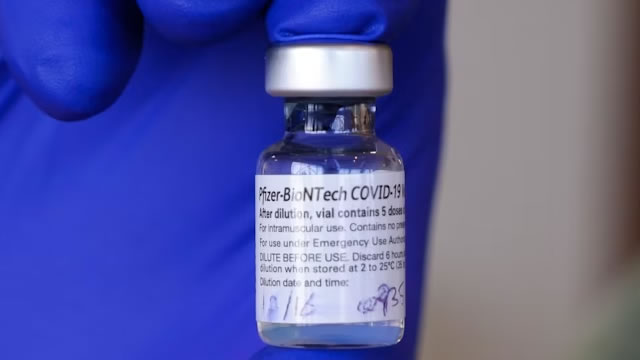

Pfizer Inc. (PFE)

2 High-Yield Dividend Stocks Yielding Over 6% That'll Pay You to Wait

High-yielding dividend stocks may not be the ticket to superior returns, but they can rank pretty high on the list of nice-to-haves for investors in retirement or those who could use a bit of extra financial flexibility at the end of any given month.

Pfizer (PFE) CEO on Braftovi Reducing Colorectal Cancer Death Risk "in Half"

Dr. Albert Bourla, CEO of Pfizer (PFE), joins Nicole Petallides on Morning Trade Live to discuss the latest results of his company's Braftovi drug trials. According to Dr. Bourla, results showed it can reduce risk of colorectal cancer deaths by 51%.

PFE or LLY: Which Is the Better Value Stock Right Now?

Investors looking for stocks in the Large Cap Pharmaceuticals sector might want to consider either Pfizer (PFE) or Eli Lilly (LLY). But which of these two stocks presents investors with the better value opportunity right now?

Are Investors Undervaluing Pfizer (PFE) Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Unlocking Pfizer's Value: Cost Controls And Oncology Pipeline

Despite recent underperformance, a "Buy" rating on Pfizer is reiterated due to a strong Q1 EPS beat, driven by significant cost controls and margin improvement, signaling operational strength. Management's focus on non-COVID segments and aggressive cost-cutting initiatives are expected to support margins and EPS growth, trending towards the upper end of FY2025 guidance. Impending LOEs for key drugs ( ~$17B peak revenue by 2026-2030) are a concern, but Pfizer is actively investing in its pipeline, especially oncology and vaccines, to offset this.

Pfizer Inc. (PFE) Is a Trending Stock: Facts to Know Before Betting on It

Pfizer (PFE) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Investing In The Promising PD1/VEGF Bispecific - Pfizer And Instil Could Be Good Candidates

Bispecific antibodies targeting PD1 and VEGF show promise in treating non-small cell lung cancer, with Summit Therapeutics' Ivonescimab outperforming Pembrolizumab in a Phase III trial. While immature, results from competitors such as Instil Bio are promising. We think Instil Bio, through its low valuation, and Pfizer, given its dividend yield, constitute good Buy opportunities to get exposure to the field.

Pfizer's 7.5% Dividend: Income Haven or House of Cards?

A dividend yield that surpasses 7.5% from a pharmaceutical sector giant like Pfizer Inc. NYSE: PFE certainly catches the eye of income-seeking investors.

Pfizer Looks Like A Great Play At Current Valuations

Pfizer is an attractive value play, trading at a significant discount despite strong profitability and growth fundamentals versus peers. The company leads its peer group in EBITDA and revenue growth, while maintaining solid margins and forward growth expectations. Risks include increased competition in the ATTR-CM market and ongoing technical downtrends, but cost-cutting measures may enhance efficiency.

Pfizer Thinks Bigger With 3SBio Deal

Pfizer Inc. decided to think bigger after the Summit deal in February and that it needs control of a PD-1/VEGF bispecific antibody versus participating with its ADC pipeline. The 3SBio deal allows increased control of its oncology pipeline and much higher financial rewards in the long run, and comes at a relatively low cost. The jury is still out on the PD-1/VEGF bispecific antibody class of drugs, but the data to date make this approach worth exploring, and perhaps even necessary.

Pfizer Inks Up to $6B Deal to Market 3SBio's Cancer Drug Outside China

Pfizer (PFE) has announced a new agreement to develop and market a cancer drug currently being developed by Chinese drugmaker 3SBio.

Pfizer Buys Rights to PD-1 & VEGF Inhibitor From China Biotech

PFE in-licenses global rights, ex-China, to SSGJ-707, from Chinese biotech, 3SBio for an upfront payment of $1.25 billion.