Pinterest, Inc. Class A (PINS)

Pinterest vs. Etsy: Which Social E-Commerce Stock Holds Promise?

PINS' stronger growth outlook, AI-driven ad tools and Amazon partnership give it an edge over ETSY despite higher costs.

Pinterest, Inc. (PINS) Presents At Goldman Sachs Communacopia + Technology Conference 2025 Transcript

Pinterest, Inc. (NYSE:PINS ) Goldman Sachs Communacopia + Technology Conference 2025 September 9, 2025 11:10 AM EDT Company Participants William Ready - CEO & Director Conference Call Participants Eric Sheridan - Goldman Sachs Group, Inc., Research Division Presentation Eric Sheridan MD & US Internet Analyst Okay. I think with that, we're going to get going on the next one.

Pinterest: International Markets Beginning To Drive Growth

Despite the negative reaction of the stock, Pinterest delivered solid results in the second quarter. AI investments and ad tech improvements are driving engagement and ad performance, with international expansion and partnerships fueling future growth. Margins and free cash flow are also improving, although gains in recent quarters have been modest.

Pinterest Q2 Earnings: Irrational Selloff

Pinterest delivered strong Q2 results, with revenue and EBITDA exceeding expectations, driven by robust MAU and ARPU growth, especially in international markets. Management's focus on AI-driven engagement, improved ad tools, and international monetization is fueling market share gains and higher advertiser performance. Despite accelerating declines in ad pricing and downward revisions to earnings estimates, revenue growth outlook remains solid through FY27.

Pinterest: More Value To Unlock As International Monetization Grows

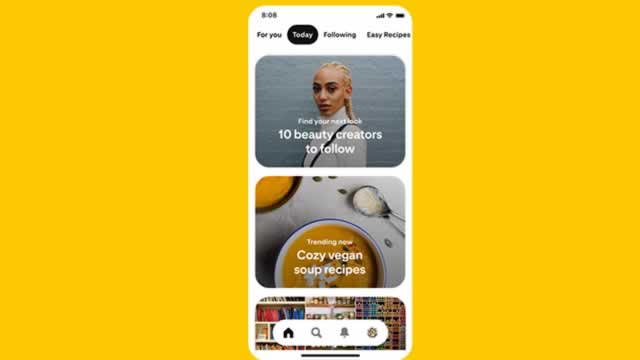

Pinterest offers "growth at a reasonable price" as small/mid-cap stocks face backlash and S&P 500 valuations peak. Despite a 10% post-earnings dip, Pinterest's stabilizing user trends and double-digit EBITDA growth present a compelling buying opportunity. Key catalysts include strong overseas monetization, Gen Z popularity, and disciplined cost controls driving robust profit expansion.

Pinterest: The Grass Is Still Green On This Side -- Share Buybacks Bonanza

Pinterest continues to deliver solid user and revenue growth, supported by strong profitability and an aggressive share repurchase program. Despite underperforming Meta, Pinterest's valuation remains attractive, trading at a significant discount while maintaining a net cash balance sheet. Management's focus on partnerships and a younger demographic, plus margin expansion, are key drivers for potential multiple expansion over time.

Pinterest, Inc. (PINS) Is a Trending Stock: Facts to Know Before Betting on It

Pinterest (PINS) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Should Your Portfolio Include PINS Stock Post Modest Q2 Results?

Pinterest's solid Q2 revenues and AI-driven ad tools fuel growth, but rising costs and tough competition weigh on margins.

Pinterest: More Downside For PINS Stock?

Pinterest (NYSE:PINS) has recently experienced a 10% decline after its quarterly earnings fell short of expectations. Nevertheless, despite this downturn, we consider the stock to be a worthwhile investment at its current price of approximately $35.

Don't Overlook Pinterest (PINS) International Revenue Trends While Assessing the Stock

Explore Pinterest's (PINS) international revenue trends and how these numbers impact Wall Street's forecasts and what's ahead for the stock.

Pinterest is winning over Gen Z and finding success with AI, but the stock price is down double digits today

Pinterest reported its second-quarter earnings on Thursday, August 7, and, in many ways, it was good news—though you wouldn't know it from how much its shares have dropped. Here's what to know:

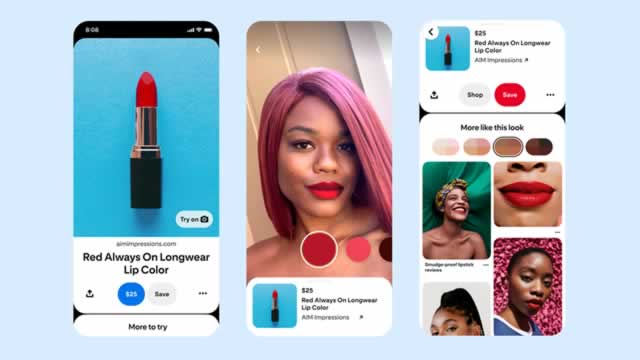

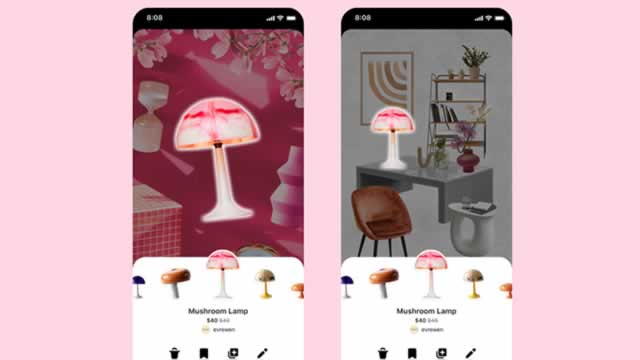

Pinterest CEO says agentic shopping is still a long way out

Pinterest CEO Bill Ready told investors on the company's second-quarter earnings call that the social app and inspirational bookmarking site could be considered an “AI-enabled shopping assistant.” However, he thinks that the agentic web, where AI agents shop on users' behalf, is still far in the future.