Polaris Inc. (PII)

Are Investors Undervaluing Polaris (PII) Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Should Value Investors Buy Polaris (PII) Stock?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Are Investors Undervaluing Polaris (PII) Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Ethic Inc. Makes New Investment in Polaris Inc. $PII

Ethic Inc. acquired a new position in shares of Polaris Inc. (NYSE: PII) in the second quarter, according to its most recent disclosure with the SEC. The firm acquired 10,105 shares of the company's stock, valued at approximately $414,000. A number of other hedge funds also recently added to or reduced their stakes

Polaris Inc. (PII) Q3 2025 Earnings Call Transcript

Polaris Inc. (NYSE:PII ) Q3 2025 Earnings Call October 28, 2025 10:00 AM EDT Company Participants J.C. Weigelt - Vice President of Investor Relations Michael Speetzen - CEO & Director Robert Mack - CFO, Executive VP of Finance & Corporate Development Conference Call Participants Noah Zatzkin - KeyBanc Capital Markets Inc., Research Division Craig Kennison - Robert W.

Polaris Inc (PII) Reports Q3 Earnings: What Key Metrics Have to Say

While the top- and bottom-line numbers for Polaris Inc (PII) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Polaris Inc (PII) Expected to Beat Earnings Estimates: Should You Buy?

Polaris Inc (PII) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Polaris Inc (PII) Moves 13.9% Higher: Will This Strength Last?

Polaris Inc (PII) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term.

Polaris shares surge on Indian motorcycle unit spin-off, profit forecast

Shares of Polaris rose more than 10% in premarket trading on Tuesday after the power-sports vehicle maker said it would spin off its Indian Motorcycle unit and forecast a third-quarter profit, beating Wall Street's loss expectations.

Polaris: Dividend Drifts On Thin Ice - Sell

Polaris faces declining sales, earnings, and business momentum, putting its 30-year dividend growth streak at risk. PII's recent strong cash flow is artificially boosted by one-time working capital shifts, masking underlying business deterioration. With real free cash flow far below annual dividend costs and Capex already minimized, sustaining the payout is increasingly unsustainable.

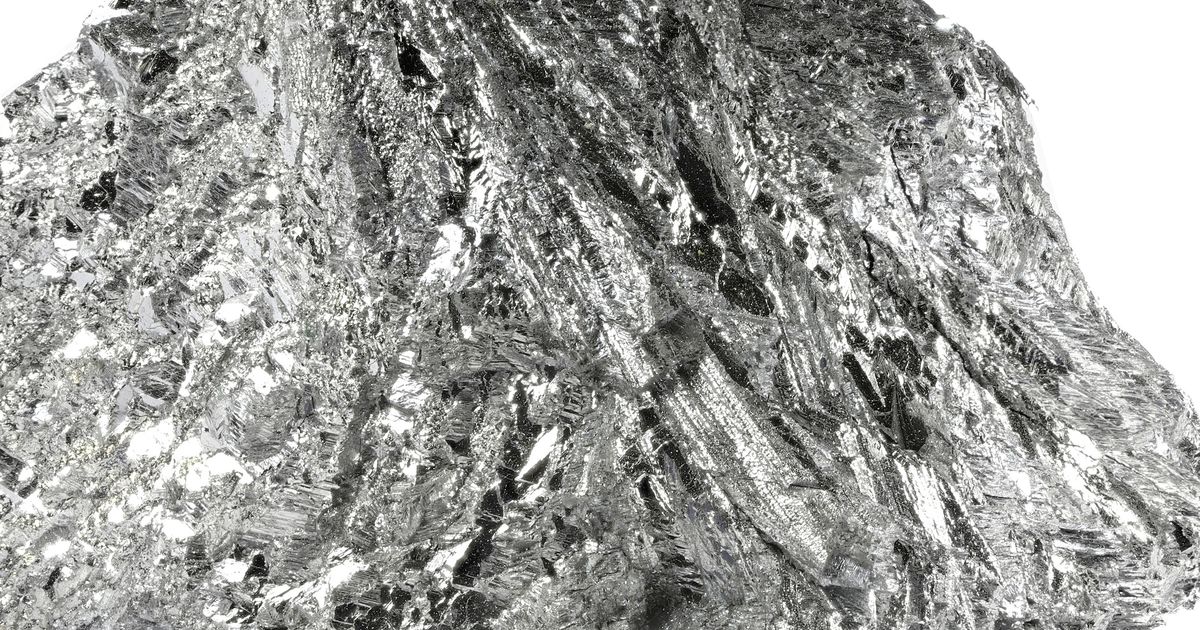

Canagold Resources reveals high grade antimony-gold results from concentrate testing at New Polaris project in BC

Canagold Resources Ltd (TSX:CCM, OTCQB:CRCUF) announced what it called “positive” results from antimony (Sb) flotation testing at its 100% owned New Polaris gold-antimony project in British Columbia. The advanced projects development company said the antimony-gold concentrate assayed 59.1% Sb and 98.3 grams per tonne (g/t) gold, while 93.1% Sb was recovered in the antimony-gold concentrate and overall, 91.8% gold was recovered in the combined gold and antimony-gold concentrates.

Canagold Resources files feasibility study report for New Polaris Project

Canagold Resources Ltd (TSX:CCM, OTCQB:CRCUF) announced that it has filed the technical report for the feasibility study of its 100% owned New Polaris gold-antimony project in northwest British Columbia. The report, titled New Polaris Project, NI 43-101 Technical Report & Feasibility Study, has been prepared in compliance with National Instrument 43-101 Standards of Disclosure for Mineral Projects.