PayPal Holdings Inc. (PYPL)

PayPal's Branded Checkout & OpEx Concern: Will Growth be Affected?

PYPL flags softer Q4 branded checkout growth and rising 2026 OpEx as it pushes investments.

PayPal shares fall as CFO flags weaker holiday-quarter spending trends

PayPal Holdings Inc (NASDAQ:PYPL, XETRA:2PP) shares fell on Wednesday after the company's finance chief warned that consumers are continuing to trade down, dampening expectations for growth in the key holiday quarter. CFO Jamie Miller told the UBS tech conference that average order values remain under pressure and that fourth-quarter branded checkout growth is running “a couple points” slower than the third quarter, even as the company maintained its overall guidance.

PayPal Holdings, Inc. (PYPL) Presents at UBS Global Technology and AI Conference 2025 Transcript

PayPal Holdings, Inc. (PYPL) Presents at UBS Global Technology and AI Conference 2025 Transcript

PayPal Stock Drops. The CFO Delivers a Sobering Outlook.

The payments company expects its branded checkout service to grow more slowly in the fourth quarter. Other segments look brighter.

PayPal's Shift Is Accelerating

PayPal delivers $6.4B in operating cash flow and a 24.36% ROE, more than doubling the sector median profitability. Shares trade at just 11.5x forward earnings and 8.52x cash flow, both deeply discounted, versus sector and historical averages. Capital returns surged with $1.5B in Q3 buybacks and $5.7B over twelve months, plus a new $0.14 quarterly dividend.

PYPL Stock Down 27.5% YTD: Is it a Buying Opportunity or Time to Exit?

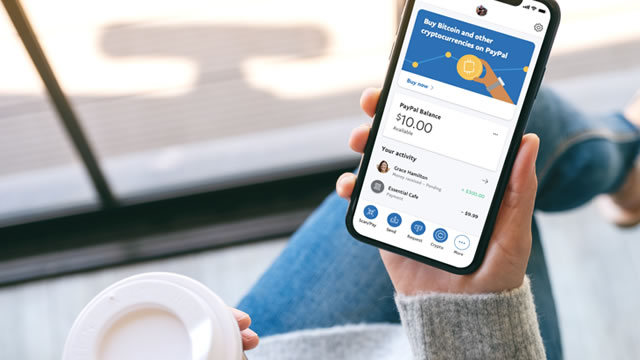

PayPal's sharp YTD slide contrasts with its push into next-gen commerce, AI, crypto and fast-growing Venmo, raising big questions for investors.

PayPal Is A Black Friday Stock Bargain: 3 Reasons To Buy Now

PayPal (PYPL) appears deeply undervalued, trading at just 11 times earnings and well below historical and peer valuations. PYPL's newly initiated dividend, robust $20 billion buyback program, and strong balance sheet highlight management's confidence and shareholder-friendly approach. Tax-loss selling and short interest may be pressuring shares, but fading selling and potential short covering could spark a January Effect rally.

Will Market Finally Notice PayPal?

PayPal (PYPL) may be a smart choice for your investment portfolio, due to its substantial cash yield, solid fundamentals, and affordable valuation. Companies of this nature can utilize cash to enhance revenue growth or simply return cash to shareholders through dividends or stock repurchases.

Investors Heavily Search PayPal Holdings, Inc. (PYPL): Here is What You Need to Know

Recently, Zacks.com users have been paying close attention to Paypal (PYPL). This makes it worthwhile to examine what the stock has in store.

PayPal: Potential Dividend Growth Champion

With its improving profitability, low payout ratio, and robust balance sheet, PayPal is exceptionally well-positioned to emerge as a dividend growth champion. PYPL's expanding financial services ecosystem further demonstrates its robust business outlook and growth potential. The stock is attractively valued with a FY2026 forward P/E ratio of just 10, making it appear undervalued.

PayPal: Patience Will Be Rewarded

PayPal is a buy after a recent selloff, with a raised price target of $100, representing over 65% upside from current levels. PYPL's fundamentals are improving under CEO Alex Chriss, with growth in TPV, revenue, and profits. Venmo's monetization and Braintree's return to profitable growth are key drivers, while product innovation and share repurchases enhance long-term value.

PayPal (NASDAQ: PYPL) Price Prediction and Forecast 2025-2030 (December 2025)

Shares of PayPal Holdings, Inc. (NASDAQ:PYPL) lost 13.35% over the past month after gaining 1.76% the month prior.